I'm in the Charlotte, NC airport between flights. Thankfully I have a bit of time to stretch my legs after the two hour ride in the

airplane cattle car.

Anyway, the Fed cut ates. Here is a

link to the statement.The Federal Open Market Committee decided today to lower its target for the federal funds rate 25 basis points to 4-1/2 percent.

Economic growth was solid in the third quarter, and strains in financial markets have eased somewhat on balance. However, the pace of economic expansion will likely slow in the near term, partly reflecting the intensification of the housing correction. Today’s action, combined with the policy action taken in September, should help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and promote moderate growth over time.

Readings on core inflation have improved modestly this year, but recent increases in energy and commodity prices, among other factors, may put renewed upward pressure on inflation. In this context, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

The Committee judges that, after this action, the upside risks to inflation roughly balance the downside risks to growth. The Committee will continue to assess the effects of financial and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

Let's look at this statement in a bit more detail.

Today’s action, combined with the policy action taken in September, should help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and promote moderate growth over time.It looks to me that the Fed is attempting to prevent further problems with this action. They are looking ahead and thinking there could be further problems. Their hope is liquidity will solve that problem.

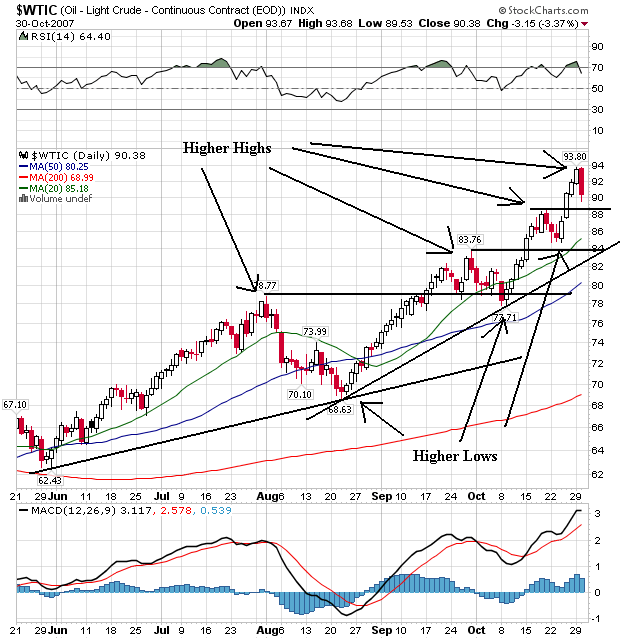

Readings on core inflation have improved modestly this year, but recent increases in energy and commodity prices, among other factors, may put renewed upward pressure on inflation.First --

recent increases in energy and commodity prices? Where have these guys been over the last few

years? From now on, all Fed governors must demonstrate in a public forum that they can read a damn price chart.

This statement dovetails nicely with some comments I received in the previous post on 3Q GDP. Some people were wondering why I though the .8% chained deflator was too low and others offered to help find out what was wrong with the particular inflation number. All these comments are appreciated, BTW.

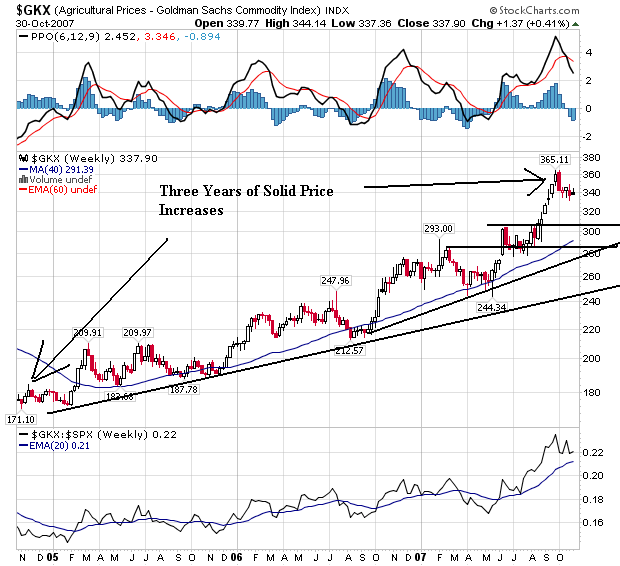

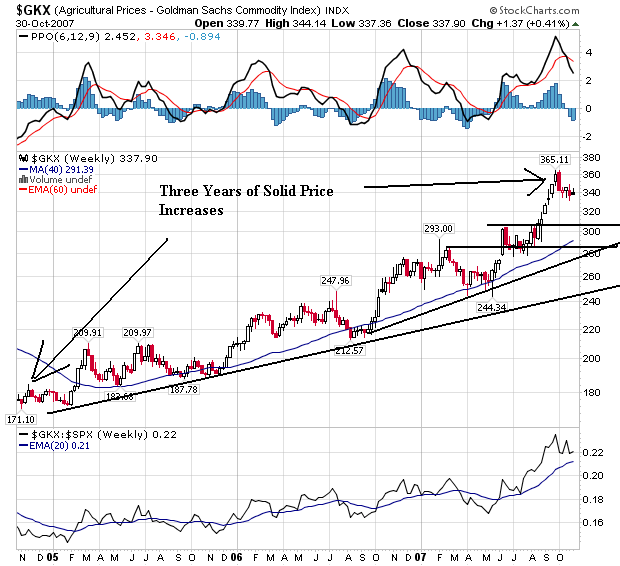

I have several problems with the inflation numbers -- most notably with the Fed's reliance on core inflation rather than overall inflation. In a period when food and energy prices are going though standard seasonal gyrations, the "we only watch core inflation" policy makes sense. However, we're not in that kind of environment right now. Largely thanks to India and China -- and their two billion or so residents who are seeing their incomes grow -- demand for commodities has really heated up. As a result we've seen a huge increase in commodity prices over the last 3-5 years.

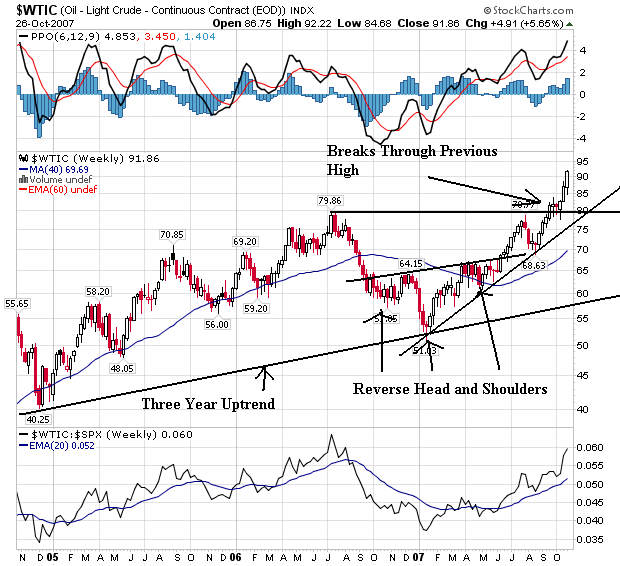

Take a look at the following charts:

Oil (It should read a three-fold increase. Sorry -- airport blogging is a bit weird).

Agricultural prices:

Copper

Aluminum

All of these charts shows big price increases. And no -- this is not an ephemeral argument. Recent earnings releases from Kraft and P&G have both noted they are experiencing margin hits because of rising commodity prices. If the largest companies in their respective financial areas are experiencing price hits, then smaller companies that lack the bargaining power surely are experiencing worse.

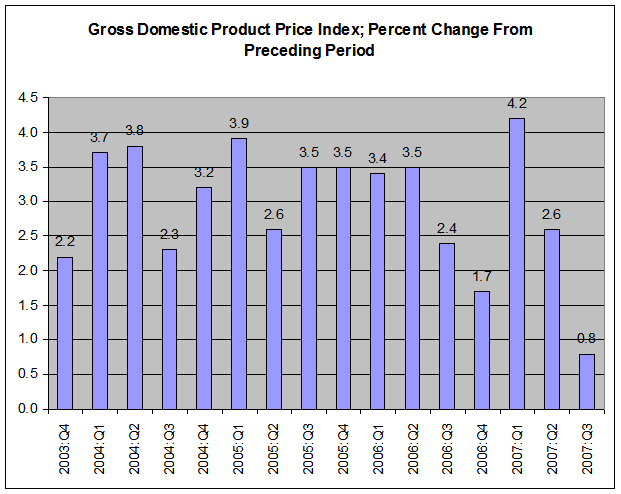

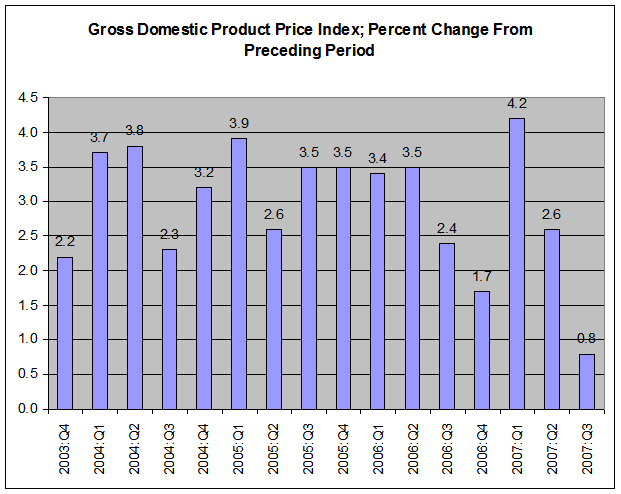

Now -- back to today's .8% increase in the chained GDP deflator. Here is a chart from

the current release the shows the previous increases from the respective previous quarter.

Now, let's ask a few questions that build on each other.

Does the .8% increase make sense in light of the previous quarters rate of growth? (This is is the previously mentioned Sesame Street test -- one of these things is not like the other one).

Especially in an environment when the economy is growing near full capacity (3.9%)?

In light of the above commodity charts that show commodity prices have been increasing for an extended length of time -- as in years?

At a time when

productivity gains are shrinking?

I'm not saying the small gain isn't possible. But in light of all the previous questions -- especially multi-year increases in commodity prices and declining productivity -- the number just doesn't add up.

I should add -- as I hopefully always do -- I could be wrong in all of this. I've been wrong before and will be wrong again (I thought Madonna was going to be a one-hit wonder). But the number is just sticking in my craw as it were.