Sorry -- I don't have pictures this weekend. I'm getting married in a week and my fiance and I are buying a house so I'm a bit swamped. I will be back on Monday.

Have a good weekend.

Saturday, May 3, 2008

Friday, May 2, 2008

The Final Point on Today's Employment Numbers

The year over year trend is still declining, and

The unemployment rate is still increasing.

Employment Surprises

From Bloomberg:

And from the BLS:

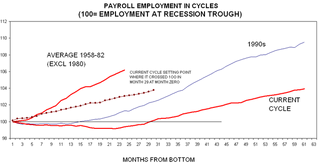

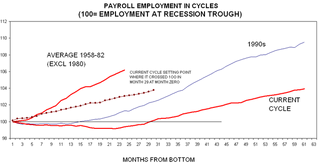

Before we start cheering, let's remember a very important fact. Job growth for this expansion was the weakest of any post WWII expansion.

That means we won't be experiencing a ton of job losses like a "standard" recession.

That being said, this is good news. Considering the market is banking on a strong long-term impact of the recent Fed rate cuts, this should send the market higher.

The U.S. lost fewer jobs than forecast in April, and the unemployment rate unexpectedly dropped, signaling that the economic slowdown didn't gather pace at the start of the second quarter.

Payrolls shrank by 20,000 workers, following a revised 81,000 drop in March that was larger than previously estimated, the Labor Department said today in Washington. Economists surveyed by Bloomberg News projected a loss of 75,000 jobs. The jobless rate fell to 5 percent, from 5.1 percent in March.

``So far there's a mild start to the recession,'' Aaron Smith, an economist at Moody's Economy.com in West Chester, Pennsylvania, said before the report. ``The data we've been seeing is weak but it's not deteriorating endlessly.''

And from the BLS:

Nonfarm payroll employment was little changed in April (-20,000), following job losses that totaled 240,000 in the first 3 months of the year, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The unemployment rate, at 5.0 percent, also was little changed in April. Employment continued to decline in construction, manufacturing, and retail trade, while jobs were added in health care and in professional and technical services.

Before we start cheering, let's remember a very important fact. Job growth for this expansion was the weakest of any post WWII expansion.

That means we won't be experiencing a ton of job losses like a "standard" recession.

That being said, this is good news. Considering the market is banking on a strong long-term impact of the recent Fed rate cuts, this should send the market higher.

Food Prices Starting To Hit Subsidies

From the LA Times:

OK -- the "multimillionaire farmer" line is a bit over the top and any statement from an ethanol lobbyist should be completely ignored. However, the basic point is obvious: ethanol

-- is a poor way (at best) to achieve energy independence, and

-- ethanol has royally screwed up the food supply in fundamental ways

My guess is that when someone proposed the idea of ethanol there was testimony from a really nerdy, wonkish economist who predicted that what is now happening would result from the policy. Of course, no one listens to wonkish economists because they have little to no sex appeal. They only rely on such annoying things as historical facts.

The American farmer, long an untouchable political icon, has even become something of a political embarrassment on Capitol Hill, with President Bush earlier this week demanding an end to crop subsidies for "multimillionaire farmers."

Congress just last year required that more ethanol be added to the gasoline supply. The mandate is now blamed for inflating the price of corn and other staples.

"It's hard to believe that in five months our country has gone from a strong commitment to pay any price for energy security to the kind of backlash we've seen against ethanol," said Jon Doggett, a lobbyist for the National Corn Growers Assn.

In Congress, some lawmakers are calling for changes in the nation's commitment to ethanol as the biofuel of choice to replace oil. "This is a classic case of the law of unintended consequences. Congress surely did not intend to raise food prices by incentivizing ethanol, but that's precisely what's happened," said Rep. Jeff Flake (R-Ariz.), who introduced legislation this week that would end federal support for ethanol.

Farm-state lawmakers and agriculture lobbyists are stepping up their efforts to protect ethanol, as well as farm subsidies, which have drawn a veto threat from Bush.

OK -- the "multimillionaire farmer" line is a bit over the top and any statement from an ethanol lobbyist should be completely ignored. However, the basic point is obvious: ethanol

-- is a poor way (at best) to achieve energy independence, and

-- ethanol has royally screwed up the food supply in fundamental ways

My guess is that when someone proposed the idea of ethanol there was testimony from a really nerdy, wonkish economist who predicted that what is now happening would result from the policy. Of course, no one listens to wonkish economists because they have little to no sex appeal. They only rely on such annoying things as historical facts.

Transports Are Confirming Rally

Over the last week or so I have written that while the QQQQs were rallying the S&P and Russell 2000 were stuck underneath resistance levels. Therefore, the QQQQ rally was questionable.

That changed yesterday when the IWMs and SPYs broke through resistance on decent volume.

Now we have another confirming signal: the transports are also moving higher.

On the five year chart, notice the transports dropped through support at the end of last year and really started to fall during the first part of this year. This development was a chief reason why I wrote the Is a Bear Market Developing series at the end of last year.

On the yearly chart, notice the Transports formed a reverse head and shoulder formation during the sell-off, which they have now rallied through. Also note that over the last few days the Transports have risen back above the 5-year trend line which the index broke in its late 2007 sell-off.

On the daily chart notice the following:

-- Prices are above the SMAs

-- The short SMAs are above the longer SMAs

-- Prices have broken through the 200 day SMA

-- The three shorter SMAs are moving higher

-- The three shorter SMAs have moved through the 200 day SMA

Afraid to Trade has been all over this development.

That changed yesterday when the IWMs and SPYs broke through resistance on decent volume.

Now we have another confirming signal: the transports are also moving higher.

On the five year chart, notice the transports dropped through support at the end of last year and really started to fall during the first part of this year. This development was a chief reason why I wrote the Is a Bear Market Developing series at the end of last year.

On the yearly chart, notice the Transports formed a reverse head and shoulder formation during the sell-off, which they have now rallied through. Also note that over the last few days the Transports have risen back above the 5-year trend line which the index broke in its late 2007 sell-off.

On the daily chart notice the following:

-- Prices are above the SMAs

-- The short SMAs are above the longer SMAs

-- Prices have broken through the 200 day SMA

-- The three shorter SMAs are moving higher

-- The three shorter SMAs have moved through the 200 day SMA

Afraid to Trade has been all over this development.

Thursday, May 1, 2008

Friday's Forex Round-Up

Let's take a look at the charts.

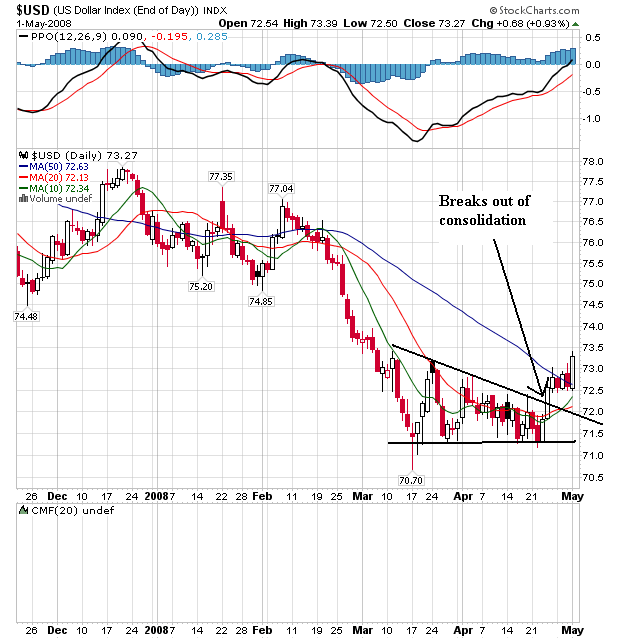

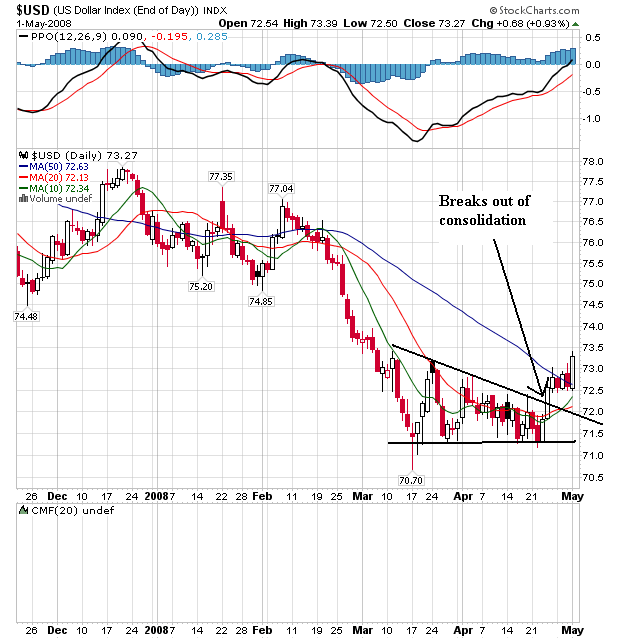

The dollar has broken out of a triangle consolidation pattern and rallied. Notice prices are above the SMAs which will pull them higher. Also note the 10 day SMA just crossed over the 20 day SMA which is a bullish crossover.

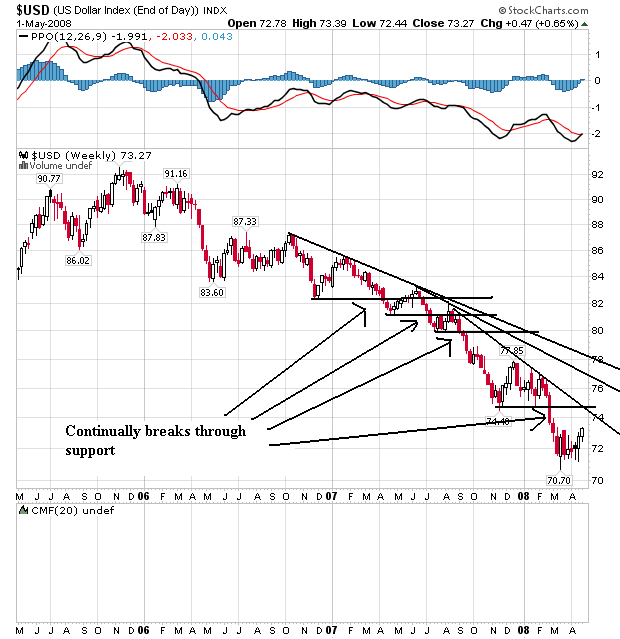

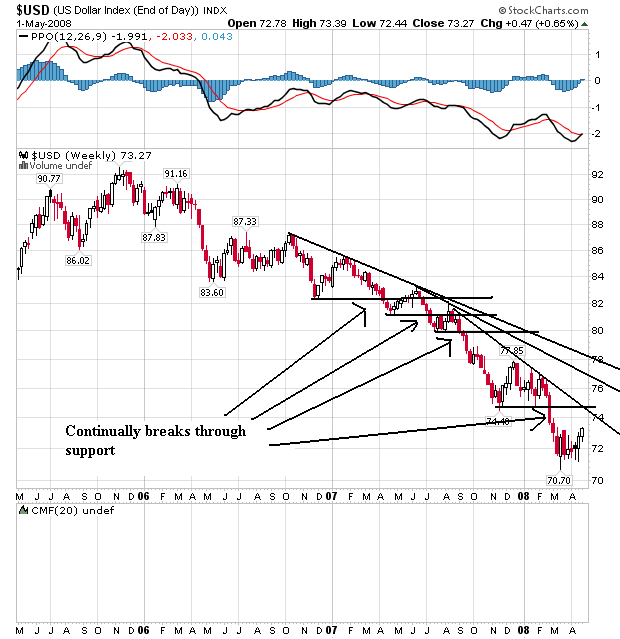

However, the dollar is still at the bottom of a long downward trek. Before we get too excited about the rally, let's remember the longer term context.

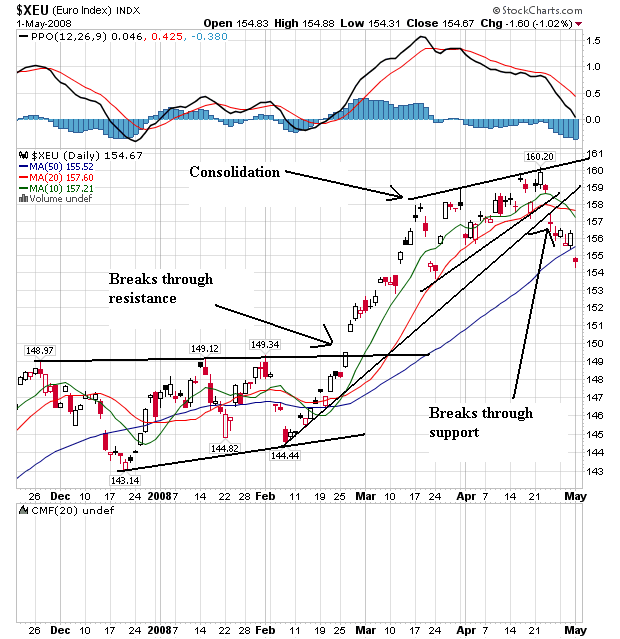

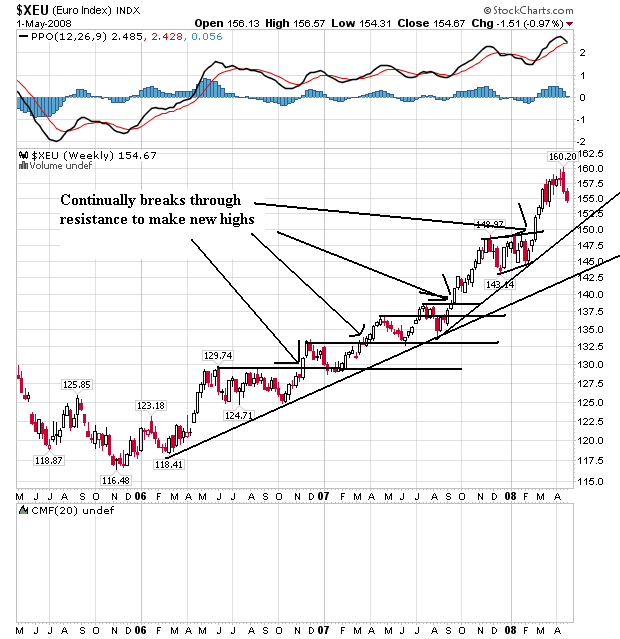

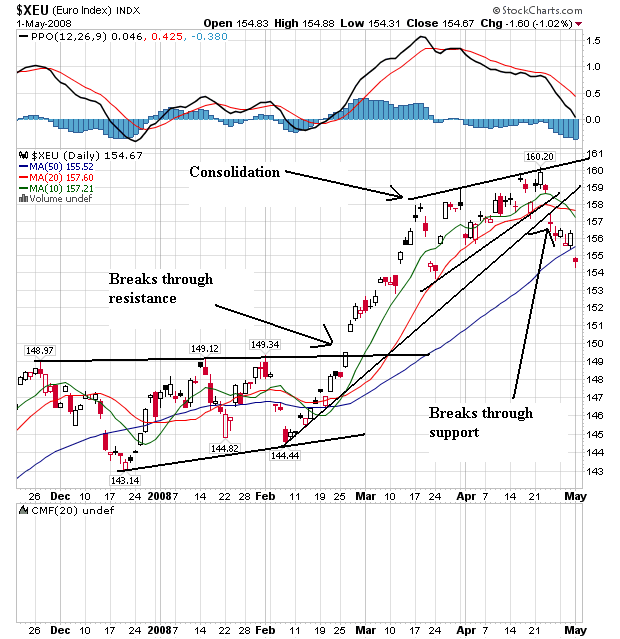

The euro broke out of a triangle consolidation pattern late February and rallied for two months. The euro formed another triangle/pennant consolidation pattern in mid-March and has since fallen through support. Prices have fallen through the 50 day SMA which is a bearish signal.

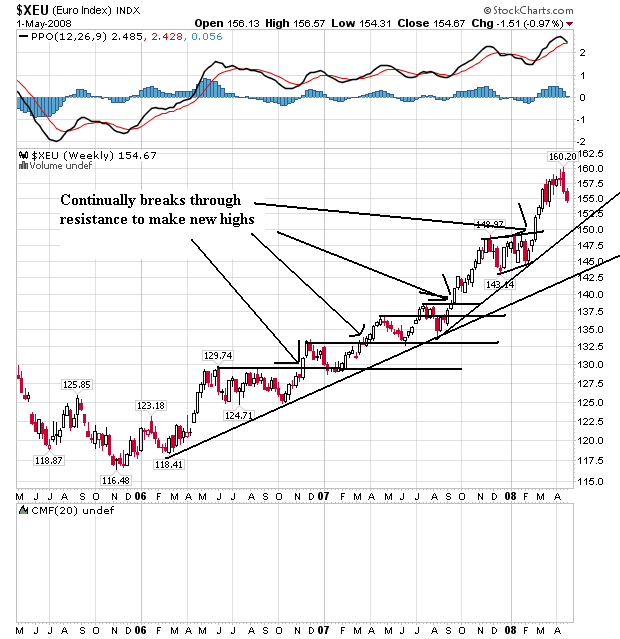

However on the long-term chart, notice the euro is still in the middle of a rally.

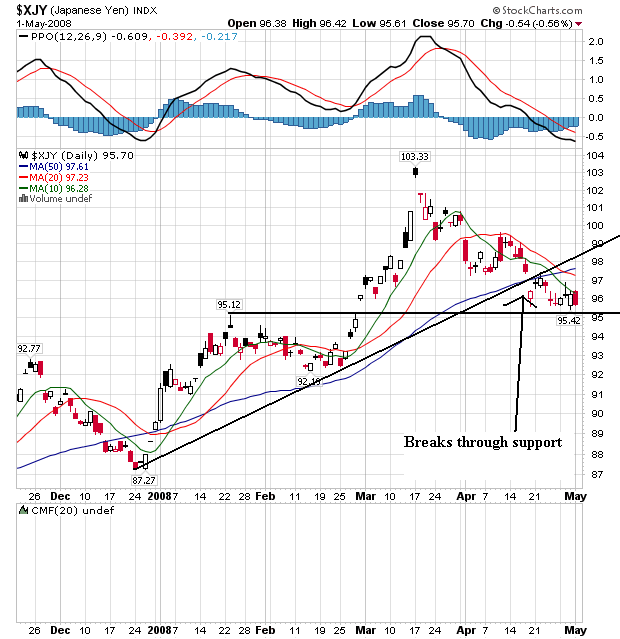

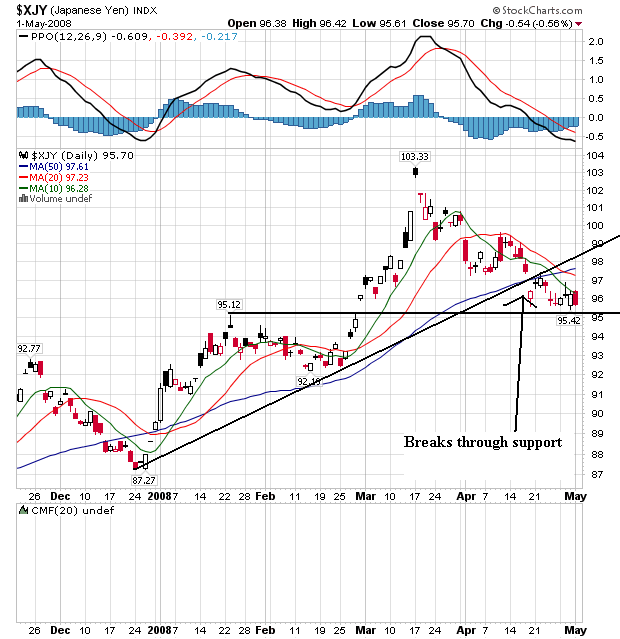

The yen had been rallying since late December. However, it has fallen through support from that rally. Also note the 10 and 20 day SMA have fallen through the 50 day SMA, a bearish signal. Finally, notice that prices are below all the shorter SMAs, which is also bearish.

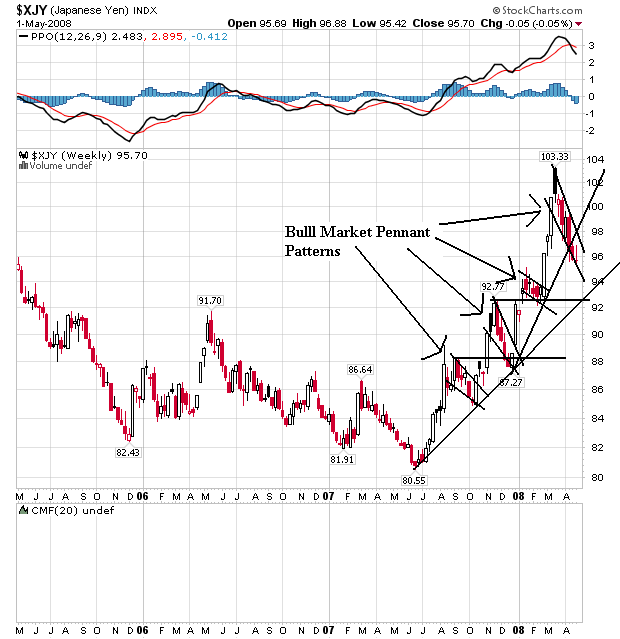

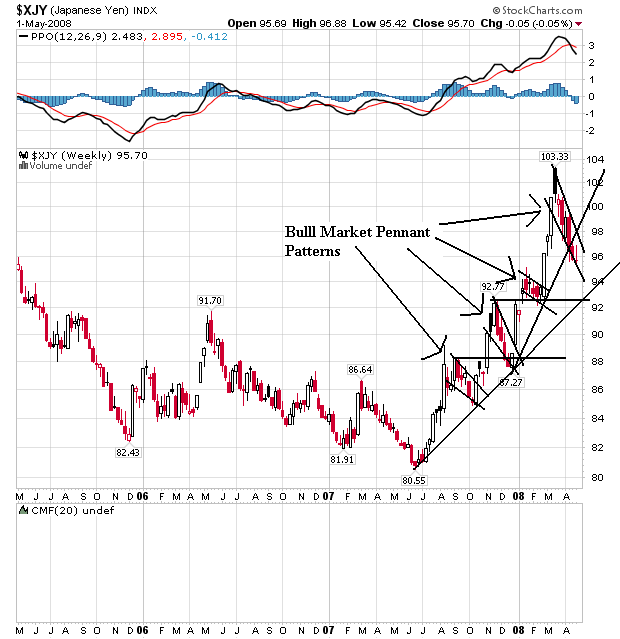

Since mid-summer the yen has rallied. However, also notice

Here's the central story to the forex markets for the last week or so:

Bad economic news in the US depresses the dollar because bad economic news makes the US economy a less attractive place for foreigners to invest. At the same time, high inflation news from Europe has led the European Central Bank (ECB) to keep rates unchanged. Therefore, the difference between US and European interest rates remains high. This makes the euro attractive as an investment, leading to its recent gains.

On Thursday, we learned that European business confidence is dropping as the result of inflationary pressures:

One of the main reasons the euro has done so wel versus the dollar is the interest rate differential. So long as interest rates the in euro area are higher than the US the euro should have a trading floor. And there is every indication European interest rates will remain high:

In other words -- interest rates might not be high enough. That means the ECB is taking their role in promoting price stability far more seriously than the Federal Reserve.

The previous Wednesday, there were more hawkish statements from the ECB

On Monday, the European Central bank reiterated its stance that price stability is their most important objective:

But the euro area will be under increased pressure to drop interest rates as retail sales showed a sharp decline:

The situation in France should look really familiar by now.

There was more bad news from the euro area:

Regarding Japan, Terri Belkas at DailyFx summed up Japan's basic problems on Saturday:

On Wednesday, the Bank of Japan released its half-year report, which concluded

Japan held interest rates at .5%. In addition, the report omitted a reference to raising interest rates for the first time in two years."

Also note the euro/dollar sentiment is changing:

Barron's ran a story last weekend that argued the dollar will rally this year. Here is the basic reasoning:

After the Fed rate cut, the dollar dropped:

The reason?

As a result:

The dollar has broken out of a triangle consolidation pattern and rallied. Notice prices are above the SMAs which will pull them higher. Also note the 10 day SMA just crossed over the 20 day SMA which is a bullish crossover.

However, the dollar is still at the bottom of a long downward trek. Before we get too excited about the rally, let's remember the longer term context.

The euro broke out of a triangle consolidation pattern late February and rallied for two months. The euro formed another triangle/pennant consolidation pattern in mid-March and has since fallen through support. Prices have fallen through the 50 day SMA which is a bearish signal.

However on the long-term chart, notice the euro is still in the middle of a rally.

The yen had been rallying since late December. However, it has fallen through support from that rally. Also note the 10 and 20 day SMA have fallen through the 50 day SMA, a bearish signal. Finally, notice that prices are below all the shorter SMAs, which is also bearish.

Since mid-summer the yen has rallied. However, also notice

Here's the central story to the forex markets for the last week or so:

The dollar has been weighed down recently by a combination of gloomy U.S. economic data and high European inflation.

Bad economic news in the US depresses the dollar because bad economic news makes the US economy a less attractive place for foreigners to invest. At the same time, high inflation news from Europe has led the European Central Bank (ECB) to keep rates unchanged. Therefore, the difference between US and European interest rates remains high. This makes the euro attractive as an investment, leading to its recent gains.

On Thursday, we learned that European business confidence is dropping as the result of inflationary pressures:

Business confidence in Germany and France, which account for about half the euro-region economy, slumped in April as record oil and food prices stoked inflation.

The Munich-based Ifo institute said its business climate index, based on a survey of 7,000 executives, fell to 102.4 from 104.8 in March. That's the lowest since January 2006. In France, sentiment among 4,000 manufacturers slid to a 16-month low of 106 from 108, Insee, the Paris-based national statistics office said.

Inflation in the 15 euro nations jumped to a 16-year high of 3.6 percent in March, crimping the purchasing power of companies and consumers. With the euro's 9 percent gain against the dollar this year threatening exports and the U.S. housing recession pushing up credit costs worldwide, the International Monetary Fund this month cut its growth forecast for Europe.

``Everything is worrying for executives: raw material prices climbing almost uncontrollably, the euro's rise, the global slowdown that's shaping up,'' said Bruno Cavalier, an economist with Oddo & Cie. in Paris. ``There's every reason for growth to deteriorate.'

One of the main reasons the euro has done so wel versus the dollar is the interest rate differential. So long as interest rates the in euro area are higher than the US the euro should have a trading floor. And there is every indication European interest rates will remain high:

Food-price inflation in Europe accelerated to 6.2 percent in March from 5.8 percent in the previous month. That's the highest since the European Union's statistics office, Eurostat, began the current data series in 1997. The prices for rice, soybeans, wheat and corn have all risen to records this year.

Crude oil reached a record of $119.90 a barrel on April 22.

Policy makers including Germany's Axel Weber and Juergen Stark have suggested the ECB's current benchmark rate of 4 percent may not be high enough to combat inflation.

In other words -- interest rates might not be high enough. That means the ECB is taking their role in promoting price stability far more seriously than the Federal Reserve.

The previous Wednesday, there were more hawkish statements from the ECB

The euro's push through $1.60 Tuesday was propelled in part by remarks by ECB council member and Bank of France Gov. Christian Noyer, who told French radio that the ECB would take any "necessary" steps to bring inflation back down to its 2% target by 2009. Consumer inflation in the euro-zone was pegged at an annual rate of 3.6% in March.

"If needed, we will move interest rates," Noyer said.

But Noyer told the Wall Street Journal Europe that his comments were over-interpreted by the markets.

"Movements can go both ways," he said. "I would never engage in a discussion about the future path of interest rates, simply because nobody knows."

On Monday, the European Central bank reiterated its stance that price stability is their most important objective:

European Central Bank President Jean-Claude Trichet reiterated yesterday that he's concerned about a surge in the euro against the dollar, according to an interview with the Austrian state broadcaster. He added that the ECB's ``responsibility'' is to ``preserve price stability in the medium and long term.''

ECB policy makers have held the main refinancing rate at a six-year high of 4 percent since June to contain inflation. The U.S. central bank has cut the fed funds target by 3 percentage points to 2.25 percent since September to prevent banks' reluctance to lend from plunging the economy into a recession.

But the euro area will be under increased pressure to drop interest rates as retail sales showed a sharp decline:

The measure of sales growth in the euro region declined for a second month to a seasonally adjusted 41.8 from 48.2 in March. A reading below 50 indicates contraction. The index, which is based on a survey of more than 1,000 executives compiled for Bloomberg News by NTC Economics Ltd., is at the lowest level since its introduction in January 2004. Sales also fell from a year earlier.

.....

``Rising inflation is hitting households' purchasing power and is undoing some of the positive stimulus, such as strong employment growth and rising wages,'' said Nick Kounis, an economist at Fortis Bank in Amsterdam. ``The dilemma facing the ECB just gets worse.''

.....

Sales fell across all three of the largest economies in the euro zone, led by Italy, where retail spending dropped at the fastest rate in the survey's history. In Germany, sales fell the most in three months, while in France they declined the most since January 2006.

``Italian indicators have been on a predictable and steady downward trend for the past year,'' said Morgan Stanley economist Vladimir Pillonca, who predicts Italy may be the first and only country in the euro region to enter into a recession this year.

Praktiker AG, Germany's second-largest home-improvement retailer, said April 23 that its first-quarter loss widened on weaker demand. Chief Executive Officer Wolfgang Werner said ``the first three months were very bad in domestic sales.''

In France, ``inflation and the end of the rise in real-estate prices, and of the ability to take on loans, are weighing on consumption,'' said Yann Lepape, an economist at Oddo & Cie. in Paris. ``The trend is starting to go downward.''

The situation in France should look really familiar by now.

There was more bad news from the euro area:

The initial selloff in the common currency came during the London trading session, after news that French consumer confidence fell to a record low in April and a euro-zone retailing index plunged. This reinforced attitudes that the economies of Europe are succumbing to the spill-over effects of the U.S. economic downturn.

Regarding Japan, Terri Belkas at DailyFx summed up Japan's basic problems on Saturday:

Inflation driven by rising costs will discourage spending by firms and consumers alike and leaves the Bank of Japan in a precarious position. While the policy board likely remains in favor of rate normalization, substantial downside risks to exports and faltering consumption will force the Bank to leave rates unchanged and if anything, will lead them to consider cutting rates. Nevertheless, with interest rates already at an ultra-low 0.50 percent, the stimulating potential of a 25bp rate cut would be extremely small and leaves the odds in favor of steady rates for much of this year.

On Wednesday, the Bank of Japan released its half-year report, which concluded

"Japan's economy is slowing, mainly due to the effects of high energy and materials prices," the BoJ said it its half-yearly outlook report Wednesday. "Given the current situation where the outlook for economic activity and prices is highly uncertain, it is not appropriate to predetermine the direction of future monetary policy."

The bank said conditions had weakened since its October outlook, with both housing and business fixed investment weaker than expected.

The world's second-largest economy will grow at 1.5% in the fiscal year ending March 31, slower than an October forecast for a 2.1% expansion, while consumer prices will rise 1.1%, faster than an earlier estimate for a 0.4% rise, the central bank said in a statement. Growth next year is likely to range between 1.5% to 2%, boosted by a rebound in overseas demand and easing commodity prices, the bank said.

Japan held interest rates at .5%. In addition, the report omitted a reference to raising interest rates for the first time in two years."

Also note the euro/dollar sentiment is changing:

"Europe is really not insulated and its economy is beginning to show signs of a slowdown," said Meadows. "While most people now believe the Fed is about to end its easing cycle, a growing number of investors believe the ECB may have to start cutting rates really soon."

Barron's ran a story last weekend that argued the dollar will rally this year. Here is the basic reasoning:

When the Federal Reserve cuts interest rates for a seventh consecutive time this Wednesday, it will begin to wind down a pernicious campaign that has flooded the market with cheap dollars since last summer. At the same time, the whoosh of air from Europe's deflating credit bubble puts new pressure on the European Central Bank to begin cutting borrowing costs in order to goose growth.

The result should be a major shift in global monetary policy that reverses billions of recent short-dollar, long-commodity bets and undercuts high-flying stocks like fertilizer outfit Mosaic (ticker: MOS) and oil-services giant Halliburton (HAL) that earn gobs of money overseas. The strategy shifts by central banks will drive a greenback comeback against the overpriced euro, turning back the 15% slide that since August has lifted the euro -- to a record $1.60 last week -- even as the dollar continues to struggle against the undervalued currencies of emerging Asia.

After the Fed rate cut, the dollar dropped:

The dollar fell after the Federal Reserve reduced its target for overnight lending between banks by a quarter-percentage point to 2 percent, the lowest level in almost four years.

The U.S. currency dropped versus the euro, pound and real as policy makers said the economy remains weak, indicating to some traders the Fed may lower rates further if warranted. The dollar has decreased 12 percent against the euro since Sept. 18, when the Fed began lowering the target from 5.25 percent.

``The Fed kept all of their options open,'' said Michael Woolfolk, senior currency strategist at Bank of New York Mellon Corp. in New York, the world's largest custodian bank, with more than $20 trillion in assets under administration. ``The market expected more hawkish tones they didn't get, and the dollar rally is unlikely to materialize.''

The reason?

But there wasn't a decisive "all-clear" announcement on more possible rate cuts, which have been continuing for months and have been a big factor in the dollar's sharp declines. The committee noted "further" softness in U.S. labor markets and financial markets' "considerable stress."

"Our sense is that the market was looking for...a stronger signal of a policy pause," said Nick Bennenbroek, head of currency strategy at Wells Fargo Bank. "We suspect it is that lack of that direct signal that is contributing to the dollar's dip after the announcement."

As a result:

"We got a major status quo statement," Mr. Trevisani said. "We're now back to looking at economic statistics, and the market wants to sell the euro but they're not going to do it until there's proof, a change in U.S. economic data."

Today's Markets

It's a rally.

On the QQQQs notice the following:

-- Prices crossed the 200 day SMA today

-- Prices are above all the SMAs

-- The shorter SMAs are bullishly aligned (10>20>50)

-- All the shorter SMAs are headed higher.

For the last few weeks I have been complaining that one of the other two averages (IWMs and SPYs) were not breaking out of their ranges. That changed today.

Both the SPYs and the IWMs broke through key resistance areas today.

Onward and upward.

On the QQQQs notice the following:

-- Prices crossed the 200 day SMA today

-- Prices are above all the SMAs

-- The shorter SMAs are bullishly aligned (10>20>50)

-- All the shorter SMAs are headed higher.

For the last few weeks I have been complaining that one of the other two averages (IWMs and SPYs) were not breaking out of their ranges. That changed today.

Both the SPYs and the IWMs broke through key resistance areas today.

Onward and upward.

Yesterday's GDP Report, Well, Stunk

From the NY Times:

Gross Private domestic investment decreased 4.7%, with fixed investment (think real estate) dropping 9.7%. Residential turned in another dismal quarter with a drop of 26.7%. However, non-residential also dropped, coming in at -2.5%. This is the first decrease since the fourth quarter of 2006 and that figure was out of place as well. In other words, it's been a long time since nonresidential figures were negative.

Consumer spending increased 1%. Spending on durable goods decreased 6.1% and spending on non-durable goods decreased 1.3%. Services increased 3.4% -- a very high number in this series indicating we probably won't see growth in this area at this level for the next few quarters. This is an incredibly big issue going forward. Consumer spending accounts for 70% of US GDP. When the consumer stops spending, the US stops growing.

Exports increased 5.5% and imports decreased 2.5%. That's about the only good news here.

Short version -- this report stinks and points to serious trouble ahead. There's no good news here.

The weak performance reflected the increasingly thrifty inclinations of American consumers in the face of plummeting real estate prices, tightening credit and a deteriorating job market. Economic growth was also hampered by a continued pullback in construction and business investment.

The only factors preventing the economy from sliding backward were the growth of American exports — aided by a weakening dollar — and a buildup of inventories by businesses.

Gross Private domestic investment decreased 4.7%, with fixed investment (think real estate) dropping 9.7%. Residential turned in another dismal quarter with a drop of 26.7%. However, non-residential also dropped, coming in at -2.5%. This is the first decrease since the fourth quarter of 2006 and that figure was out of place as well. In other words, it's been a long time since nonresidential figures were negative.

Consumer spending increased 1%. Spending on durable goods decreased 6.1% and spending on non-durable goods decreased 1.3%. Services increased 3.4% -- a very high number in this series indicating we probably won't see growth in this area at this level for the next few quarters. This is an incredibly big issue going forward. Consumer spending accounts for 70% of US GDP. When the consumer stops spending, the US stops growing.

Exports increased 5.5% and imports decreased 2.5%. That's about the only good news here.

Short version -- this report stinks and points to serious trouble ahead. There's no good news here.

Wednesday, April 30, 2008

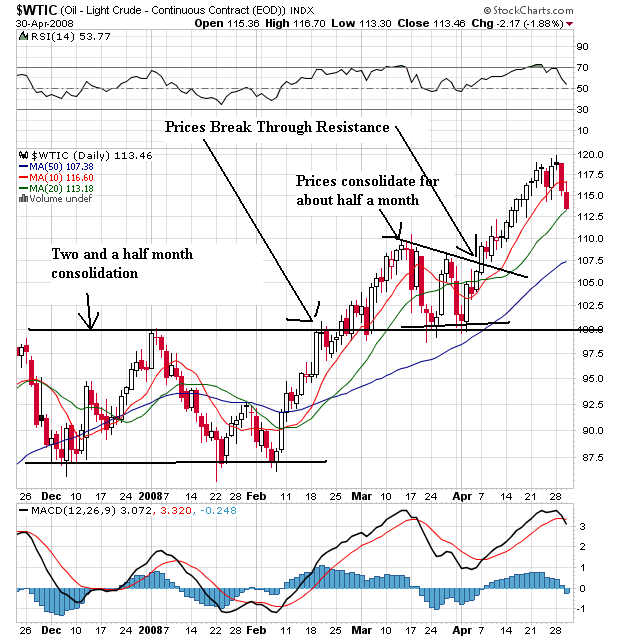

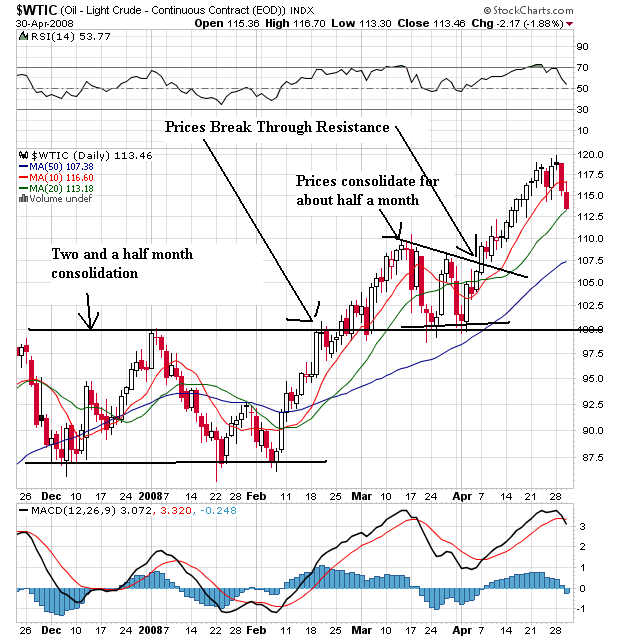

Thursday Oil Market Round-Up

Let's start with the charts.

On the daily chart, notice the following:

-- Prices have twice broken through resistance to make new highs.

-- The shorter SMAs are above the longer SMAs

-- Prices are currently at the 20 day SMA. Prices have dropped through this number before and rallied again

-- Prices have consolidated their gains are each advance.

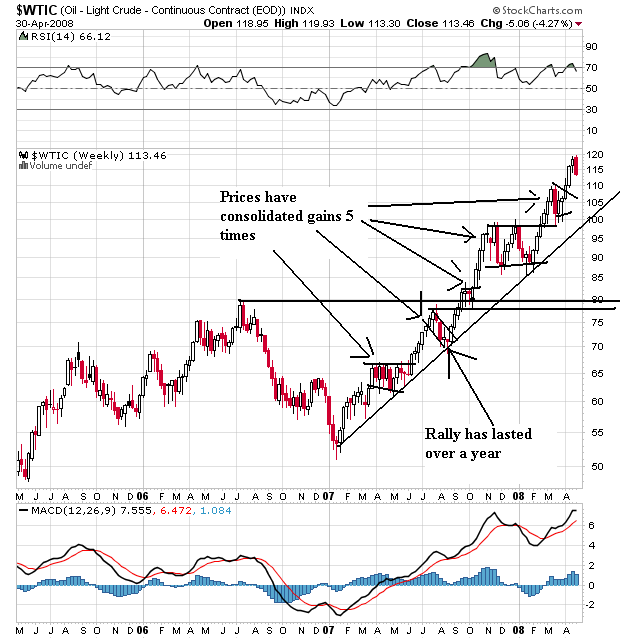

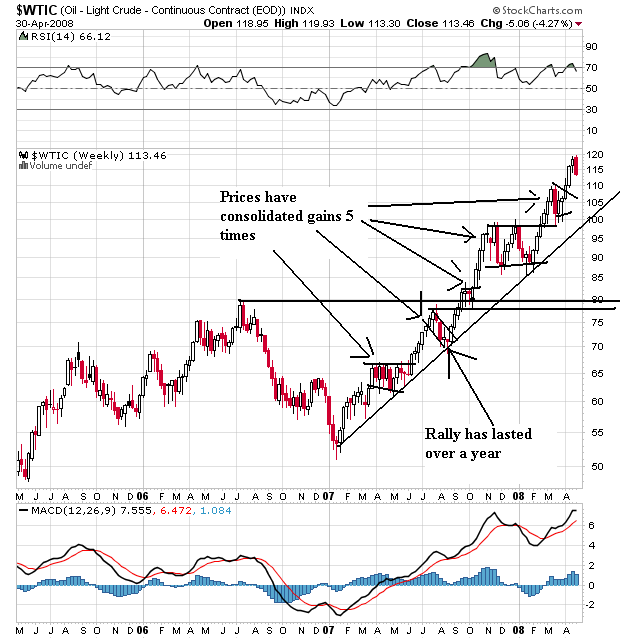

On the weekly chart, notice the following:

-- Prices have been advancing for over a year

-- After each advance prices have consolidated their gains

-- This is a very bullish chart

Although the oil market dropped last Wednesday, traders pointed to a weak dollar as a primary driver of the market:

That theme continued intolast Thursday:

The dropping dollar has been a key reason for the spike in commodity prices. Commodities are denominated in dollars. Therefore, a dropping dollar is by definition a price decrease as well. Traders have to bid up the commodity just to tread water.

An oil strike on Monday helped to send the market higher.

The strike in the British Isles led to some of the highest prices of all time:

The strike ended on Tuesday.

On Wednesday, Goldman Sachs said the window for oil dropping on Spring weakness was "closing fast"

The central issue here is there is a ton of money flowing into the oil market right now; it's the latest boom area of the market. And so long as that situation continues, we'll be experiencing high oil prices.

Goldman isn't the only grop that thinks oiloil will keep rallying for a long time:

Oil's increase in price is the most important of the last 30 years:

Finally, yesterday's This Week in Petroleum report showed retail prices are still spiking.

Short version: The only bearish news of the week was a possible pause in the Fed's interest rate policy of lowering rates. That should help the dollar rise in value which should lead to a drop in oil prices. Hopefully. However, there are plenty of fundamental drivers to the demand side of the oil market right now, starting with China and India.

On the daily chart, notice the following:

-- Prices have twice broken through resistance to make new highs.

-- The shorter SMAs are above the longer SMAs

-- Prices are currently at the 20 day SMA. Prices have dropped through this number before and rallied again

-- Prices have consolidated their gains are each advance.

On the weekly chart, notice the following:

-- Prices have been advancing for over a year

-- After each advance prices have consolidated their gains

-- This is a very bullish chart

Although the oil market dropped last Wednesday, traders pointed to a weak dollar as a primary driver of the market:

``The weakness of the dollar is a great driver here,'' said Francisco Blanch, head of commodities research at Merrill Lynch & Co. in London. ``Oil has become a little bit of a monetary phenomenon, where low rates boost demand for oil in emerging markets.''

That theme continued intolast Thursday:

Crude oil fell more than $2 a barrel after the dollar rose the most against the euro since December, reducing the appeal of commodities to investors.

The dollar strengthened after a report showed German business confidence dropped more than expected in April. Commodity prices also fell because U.S. stocks rallied. Nigeria's white-collar oil workers union halted a partial strike that began earlier today at Exxon Mobil Corp.'s operations in the country, Reuters reported, citing a union official.

``You are seeing a move away from commodities because of the rally of the dollar and in equities,'' said John Kilduff, vice president of risk management at MF Global Ltd. in New York.

``The news from Nigeria is also helping a little bit but this is mostly about the dollar and equities.''

Crude oil for June delivery fell $2.24, or 1.9 percent, to settle at $116.06 a barrel at 2:47 p.m. on the New York Mercantile Exchange. Prices are up 80 percent from a year ago.

Oil reached a record $119.90 a barrel on April 22 after the dollar touched an all-time low against the euro. The euro fell 1.3 percent to $1.5676 per dollar at 3:14 p.m. in New York, from $1.5889 yesterday.

``The weak dollar has been the key driver of the reality in commodities,'' said Tom Bentz, a broker at BNP Paribas in New York. ``Lately there has been a direct correlation between the dollar and crude-oil prices, which hasn't always been the case.''

The dropping dollar has been a key reason for the spike in commodity prices. Commodities are denominated in dollars. Therefore, a dropping dollar is by definition a price decrease as well. Traders have to bid up the commodity just to tread water.

An oil strike on Monday helped to send the market higher.

BP PLC on Sunday shut down the Forties Pipeline System that carries more than 700,000 barrels of oil a day to the U.K. because of a 48-hour walkout by employees at a refinery in central Scotland. Workers walked out of the Grangemouth refinery vowing not to give ground in their dispute with refinery owner Ineos over plans to close a generous pension scheme to new employees. Ineos Chief Executive Tom Crotty said it could take a week for the plant to return to production once the strike ends on Tuesday. BP said its pipeline could be up and running within 24 hours. BP's Kinneil plant, the onshore processing center for the pipeline system, is powered from the Grangemouth site.

"With the refinery being shut down, it will affect supplies from the North Sea and that has a potentially significant impact," said David Moore, a commodity strategist with the Commonwealth Bank of Australia in Sydney. "That comes at the same time that there's production disruptions from Nigeria. So the combined effect of those is the immediate factor that's put pressure on oil prices."

In Nigeria, the Movement for the Emancipation of the Niger Delta, or MEND, on Friday said its fighters hit an oil pipeline late Thursday, the fourth conduit the group has attacked in the past week. MEND said the pipeline belongs to a Royal Dutch Shell PLC joint venture. A Shell spokesman confirmed one of its pipelines had been hit, but provided no additional details.

Separately, workers at an ExxonMobil Corp. joint venture in Nigeria cut production by an unspecified amount to demand more pay.

The strike in the British Isles led to some of the highest prices of all time:

Crude-oil futures closed slightly higher Monday after hitting a new record near $120 a barrel, as a strike at Scottish refinery forced a pipeline closure, while rebel attacks in Nigeria and tension in Persian Gulf also fanned concerns about supply disruptions.

Crude oil for June delivery climbed more than $1 to a new high of $119.93 a barrel in overnight electronic trading, surpassing the previous high of $119.90 hit last week. It ended up 23 cents, or 0.2%, at $118.75 a barrel on the New York Mercantile Exchange.

The gains were driven by supply concerns after hundreds of oil workers at Ineos PLC's Grangemouth refinery started a two-day strike Sunday, forcing the closure of a BP -operated pipeline which transports 700,000 barrels of oil a day, or about 40% of the U.K.'s daily crude production.

The strike ended on Tuesday.

On Wednesday, Goldman Sachs said the window for oil dropping on Spring weakness was "closing fast"

Goldman Sachs Group Inc., the most profitable Wall Street bank, said the window for a decline in oil this spring is `closing fast,' as prices rise to records and the summer period of peak gasoline demand approaches.

U.S. crude imports are likely to rise because of lower inventories and the strength of local oil prices relative to the rest of the world, Goldman analysts led by Giovanni Serio said in their Energy Weekly report.

``Looking into the second half of this year, given the fundamental tightness, we believe the risks are substantially skewed to the upside,'' the report said.

The central issue here is there is a ton of money flowing into the oil market right now; it's the latest boom area of the market. And so long as that situation continues, we'll be experiencing high oil prices.

Goldman isn't the only grop that thinks oiloil will keep rallying for a long time:

Surging crude prices, which could surpass $200 a barrel in four years on tight supplies, could push gasoline prices to as high as $7 a gallon, CIBC World Markets analysts said Thursday.

Crude supplies are actually lower than some official estimates indicate, while demand is unlikely to fall anytime soon, according to a statement by analysts led by Jeff Rubin at CIBC, an investment bank. They forecast that these tighter supplies and continued strong demand will drive oil and gasoline prices to roughly double their current levels by 2012.

"It is increasingly clear that the outlook for oil supply signals a period of unprecedented scarcity," said Rubin. "Despite the recent record jump in oil prices, oil prices will continue to rise steadily over the next five years."

Oil's increase in price is the most important of the last 30 years:

Demand in China continues to fuel demand, along with flare-ups in oil-exporting nations and a weaker dollar. But U.S. demand, after rising for years, is not a key contributor, Alliance Bernstein economist Joseph Carson says today in a note to clients. Domestic oil demand has dropped 1.6% over the last year as the economy weakens. He calls a price increase due to non-domestic factors “an exogenous shock, similar to to the supply shortages of the mid-1970s, early 1980s and briefly in the early 1990s.”

With the price shock of 2007-08, spending on energy as a share of wage income has shot up above 6%, topping the 1974-75 and 1990-91 shocks to be the worst since the 1980-81 runup. Comparing the additional cost of energy to income growth (especially sluggish in recent years), the current shock is far worse than any of the three prior ones, Mr. Carson says.

The figures “suggest that energy costs will crowd out other spending components because income growth is being stifled by weakness in payroll employment,” he writes. “Moreover, relatively thin saving flows offer consumers little cushion against the rising oil prices.”

Finally, yesterday's This Week in Petroleum report showed retail prices are still spiking.

For the fifth consecutive week, the U.S. average retail price for regular gasoline moved higher, reaching yet another all-time high price of 360.3 cents per gallon. The average price has spiked 21.4 cents since April 14. On a regional basis, while prices increased throughout the country, they did so at a somewhat slower pace than was the case during the previous week. The largest increase occurred on the East Coast where the average price jumped by 11.7 cents to 360.1 cents per gallon. This was the only region of the country to experience an increase greater than 10 cents. The price in the Midwest increased by 9.8 cents to 356.8 cents per gallon, up by 64.3 cents from a year earlier. The average price in the Gulf Coast was up by 9.4 cents to 350.5 cents per gallon. The average price in the Rocky Mountains, the lowest of any region, rose to 347.8 cents per gallon, up 6.2 cents from the previous week. Once again, the West Coast average price increased the least of any region, moving up by 5.2 cents to 378.6 cents per gallon. Nonetheless, despite the relatively small increase, the average price was the highest of any region. The average price in California increased by 4.6 cents to hit 389.2 cents per gallon.

Short version: The only bearish news of the week was a possible pause in the Fed's interest rate policy of lowering rates. That should help the dollar rise in value which should lead to a drop in oil prices. Hopefully. However, there are plenty of fundamental drivers to the demand side of the oil market right now, starting with China and India.

Today's Markets

The big news today was the Fed, whose statement had the following paragraph:

The markets interpreted this as a sign the Fed would pause on the rate cuts. As a result, the markets tanked hard after the announcement. More importantly, the need for confirmation from the SPYs or IWMS of the QQQQ rally didn't happen again.

Note the QQQQs are still in a strong upswing.

But....

The SPYs and the IWMs are still trying to break out from consolidation patterns into a place where they can get some strong bull market style running going on. But they haven't broken past key resistance areas. And until they do, we've got a problem.

The substantial easing of monetary policy to date, combined with ongoing measures to foster market liquidity, should help to promote moderate growth over time and to mitigate risks to economic activity. The Committee will continue to monitor economic and financial developments and will act as needed to promote sustainable economic growth and price stability.

The markets interpreted this as a sign the Fed would pause on the rate cuts. As a result, the markets tanked hard after the announcement. More importantly, the need for confirmation from the SPYs or IWMS of the QQQQ rally didn't happen again.

Note the QQQQs are still in a strong upswing.

But....

The SPYs and the IWMs are still trying to break out from consolidation patterns into a place where they can get some strong bull market style running going on. But they haven't broken past key resistance areas. And until they do, we've got a problem.

Anatomy Of Fraud

The WSJ has a great story on how fraud at Countrywide started and spread. It starts with the Fast and Easy program

First -- naming a lending program fast and easy? That just doesn't sound right, does it? It reminds me of a late night TV commercial. And there was no oversight of the brokers who obviously needed some serious oversight.

And get this:

BUT:

So -- Countrywide just says there are no problems with the loans, but doesn't release the figures to back that up. And during another conference call, the company admits the possibility of problems are a lot higher. Now I'm really suspicious, especially considering Countrywide's deteriorating reputation.

And here's a great story about a loyal and trustworthy employee:

So -- the guy is under investigation for fraud. Let's hire him! Yeah, and then we'll put him in a position where he can make more loans. And the best part? The US taxpayer gets to foot the bill! What a deal..

Fast and Easy borrowers aren't required to produce pay stubs or tax forms to substantiate their claimed earnings. In many cases, Countrywide didn't even require loan officers to verify employment, according to an October 2006 presentation by Countrywide's consumer-lending division. That left the program vulnerable to abuse by Countrywide loan officers and outside mortgage brokers seeking loans for customers who might have been turned away if their finances had been more closely scrutinized, according to three current and former Countrywide senior executives and to several mortgage brokers who arranged loans through the program.

First -- naming a lending program fast and easy? That just doesn't sound right, does it? It reminds me of a late night TV commercial. And there was no oversight of the brokers who obviously needed some serious oversight.

And get this:

A spokesman for Countrywide says that Fast and Easy loans are not plagued by defaults. As of March 31, about 3% of Fast and Easy loans were 30 days or more overdue, compared with 3.5% for Countrywide's fully documented prime loans, he says. Fast and Easy borrowers, he says, had to meet credit standards that were tougher than those for prime loans requiring full documentation.

BUT:

During a conference call with investors last July, Countrywide acknowledged that Fast and Easy loans were riskier than fully documented prime loans. A chart provided to investors showed that a borrower who wasn't required to document income would be at least 50% more likely to fall behind on payments than a similar borrower who did provide documentation.

.....

The quarterly financial results, which included $3.05 billion of credit-related charges, did not provide details about the performance of the company's "no-doc" loans, including the Fast and Easy ones. Late payments increased across the board: About 36% of "subprime" loans to people with weak credit records were at least 30 days overdue, up from 20% a year before. For all loans serviced by Countrywide, a category mostly made up of prime loans, the delinquency rate was 9.3%, nearly double the year-earlier 4.9%.

So -- Countrywide just says there are no problems with the loans, but doesn't release the figures to back that up. And during another conference call, the company admits the possibility of problems are a lot higher. Now I'm really suspicious, especially considering Countrywide's deteriorating reputation.

And here's a great story about a loyal and trustworthy employee:

In late 2001, mortgage broker Kourosh Partow got a job in Countrywide's Anchorage, Alaska, office, despite being under investigation for lending abuses in Wisconsin, where his license was revoked several months later. Mr. Partow began writing Fast and Easy loans for another person who was speculating in real estate, federal prosecutors later said.

"In each instance, Partow simply falsified the borrower's income and often bank accounts so as to make it appear that the borrower easily qualified for the loan program offered by Countrywide with no further internal checks necessary," the Justice Department said in a filing last summer in federal district court in Anchorage.

Countrywide sold some of the loans originated by Mr. Partow to Fannie Mae, and neither firm detected the fraud for years, according to documents filed in the case.

So -- the guy is under investigation for fraud. Let's hire him! Yeah, and then we'll put him in a position where he can make more loans. And the best part? The US taxpayer gets to foot the bill! What a deal..

A Great Explanation Of the Current Market

From the WSJ:

Whenever the Fed eventually ceases its series of rate cuts that began last year, it will effectively stabilize the supply of dollars sloshing through the world economy. In particular, analysts say much of so-called "cheap money" available in recent months has flowed into speculation in various assets, including commodities, which many investors have used as an alternative to the volatile stock market.

Peter Cardillo, chief market economist at Avalon Partners, said many of those commodity bets seemed to be unwound Tuesday as speculators bet that the Fed is about to turn off its spigot of cash.

"I wouldn't call this a panic selloff, but it's very clear people are taking some money off the table," said Mr. Cardillo. "They're betting that the Fed is going to surprise us," possibly by not cutting rates at all Wednesday.

Commodity Wednesday's

Let's take a look at the charts to see what they say.

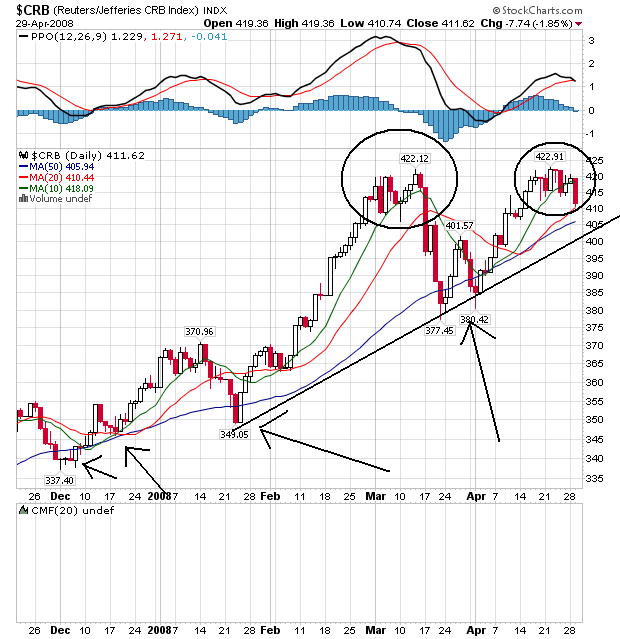

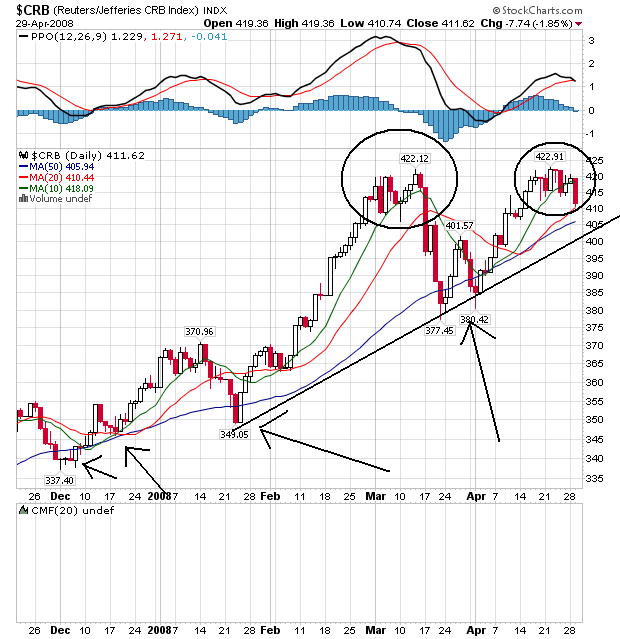

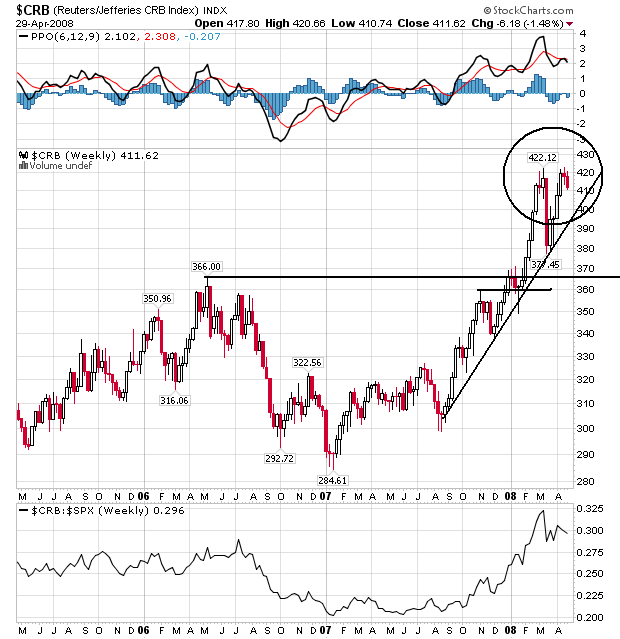

The overall CRB chart is bullish. Notice the following:

-- Prices have bounced off the SMAs for the last 4 months, using them as support

-- The shorter SMAs are higher than the longer SMAs

However, also note the possible top forming; I have circled both tops.

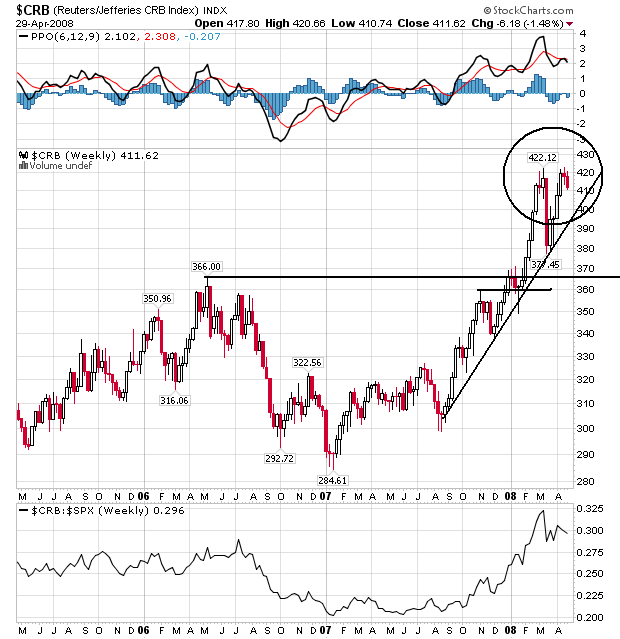

On the weekly chart, notice the following:

-- Prices have been rallying since August

-- Prices have moved through resistance on a regular basis and continually made new highs

-- But, the possible double top is very clear on this chart.

So -- what is going on here? There is growing speculation the Federal Reserve is near the end of its rate cuts -- or will at least pause after today. If this happens, the dollar's slide may stop (at least for now). Because most commodities are priced in dollars a drop in the dollar's value is a de facto increase in a commodity price. So traders are waiting to see what happens with the dollar right now.

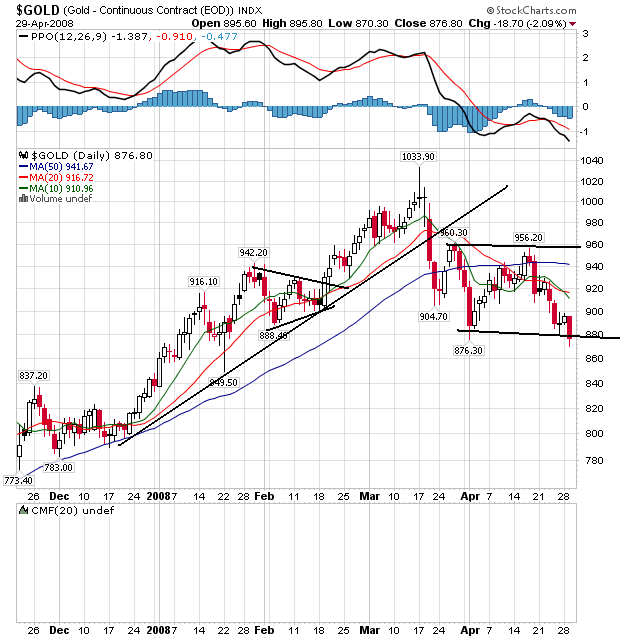

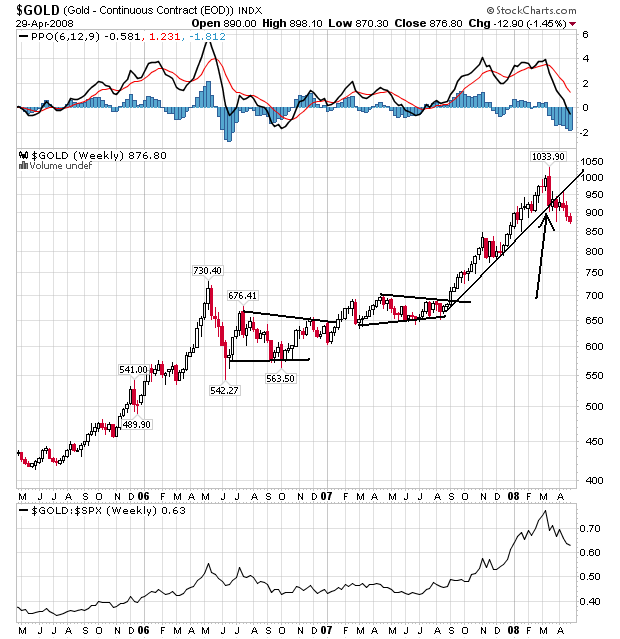

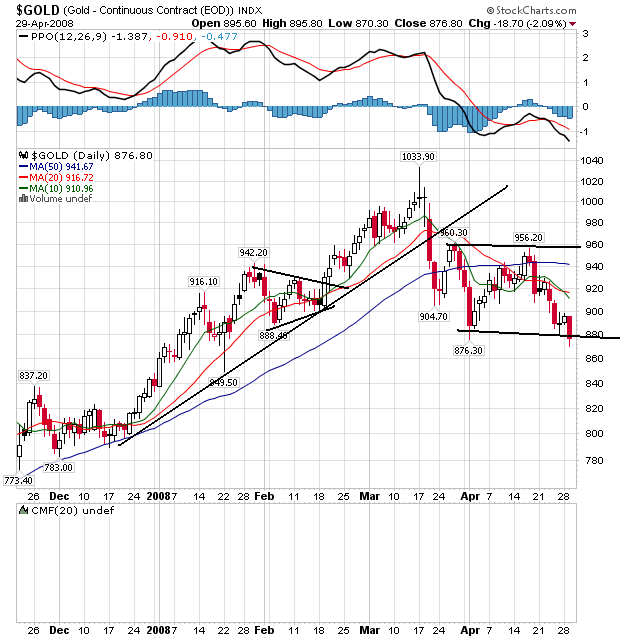

I use gold as a proxy for inflation expectations. Notice the following on the chart above:

-- Prices have dropped below the trend line that started in late December

-- The shorter SMAs have dropped below the longer SMAs -- a bearish signal

-- Prices are below all the shorter SMAs, which will pull these SMAs lower.

-- Prices are now consolidating below the shorter SMAs

This is a chart that says a reversal is occurring in the market.

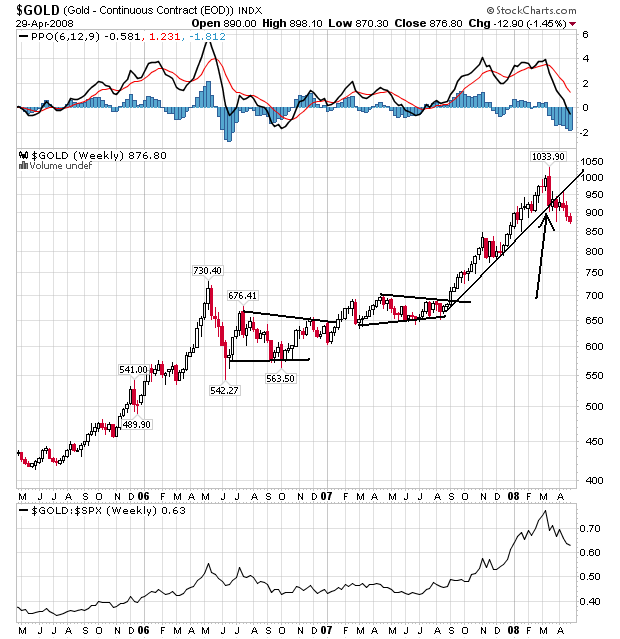

On gold's weekly chart, notice prices have clearly broken the long-term trend line that started at the end of last summer. Again, assuming gold is a valid proxy for inflation (which I think it is), this chart tells us traders are thinking inflation may have peaked, or is about to peak.

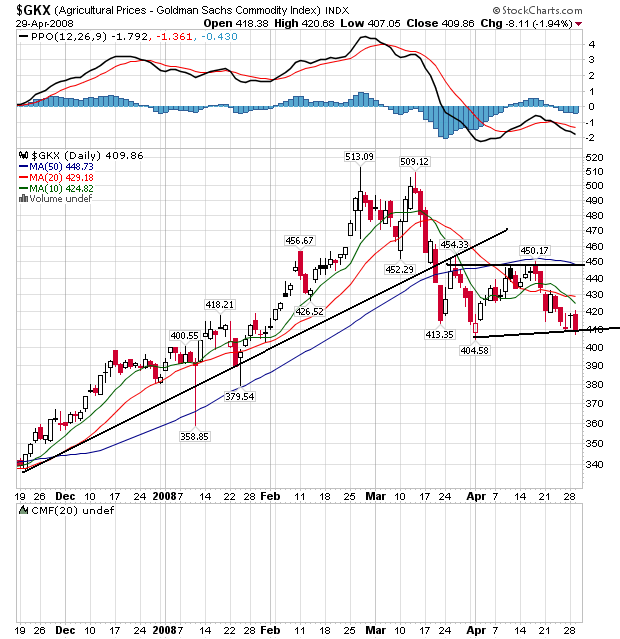

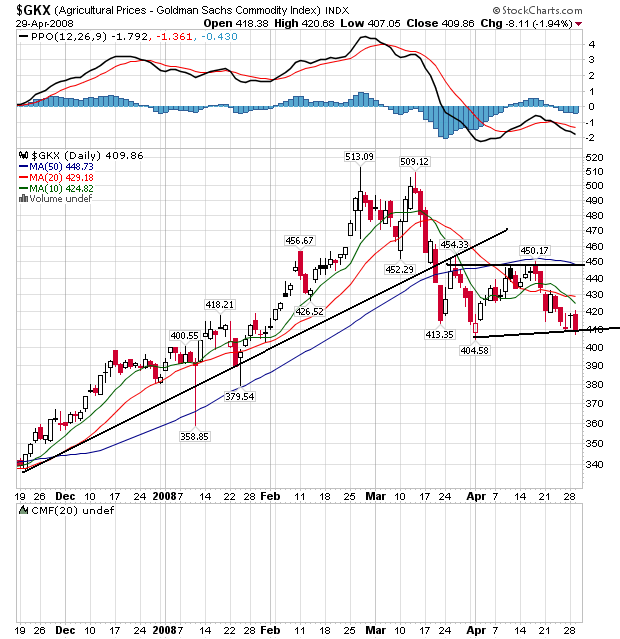

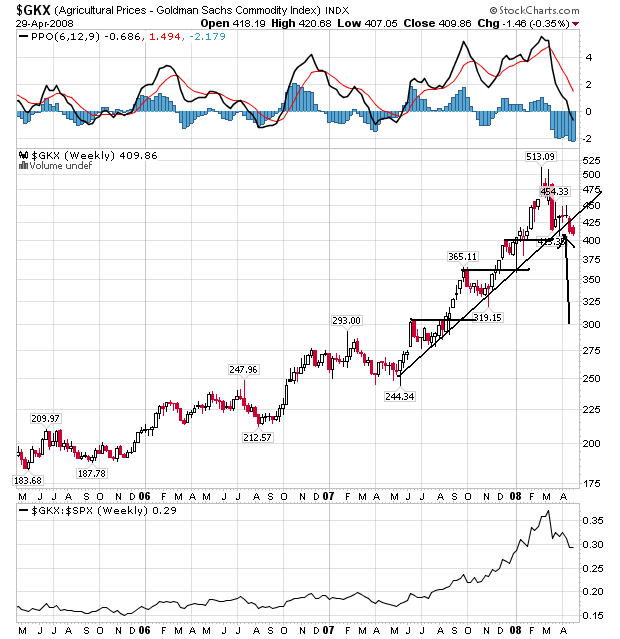

On the agricultural prices daily chart, notice the following:

-- Prices have broken below the trend line started last November

-- Prices are below the SMAs

-- The shorter SMAs have crossed below the longer SMAs

This is a chart that says a reversal may be occurring.

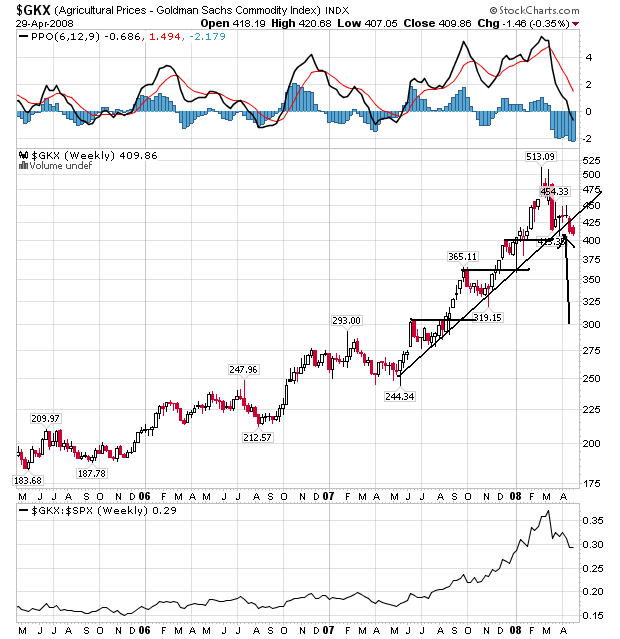

On the agricultural prices weekly chart, notice the following:'

-- Prices have been in a strong rally for about a year, continually breaking through previous resistance to make new highs. BUT,

-- Prices have dropped below the trend line, indicating prices may be in a reversal right now.

So, what's causing this? Several commodities have grabbed the headlines lately. Rice is at the top of that list. Food riots have been reported in some countries and some governments have halted exports. As a result, we get charts like this:

Rice is moving higher in a big way, with little stopping it from the upside right now. So long as we continue to have the same type of news stories expect this chart to continue along its upward trajectory.

Corn is still rallying. It started a new upward move at the beginning of October and is still moving higher. It has broken through hey resistance levels as well.

BUT,

Wheat has broken its uptrend and is clearly looking for a new low right now. This is what is keeping the agricultural prices a bit lower right now.

The overall CRB chart is bullish. Notice the following:

-- Prices have bounced off the SMAs for the last 4 months, using them as support

-- The shorter SMAs are higher than the longer SMAs

However, also note the possible top forming; I have circled both tops.

On the weekly chart, notice the following:

-- Prices have been rallying since August

-- Prices have moved through resistance on a regular basis and continually made new highs

-- But, the possible double top is very clear on this chart.

So -- what is going on here? There is growing speculation the Federal Reserve is near the end of its rate cuts -- or will at least pause after today. If this happens, the dollar's slide may stop (at least for now). Because most commodities are priced in dollars a drop in the dollar's value is a de facto increase in a commodity price. So traders are waiting to see what happens with the dollar right now.

I use gold as a proxy for inflation expectations. Notice the following on the chart above:

-- Prices have dropped below the trend line that started in late December

-- The shorter SMAs have dropped below the longer SMAs -- a bearish signal

-- Prices are below all the shorter SMAs, which will pull these SMAs lower.

-- Prices are now consolidating below the shorter SMAs

This is a chart that says a reversal is occurring in the market.

On gold's weekly chart, notice prices have clearly broken the long-term trend line that started at the end of last summer. Again, assuming gold is a valid proxy for inflation (which I think it is), this chart tells us traders are thinking inflation may have peaked, or is about to peak.

On the agricultural prices daily chart, notice the following:

-- Prices have broken below the trend line started last November

-- Prices are below the SMAs

-- The shorter SMAs have crossed below the longer SMAs

This is a chart that says a reversal may be occurring.

On the agricultural prices weekly chart, notice the following:'

-- Prices have been in a strong rally for about a year, continually breaking through previous resistance to make new highs. BUT,

-- Prices have dropped below the trend line, indicating prices may be in a reversal right now.

So, what's causing this? Several commodities have grabbed the headlines lately. Rice is at the top of that list. Food riots have been reported in some countries and some governments have halted exports. As a result, we get charts like this:

Rice is moving higher in a big way, with little stopping it from the upside right now. So long as we continue to have the same type of news stories expect this chart to continue along its upward trajectory.

Corn is still rallying. It started a new upward move at the beginning of October and is still moving higher. It has broken through hey resistance levels as well.

BUT,

Wheat has broken its uptrend and is clearly looking for a new low right now. This is what is keeping the agricultural prices a bit lower right now.

Tuesday, April 29, 2008

Today's Markets

First, the QQQQs are clearly in a rally

Notice the following:

-- Prices are above the SMAs

-- All the shorter SMAs are moving higher

-- The shorter SMAs are higher than the longer SMAs

-- Prices have been in a clear uptrend since mid-March

However, we're still waiting for the two other averages to confirm.

Notice the IWMs are still looking to break out

And looking at the 1 month chart, we're having a tough time getting through the 72 area with anything looking like some strength

On the SPYs daily chart, notice we've had 8 days of spinning tops. That means there is no momentum in the average moving higher.

The bottom line is we need the SPYs or IWMs to confirm in a big way. And we're just not getting it right now.

Notice the following:

-- Prices are above the SMAs

-- All the shorter SMAs are moving higher

-- The shorter SMAs are higher than the longer SMAs

-- Prices have been in a clear uptrend since mid-March

However, we're still waiting for the two other averages to confirm.

Notice the IWMs are still looking to break out

And looking at the 1 month chart, we're having a tough time getting through the 72 area with anything looking like some strength

On the SPYs daily chart, notice we've had 8 days of spinning tops. That means there is no momentum in the average moving higher.

The bottom line is we need the SPYs or IWMs to confirm in a big way. And we're just not getting it right now.

Read This Now

Over at Econbrowser there is a great piece on tax policy, the dollar, interest rates and the deficit.

Son of We're Nowhere Near the Bottom in Housing

From the AP

Housing prices dropped in February at the fastest rate ever, a widely watched index showed on Tuesday, reflecting that the housing slump is gaining momentum and showing no signs of letting up.

The Standard & Poor's/Case-Shiller home price index of 20 cities fell by 12.7 percent in February versus last year, the largest decline since its inception in 2001. Seventeen of the 20 metro areas reported record annual declines.

Here's the short version to how I am reading the housing market right now. There is already a ton of supply. With foreclosures increasing at incredibly high rates supply will obviously increase. At the same time, US consumers are faced with record levels of household debt and payments on that debt, a tanking job market and declining income. In other words, supply and demand of the housing market is seriously out of whack which will lead to declining home prices for the foreseeable future. (here's a link with tons of charts)

As a result of all this, home prices will have to drop in a big way -- which they already are.

Here's a link to the Case Chiller Press Release.

We're Nowhere Near the Bottom In Housing

From CNBC:

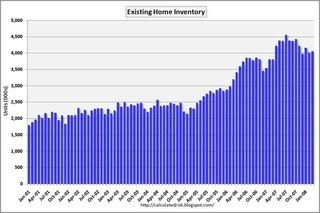

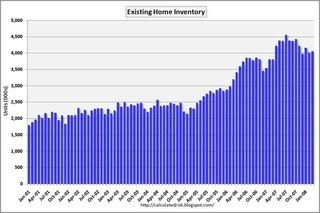

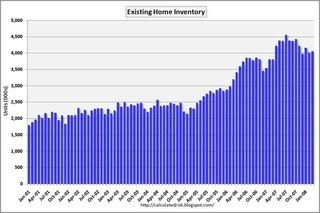

Now consider these inventory charts from Calculated Risk and ask yourself, "is housing getting better or worse?"

Need I say anything more?

U.S. home foreclosure filings jumped 23 percent in the first quarter from the prior quarter, and more than doubled from a year earlier, as more overextended borrowers failed to make timely payments, real estate data firm RealtyTrac said Tuesday.

....

"I'm more convinced that we haven't seen the peak of foreclosure activity yet, and the wave probably won't crest until late third or fourth quarter of 2008," he added.

Now consider these inventory charts from Calculated Risk and ask yourself, "is housing getting better or worse?"

Need I say anything more?

We're Nowhere Near the Bottom In Banking/Finance

From the WSJ:

From the WSJ:

From IBD:

Deutsche Bank AG Tuesday reported its first quarterly net loss in five years, reflecting additional asset write-downs, lower revenue and a trading loss in a deteriorating market.

Germany's largest bank by market capitalization said its net loss was €131 million compared with a net profit of €2.12 billion a year earlier. Reflecting fallout from the global financial crisis, quarterly revenue tumbled 52% to €4.6 billion from €9.6 billion, and the bank swung to a trading loss of €1.58 billion from a €3.97 billion trading profit in the year-earlier quarter.

The bank marked down assets by a net €2.7 billion for the quarter. The write-downs included around €1.77 billion on leveraged finance loans and loan commitments and €885 million on commercial real-estate and residential mortgage-backed securities, including Alt-A mortgages, which are a step above subprime quality.

First-quarter write-downs were slightly higher than the approximate €2.5 billion the bank had anticipated April 1 when it warned that its quarterly result would be weak.

From the WSJ:

The United Kingdom's largest mortgage lender, HBOS PLC, said Tuesday that it would launch a £4 billion ($7.96 billion) rights issue to reinforce its capital and bolster the bank against a worsening market.

It also cut its dividend payout to 40% for 2008 from 46% in 2007, saying this reflected the bank's ongoing capital requirements. "In future years, the board intends to pursue a progressive dividend policy, growing dividends in line with underlying earnings," HBOS said.

The rights issue offers investors two new ordinary shares at 275 pence each for every five held, 45% below the lender's closing share price of 496 pence Monday.

From IBD:

Morgan Stanley (MS) warned that difficulties in the credit markets are only in their "third inning," and urged shareholders to sell financial stocks that have rebounded off March lows. "We think it's a mistake to chase this rally," it said in a investors note. It predicted dividend cuts at Bank of America, (BAC) SunTrust Banks, (STI) U.S. Bancorp (USB) and Wells Fargo. (WFC) It also expects Citigroup (C) and Wachovia (WB) to further cut their payouts. SunTrust and Citi rose, while the others dipped.

Treasury Tuesdays

The bottom line story of the last few weeks in the credit market is traders are moving into riskier areas of the bond market.

While the previous points are good news, they look an awful lot like bottom fishing by money managers to me. They are less indicators of intra-credit market sentiment and more indicators of speculative sentiment. As a result, I still think the LIBOR issues are troubling as the represent what banks are thinking -- especially about each other. And increasing LIBOR rates indicates banks are still concerned about other banks ability to repay loans.

Same point, different article:

Another article made the same point:

In the short term treasury market, notice the upward trend of last 6 months has been broken. That means traders are more comfortable with what is happening in the credit markets overall.

The short end of the Treasury curve was not the only part of the curve to see some selling. The 7-10 year also experienced some selling:

The 7-10 year area of the market has clearly seen some selling as well, as it has also broken an uptrend.

And the 20+ year is in an obvious trading range.

But we know that all is still not well in the credit markets, as LIBOR is spiking again:

There were two auctions last week. Last Wednesday's auction went well:

That makes the horrible result of Thursday's 5 year auction that much more important:

Remember -- the US government is bleeding debt right now (and will be for the foreseeable future). Consider the following:

One of the main reasons for the decline in foreign interest is the slumping dollar:

In Thursday's market summary, IBD noted that inflation concerns were taking their toll on prices:

The market is not the only one worried about inflation -- the Federal Reserve may actually be more concerned about that now.

Here are three charts of the year over year change in three inflation levels -- CPI, PPI and Import prices.

The year over year change in CPI is hovering around 4%.

PPI's annual YOY change is running at around 7%.

Import/Export prices are increasing to 8% YOY.

So, we have the following points to keep an eye on.

-- Inflation is heating up and will probably impacting bond traders sentiment for some time

-- Because of a high deficit, there will be a big supply of Treasury bonds hitting the market. Increased supply means there will probably be upward pressure on interest rates

-- There is growing speculation the Fed is nearing the end of rate cuts. That may lead to increased rates as well.

-- Traders are selling Treasuries and moving into riskier assets.

The major U.S. indexes have been rallying since hitting a trough in mid-March. The difference between corporate bond yields and ultra-safe Treasurys has narrowed, as has the spread between mortgage agency bonds and Treasurys. And the cost of buying a type of insurance against corporate defaults has plunged.

While the previous points are good news, they look an awful lot like bottom fishing by money managers to me. They are less indicators of intra-credit market sentiment and more indicators of speculative sentiment. As a result, I still think the LIBOR issues are troubling as the represent what banks are thinking -- especially about each other. And increasing LIBOR rates indicates banks are still concerned about other banks ability to repay loans.

Same point, different article:

Investors are turning to riskier investments that had been all but abandoned earlier this year, such as corporate bonds, where last week a record $40.1 billion in new debt came to market, including issues from embattled companies such as Citigroup Inc. and Merrill Lynch & Co. Meantime, the premium that investors are demanding on corporate debt -- even low-quality speculative grade, or "junk," bonds -- is coming down as fears subside.

"We established that the Fed was going to backstop the markets, keep things stable and slowly but surely nurse the markets back to health," says Daniel Shackelford, a portfolio manager at T. Rowe Price Group Inc. As a result, "risk-taking has come back in the market."

Another article made the same point:

While they are diving into riskier corporate debt, investors have been pulling away from safer Treasury bonds, especially among short-term securities most sensitive to Federal Reserve policy.

Many now believe that when the Federal Open Market Committee meets Tuesday it will lower the benchmark federal-funds rate by a quarter of a percentage point to 2% but will signal a pause in additional moves until the economic outlook becomes more clear.

The recent selloff in the market for Treasury bonds was fast and furious. Yields on U.S. Treasury two-year notes rose to 2.42% Friday from 2.17% the week before and substantially above the 1.33% low hit on the day after the Bear Stearns deal was announced. Yields rise as bonds' prices fall.

Mortgage-backed bonds, one of the hardest-hit corners of the market, also have improved, especially those backed by government agencies Fannie Mae and Freddie Mac. The spread on these bonds has narrowed by almost a full percentage point from March levels.

In the market where investors buy and sell insurance against corporate defaults, fears of a financial institution collapse also are abating. Insurance against default on $10 million of Merrill Lynch debt for five years now costs $167,000 annually, down from a high of $335,000 in mid-March, though it is still much higher than it was last June, when it was $25,000, according to pricing service Markit.

In the short term treasury market, notice the upward trend of last 6 months has been broken. That means traders are more comfortable with what is happening in the credit markets overall.

The short end of the Treasury curve was not the only part of the curve to see some selling. The 7-10 year also experienced some selling:

The 7-10 year area of the market has clearly seen some selling as well, as it has also broken an uptrend.

And the 20+ year is in an obvious trading range.

But we know that all is still not well in the credit markets, as LIBOR is spiking again:

An interest-rate based on what banks charge each other for loans has risen in the last week, sidestepping a general improvement in credit sentiment and acting as a reminder of the still-severe hurdles facing U.S. banks.

The London inter-bank offered rate, or Libor, has risen 23 basis points since April 1 to 2.91%, according to three-month U.S. dollar Libor rates quoted by FactSet Research. It's risen 33 basis points since mid-March, when several other market indicators instead started to show signs of improvement. One basis point is 1/100th of a percentage point.

"The stress in the money markets is still acute," said BNP Paribas economist Gizem Kara and colleagues in a note Thursday.

A higher Libor rate means banks are charging more for short-term loans to each other, suggesting they are more nervous about the borrowers' ability to pay back. It may also indicate banks, struggling with billions in bad loans, are hoarding capital and less likely to loan to each.

There were two auctions last week. Last Wednesday's auction went well:

Yields on two-year Treasury notes held near an almost two-month high after the U.S. sold a record $30 billion of the securities, indicating investors are more willing to buy debt even as expectations fade for interest-rate cuts.

The notes were sold at a yield of 2.225 percent, below the 2.2336 percent average estimate of nine bond-trading firms surveyed by Bloomberg News. The group of investors that includes foreign central banks bought a bigger share than their average over the past six auctions.

Indirect bidders, the category that includes foreign central banks, bought 33.6 percent of today's sale, the most in seven months. At the past six auctions, the group bought 23 percent on average.

That makes the horrible result of Thursday's 5 year auction that much more important:

``It was a horrible, horrible auction,'' said David Ader, head of U.S. government bond strategy in Greenwich, Connecticut, at RBS Greenwich Capital, one of the 20 securities firms required to bid at Treasury sales. ``An auction result like this is going to push people to say, `I'm going to step aside.'''

At today's sale, the biggest since February 2003, the bid- to-cover ratio, which gauges demand by comparing total bids with the amount of securities offered, was $1.65 for every $1 sold. That was the lowest since February 2003, and down from $1.98 in March.

Indirect bidders, a group of investors that includes foreign central banks, bought 29 percent of the securities, down from 34 percent in March.

Traders pushed two-year note yields to the highest level since Jan. 18 on speculation the central bank won't lower borrowing costs further after this month. The losses pushed the securities' yield above the Fed's benchmark rate by 14 basis points, the most since June 2006.

Remember -- the US government is bleeding debt right now (and will be for the foreseeable future). Consider the following:

The Treasury's deficit for the month of February totaled $175.6 billion, making for a fiscal year-to-date deficit of $263.3 billion -- up 62 percent from this time last year. Outlays are on the rise, up 10.2 percent year-to-date and reflecting rising spending on defense and higher interest payments, which are a result of the rising debt. Receipts are up this fiscal year, but only by 1.3 percent. Individual income taxes are barely higher and corporate taxes are 15 percent lower. Rising spending and falling receipts, and the risk that receipts will fall further as the economy weakens, are making the budget deficit a bigger and bigger issue for the economy and for the value of the dollar.

One of the main reasons for the decline in foreign interest is the slumping dollar:

The Japanese, who own $586.6 billion, or 12 percent of U.S. government debt, had their worst quarter in Treasuries this decade, losing 7 percent in the first three months of the year as the dollar fell to the lowest since 1995 versus the yen, Merrill Lynch & Co. indexes show. Dai-ichi Mutual Life Insurance Co., Meiji Yasuda Life Insurance Co. and Sumitomo Life Insurance Co., three of the nation's four-biggest insurers, would rather accept the world's lowest bond yields in Japan than buy U.S. debt.

``It's too early to say the dollar will stop falling,'' said Masataka Horii, head of the investment team in Tokyo for the $53.1 billion Kokusai Global Sovereign Open, Asia's biggest bond fund. ``The U.S. economy will be slow for a while.''

Japan owns more Treasuries than any other nation. After raising their holdings by $9.2 billion to $620.6 billion between March and July 2007, Japanese investors trimmed that stake by $34 billion through February, the Treasury said April 15.

America relies on foreign investors, who own more than half the U.S. government debt outstanding, to finance a deficit that New York-based Goldman Sachs Group Inc. predicts will expand to a record $500 billion for the year ending Sept. 30, after a $163 billion gap last year. Without their support, long-term interest rates would be 0.9 percentage point higher, a 2006 Federal Reserve study found.

In Thursday's market summary, IBD noted that inflation concerns were taking their toll on prices:

With oil prices approaching the $120-per-barrel mark and soaring food costs, worries about inflation hit the longer end of the bond market. The benchmark 10-year Treasury note yielded 3.74%, up from 3.71% late Tuesday.

Longer-dated bonds are among the most sensitive investments to inflation expectations, since rising prices diminish the cash flow from fixed income and erode the overall value of the investment over time.

"The market is worried about inflation — that seems to be new story," said Thomas di Galoma, head of government trading at Jefferies & Co. in New York.

The market is not the only one worried about inflation -- the Federal Reserve may actually be more concerned about that now.

The Federal Reserve is likely to cut its short-term interest rate by a quarter of a percentage point next week -- but then may be ready for a breather.

The Fed, meeting Tuesday and Wednesday, is likely to make what would be its seventh cut in eight months. The reason: Some officials see a case for more insurance against a deeper recession.

But others are concerned a cut could contribute to inflationary pressure with little benefit for growth. That means the option of standing pat will likely also be on the table. If it does cut rates, the Fed could signal in the statement accompanying the decision an inclination to pause and assess the impact of its cuts, which have lowered the federal-funds rate to 2.25% from 5.25% since last year.

Officials say the case for lowering rates further rests primarily on the value of additional insurance against a worse-than-anticipated economic scenario.

Here are three charts of the year over year change in three inflation levels -- CPI, PPI and Import prices.

The year over year change in CPI is hovering around 4%.

PPI's annual YOY change is running at around 7%.

Import/Export prices are increasing to 8% YOY.

So, we have the following points to keep an eye on.

-- Inflation is heating up and will probably impacting bond traders sentiment for some time

-- Because of a high deficit, there will be a big supply of Treasury bonds hitting the market. Increased supply means there will probably be upward pressure on interest rates

-- There is growing speculation the Fed is nearing the end of rate cuts. That may lead to increased rates as well.

-- Traders are selling Treasuries and moving into riskier assets.

Monday, April 28, 2008

Today's Markets

Problems from a technical perspective are developing:

The 139/140 area is providing strong upside resistance to the SPYs.

Today was no exception. The markets could not advance beyond these levels.

On the IWMs notice, the markets need to move beyond 72.

But today (again) they couldn't.

The QQQQs are still strong.

Looking at the daily charts of all the averages, we are seeing strong advances with prices above the SMAs and the shorter SMAs pointing higher. These are good signs. But the only average to really get some strong beyond resistance running going on is the QQQQs. We need another average to confirm in order for this to be a real rally. My guess is traders are waiting for Wendesday's GDP number before they send the market higher or not.

The 139/140 area is providing strong upside resistance to the SPYs.

Today was no exception. The markets could not advance beyond these levels.

On the IWMs notice, the markets need to move beyond 72.

But today (again) they couldn't.

The QQQQs are still strong.

Looking at the daily charts of all the averages, we are seeing strong advances with prices above the SMAs and the shorter SMAs pointing higher. These are good signs. But the only average to really get some strong beyond resistance running going on is the QQQQs. We need another average to confirm in order for this to be a real rally. My guess is traders are waiting for Wendesday's GDP number before they send the market higher or not.

Housing Is Nowhere Near the Bottom

From Bloomberg:

I wonder how the NAR is spinning this news?

A record 18.6 million U.S. homes stood empty in the first quarter as lenders took possession of a growing number of properties in foreclosure.

The figure is 5.7 percent higher than a year ago, when 17.6 million properties were vacant, the U.S. Census Bureau said in a report today. The vacancy rate, the share of homes empty and for sale, rose to 2.9 percent, the highest in a series that goes back to 1956. About 2.3 million empty homes were for sale, compared with 2.2 million a year earlier, the report said.

The worst U.S. housing slump in more than a quarter century is deepening as falling values encourage buyers to delay purchases in hopes of getting a better deal. The median U.S. home sale price may drop 5.8 percent in 2008, the most on record, followed by another 4.7 percent decline next year, Fannie Mae, the world's largest mortgage buyer, said April 7.

I wonder how the NAR is spinning this news?

Before We Start Thinking This is Over....

From the WSJ:

Since the Fedbailed out provided default insurance for the Bear Stearns deal, traders have bid up the market. Essentially, they have been acting as though the Fed would provide default insurance for the economy as a whole, preventing a meltdown. I think this is a prime reason for the rally in the markets discussed below. But there are some other considerations going forward.

First, housing is nowhere near bottom.

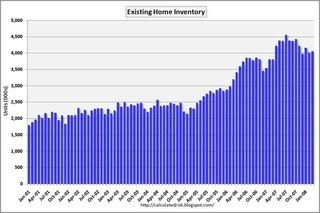

Let's start with supply. First, there are a ton of existing homes on the market -- right around 4 million (charts are from Calculated Risk).

And this is before we get into the issue of foreclosures.

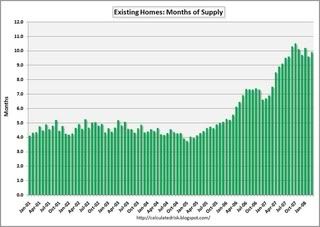

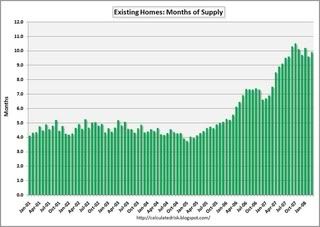

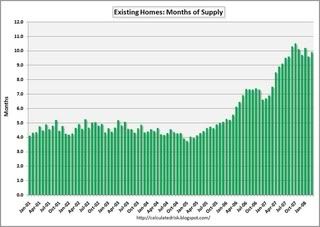

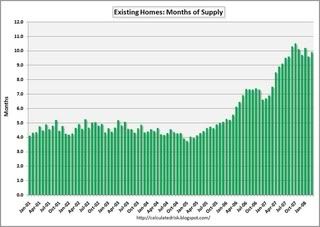

This translates into a little under a 10 months supply. Also note that this number -- months of supply -- has been increasing.

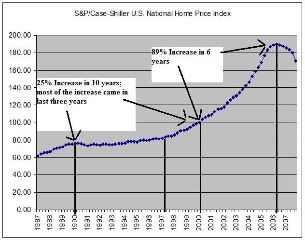

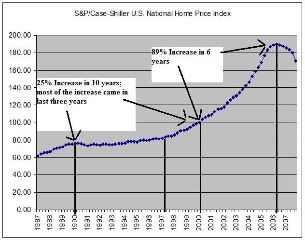

So -- we have a ton of supply on the market. Unfortunately that has not translated into a big enough cut in prices to stimulate demand. Here is a chart of the Case Shiller home price index.

Notice that prices increased about 90% in 6 years, yet have barely dropped in comparison to the massive run-up they had during the early 2000s. Simply put, we have a long way to go before we start seeing prices hit an inventory clearing level.

And who's going to buy these houses?

Job growth has been dropping, which is leading to

Dropping income, and

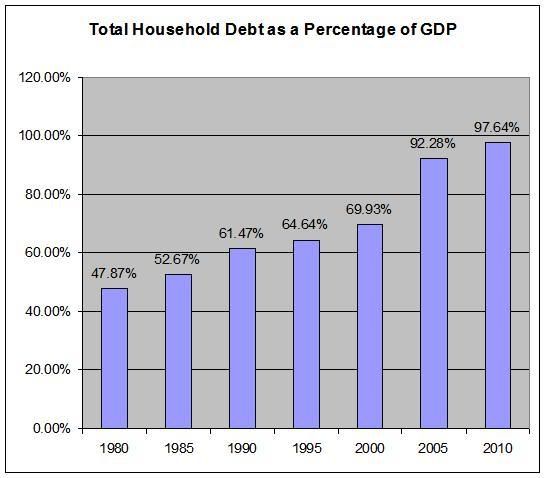

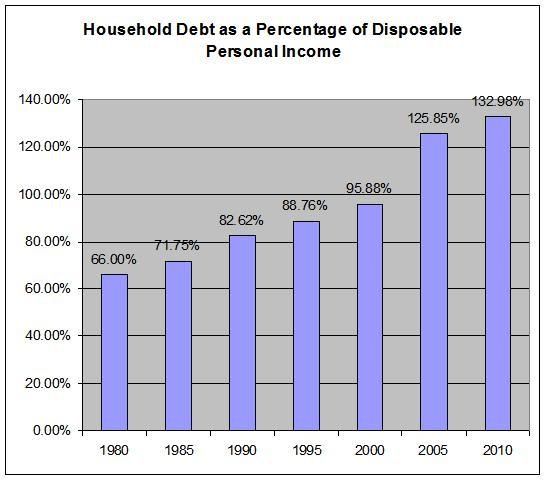

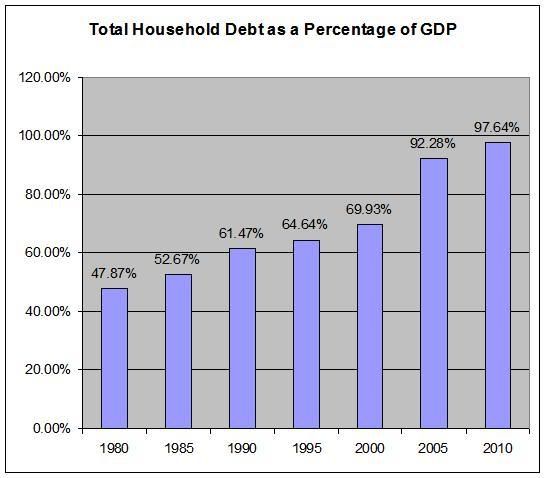

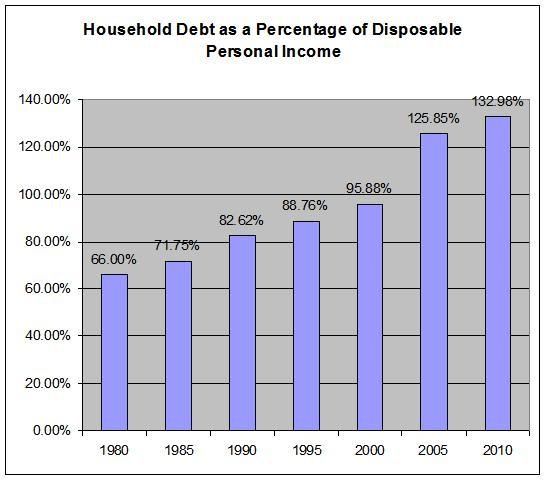

Dropping consumption. In addition, it's not like Americans can take on much more debt.

The basic economic facts are very straightforward: inventory is really high and demand is dropping. That means we can expect more price drops for the foreseeable future.

The point of all this there are big problems out there in econ land outside of the credit crisis.

"We established that the Fed was going to backstop the markets, keep things stable and slowly but surely nurse the markets back to health," says Daniel Shackelford, a portfolio manager at T. Rowe Price Group Inc. As a result, "risk-taking has come back in the market."

There remain significant trouble spots. The market for short-term loans between banks remains highly fragile. Other markets for complex debt instruments -- such as auction-rate securities, which help finance municipalities and student lenders, or collateralized debt obligations, which bundle together mortgage and other debt instruments -- have been deeply damaged by the crisis. Banks and brokerage firms are still sitting on piles of bad debt that could result in more losses.

"We still have some tough times ahead," says Alex Roever, credit strategist at J.P. Morgan Chase.

In the broader economy, housing, the trigger to the crisis, shows no sign of having hit bottom. Meanwhile, a consumer-spending pullback could be accelerating as households are pinched by rising gasoline prices, falling home prices and a sinking job market.

"The trick for investors is to figure out whether what they are seeing is a mirage," says Jason DeSena Trennert, chief investment strategist at Strategas Research Partners LLC. For example, he says the benefits of $100 billion of fiscal stimulus about to hit the economy could quickly fade.

Since the Fed

First, housing is nowhere near bottom.

Let's start with supply. First, there are a ton of existing homes on the market -- right around 4 million (charts are from Calculated Risk).

And this is before we get into the issue of foreclosures.

This translates into a little under a 10 months supply. Also note that this number -- months of supply -- has been increasing.

So -- we have a ton of supply on the market. Unfortunately that has not translated into a big enough cut in prices to stimulate demand. Here is a chart of the Case Shiller home price index.

Notice that prices increased about 90% in 6 years, yet have barely dropped in comparison to the massive run-up they had during the early 2000s. Simply put, we have a long way to go before we start seeing prices hit an inventory clearing level.

And who's going to buy these houses?

Job growth has been dropping, which is leading to

Dropping income, and