Saturday, December 29, 2012

Weekly Indicators finish the year strongly edition

- by New Deal democrat

November monthly data reported this past week was sparse, but included Case-Shiller home prices, which continued to rebound, and new home sales, which were flat. The Chicago PMI manufacturing index expanded slightly. Consumer confidence about the present increased sharply, but confidence about the future declined just as sharply, probably due to the "fiscal cliff" fiasco in Washington. This decline will be reflected as a component of the LEI.

I watch the high frequency weekly indicators because even though they are more noisy, they will signal a turn or continuation in the direction of the economy well before monthly data is reported. Even now November monthly data is still affected by Hurricane Sandy, while the weekly data is already completely unaffected.

To begin with, Employment related indicators were perhaps the most positive all year:

The Department of Labor reported that Initial jobless claims fell from 361,000 to 350,000. The four week average fell by 11,000 to 356,750. As I suggested last week, this week saw a new post-recession low in the 4 week average. Since 2 and 3 weeks ago were still slightly affected by Sandy, we could set yet more new lows in the next week or two.

The American Staffing Association Index again remained at 94. The general trend in this index is now declining slightly in comparison to last year.

The Daily Treasury Statement showed that for the first 18 days of December, $156.5 B was collected vs. $139.0 B for the first 18 days of December last year. For the last 20 days ending on Thursday, $156.5 B was collected vs. $151.0 B for the comparable period in 2011, an increase of $14.5 B or +9.7%. Tax collections have continued to increase sharply for well over a month.

Same Store Sales and Gallup consumer spending continued very positive:

The ICSC reported that same store sales for the week ending December 21 rose slightly, up +0.7% w/w and were up +3.2% YoY. Johnson Redbook showed a 2.9% YoY gain, which is a strong gain for them. The 14 day average of Gallup daily consumer spending as of December 27 was $85, compared with $77 for this week last year. Gallup's report has been running strongly positive this month.

Bond yields rose but credit spreads narrowed slightly:

Weekly BAA commercial bond yields rose +.07% this week at 4.70%. Yields on 10 year treasury bonds also rose +.11% to 1.80%. The credit spread between the two likewise decreased by .04% to 2.90%. Spreads are well off their 52 week highs.

Housing reports continue to be generally positive:

The Mortgage Bankers' Association did not report during this holiday week.

The Federal Reserve Bank's weekly H8 report of real estate loans this week rose 28 w/w to 3549. The YoY comparison, which is from the bottom, increased to +2.3%.

YoY weekly median asking house prices from 54 metropolitan areas at Housing Tracker increased +2.6% from a year ago. YoY asking prices have been positive for over an entire year.

Money supply was almost fully positive:

M1 fell -1.9% for the week, but increased +2.5% month over month. Its YoY growth rate declined slightly to +13.2%, so Real M1 also fell to +11.4% YoY. M2 increased +0.3% for the week, and was up +1.1% month over month. Its YoY growth rate rose to 8.1%, so Real M2 rebounded to 6.3%. The growth rate for real money supply has started to increase again in the last month.

Rail traffic rebounded and had a strongly positive week:

The American Association of Railroads reported that total rail traffic increased for the second week in a row, up +24,900 carloads YoY, or +4.9%. Non-intermodal rail carloads also up for the first time in many months, +2200 or +0.9%. Coal hauling was off -14,500, so ex-coal carloads were up +17,100. Negative comparisons declined to a recent low of 5. Intermodal traffic, which had suffered due to Pacific port strikes, rebounded to +22,300 or +10.2% YoY. It is very unlikely that this rebound will be sustained at this level.

Finally, the prices of oil and gasoline rose off their seasonal bottoms, and gasoline usage also fell:

Gasoline prices rose $.01 last week to $3.26. This is equal to last year's seasonal lows and probably marks the seasonal low this year as well. Oil prices per barrel increased from $88.38 to $90.70. Gasoline usage was down for one week at 8608 M gallons vs. 8923 M a year ago, or -3.5%. The 4 week average at 8517 M vs. 8761 M one year ago, was off -2.8% YoY.

Turning now to the high frequency indicators for the global economy:

The TED spread rose sharply from 0.26 to 0.30, at the high end of its 3 month range. The one month LIBOR remained staady at 0.2097, near its 3 year low.

The Baltic Dry Index was essentially flat, drifting down 1 from 700 to 699, a 3 month low, but still within the middle of its 1 year range. Harper Peterson took a holiday break and did not report its Harpex Shipping Index this week. The longer term declining trend in shipping rates for the last 3 years is intact.

Finally, the JoC ECRI industrial commodities index rose from 124.57 to 125.64. It is now up 7.07 YoY.

There was very little weakness in the high frequency data this past week. Shipping remains weak, as does gasoline usage. There were slight increases in bank lending rates and interest rates. But almost everything else was positive or strongly positive. Layoffs set a new nearly 5 year low. Tax withholding is soaring. Housing loans and prices are positive. Consumer spending continues to be very positive. Gas prices are seasonally accomodative. Money supply is very positive. Commodity prices signal strength. This week railroad data was again quite positive.

Just as at the end of last year, the most up-to-date weekly data shows a solid positive bias, perhaps reflecting a new seasonality of autumn and winter growth, that has been balanced by spring and summer stalls. Meanwhile, the "fiscal cliff" remains a wild card.

Have a nice weekend, and best wishes for a happy and safe New Year.

Thursday, December 27, 2012

A bah, humbug consumer Christmas? not so fast

. - by New Deal democrat

Yesterday the econoblogosphere was all atwitter about a MasterCard report that consumers had only spent 0.7% more this holiday season vs. last year. This is said to be the weakest showing since the recession collapse of 2008,

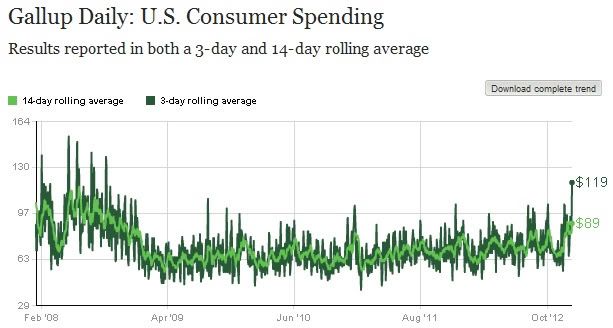

But before you accept that a the final word on the subject of consumer sales at year end 2012, take a look at this screenshot of Gallup's daily consumer spending report published yesterday, covering data fron February 2008 through December 23:

The last two weeks have seen the highest amount of consumer spending since 4 years ago, and the spike last week is by far the highest since 4 years ago as well.

So, how does this square with the MasterCard result? Two reasons are likely. First of all, the MasterCard result includes all shopping since October 28, i.e., just before Sandy. Spending was depressed from then until mid-November. Second, MasterCard is reporting credit card purchases only. Gallup, by contrast, is a relatively small sample - and so more volatile - and further is a self-report of all consumer spending. So while credit card transactions may only have increased slightly, cash buying by more frugal or budget-conscious consumers may have increased more substantially.

So I'm certainly not saying that the MasterCard data is wrong. But the Gallup consumer data earned its bones during the debt ceiling debacle last year, when it accurately and in real time showed that consumers were not slowing their spending.

Bottom line: the consumer may not have been as Scrooge-ish as reported yesterday.

New low in initial jobless claims contraindicates recession

- by New Deal democrat

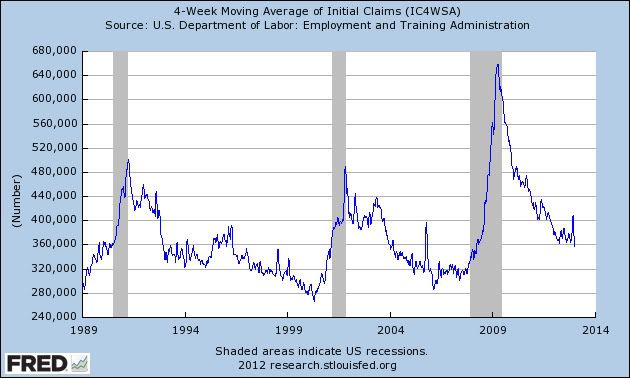

Initial jobless claims are generally acknowledged to be a short leading indicator for the economy. With this morning's report of 350,000 new claims being filed last week, the 4 week average fell to 356,750. This is the lowest 4 week average in nearly 5 years! In the nearly 50 year history of initial jobless claims data, there has never been a new low in initial claims set during a recession.

Back in July I took a look at the historical record. In all cases but one since records started to be kept back in the 1960s, initial jobless claims rose 10% from their lows before a recession began. The lowest increase was 5%. Once recessions have begun, the number of claims rose inexorably. The shortest period of time between the low in claims and the onset of recession was 2 1/2 months.

While we did have two weeks post-Sandy where initial claims were more than 10% above their previous post-recession low of 363,000, my calculations have shown that ex-Sandy, the four week average of new claims would only have risen into the low 370,000s range.

While initial jobless claims are only one indicator, it is unheard of for claims to be falling to new lows unless the economy is expanding, and is strong evidence against any thesis that a recession began earlier this year.

P.S.: The data for one week ago suggests that the effects of Sandy have almost completely dissipated. Combined NY and NJ claims one week ago were 9.4% of all claims filed, vs. 9.0% one year ago, and vs. 8.9% in October before Sandy struck. At worst, Sandy may have had about an impact of about 1000 claims.

P.P.S.: I'll update with a graph showing today's data once it is available. UPDATE:Here's the graph, starting in 1989 to compare the typical pattern, and showing this week's new post-recession low at the very end:

Wednesday, December 26, 2012

A last look at 2012 recession indicators

- by New Deal democrat

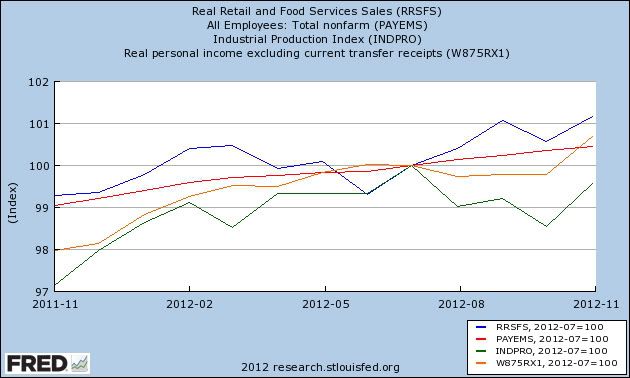

A recession is generally defined by the NBER as a substantial downturn in production, employment, sales, and income. Now that the November numbers are in, let's take a last look for where those numbers stand in 2012.

The St. Louis FRED site directs us to nonfarm payrolls, real personal income excluding transfer payments, industrial production, and real retail sales as defining metrics. Here's how those stand, normed to 100 as of July 2012:

As of now, 3 of the 4 metrics are still rising. Only industrial production has contracted since that time.

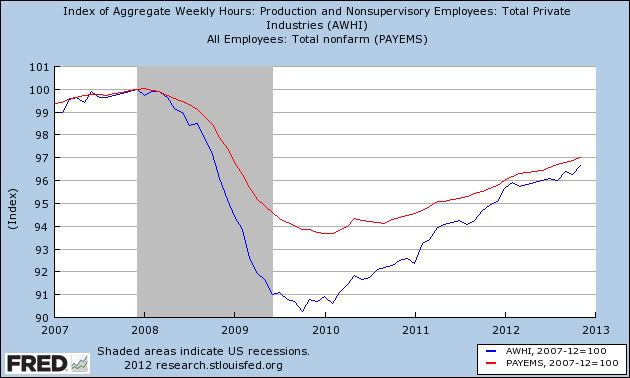

Another metric that is thought to be looked at by at least a few members of the NBER is aggregate hours, which measures the total hours worked in the economy. During the recession of 2008-09, about 6% of alll jobs were lost, but 10% of all hours worked. The deficit in hours worked was made up at the beginning of 2012, and the two have moved largely in tandem since:

So aggregate hours have also continued to increase.

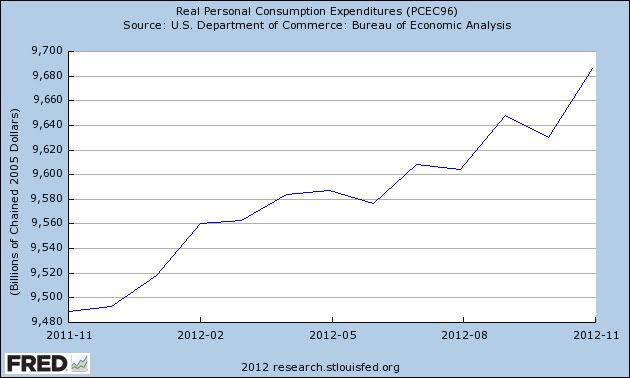

In addition to real retail sales, another way of measuring sales is via real personal consumption expenditures, which also have continued to increase:

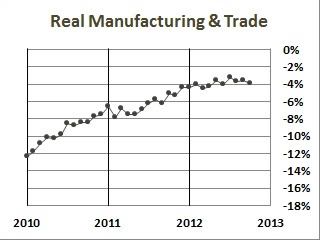

The preferred sales metrial cited by ECRI is real manufacturing and trade sales. This series isn't tracked by the St. Louis FRED, but blogger Doug Short has been measuring this recently to track ECRI's prediction, and here's his graph:

My conclusion is that, by most measures, the expansion has continued through November. Nevertheless it is clear that, no matter how you measure, the economy slowed markedly by March and has not picked up momentum since.

Monday, December 24, 2012

Household deleveraging continues

-by New Deal democrat

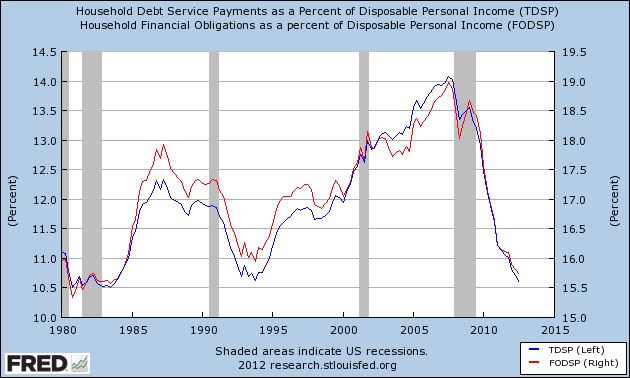

The Federal Reserve's report on household debt burdens was released last week, covering the July - September quarter. According to the bank,

The household debt service ratio (DSR) is an estimate of the ratio of debt payments to disposable personal income. Debt payments consist of the estimated required payments on outstanding mortgage and consumer debt.Both measures declined substantially, after a relative pause about a year ago for several quarters. I've combined the two measures into a single graph:

The financial obligations ratio (FOR) adds automobile lease payments, rental payments on tenant-occupied property, homeowners' insurance, and property tax payments to the debt service ratio.

Both debt service payments (blue line) and total household onligations (red line) are now less than at any time since 1984. While in recent quarters the rate of decrease has slowed, debt service payment are now only 0.1% above their all time low.

Earlier this year CNBC reported that :

U.S. home owners are refinancing their mortgages at the fastest clip since 2005, but the difference now is they are putting cash in, not taking it out.This equates to about 0.6% of all retail spending per month.

At the going rate, 25 percent of all first-lien U.S. mortgages will be refinanced this year, according to LPS Applied Analytics. That represents about $7.1 billion —just through June of this year — in savings on monthly payments, according to economists at Freddie Mac, who ran the numbers for this report.

I have long suspected that, before this cycle is over, households would set new all time lows for debt service. That looks very likely now. If anything, refinancing has increased in the last few months with new record lows in mortgage rates, and is probably keeping the economy from tipping back into recession.

Sunday, December 23, 2012

Weekly Indicators: new seasonal strength shows itself again edition

- by New Deal democrat

November monthly data reported this past week included the highest number of housing permits in 4 years, and a very good report on new home sales as well. Durble goods also showed a solid increase. Personal income, spending, and savings also all rose. The Empire State manufacturing index contracted, while Philly's improved. On the other hand, consumer sentiment soured sharply, most likely in response to the "fiscal cliff" shenanigans in Washington. The Leading Indicators in November also declined -0.2, showing a complete stall over the last 6 month period. Had Sandy not impacted initial jobless claims, most likely the LEI would have risen +0.1 instead.

Once again, let me make this reminder that I watch the high frequency weekly indicators because even though they are more noisy, they will signal a turn or continuation in the direction of the economy well before monthly data is reported. In particular, right now November monthly data is still affected by Hurricane Sandy, while its affect the weekly data has almost completely abated.

To begin with, Employment related indicators were mixed but with a positive bias:

The Department of Labor reported that Initial jobless claims rose from 343,000 to 361,000. The four week average fell by 13,750 to 367,750. As of one week ago, the effects of Hurricane Sandy were still slightly affecting the weekly number. As the elevated post-Sandy numbers wash out, the 4 week average should continue to decline slightly for at least one more week. It is quite possible that we will see a new post-recession low in the 4 week average next week.

The American Staffing Association Index remained at 94. The general trend in this index is now declining slightly in comparison to last year.

The Daily Treasury Statement showed that for the first 14 days of December, $115.6 B was collected vs. $103.1 B for the first 14 days of December last year. For the last 20 days ending on Thursday, $151.0 B was collected vs. $142.3 B for the comparable period in 2011, an increase of $8.7 B or +6.1%. Tax collections have continued to increase sharply for over a month.

Same Store Sales and Gallup consumer spending continued very positive:

The ICSC reported that same store sales for the week ending December 14 declined -4.3% w/w but were up +3.5% YoY. Johnson Redbook showed a 2.4% YoY gain, which is a strong gain for them. The 14 day average of Gallup daily consumer spending as of December 20 was $83, compared with $78 for this week last year. Gallup's report has been running strongly positive this month.

Bond yields rose but credit spreads narrowed slightly:

Weekly BAA commercial bond yields rose +.06% this week at 4.63%. Yields on 10 year treasury bonds also rose +.07% to 1.69%. The credit spread between the two likewise decreased by .01% to 2.94%. Spreads have generally increased in the last month, but remain well off their 52 week highs.

Housing reports continue to be generally positive:

The Mortgage Bankers' Association reported that the seasonally adjusted Purchase Index fell -5% from the prior week, but increased 9% YoY, close to if not at a 2 year high. The Refinance Index declined 14% for the week, as mortgage rates rose.

The Federal Reserve Bank's weekly H8 report of real estate loans this week declined -2 w/w to 3521. The YoY comparison, however, increased to +1.3% and is 1.4% above its bottom.

YoY weekly median asking house prices from 54 metropolitan areas at Housing Tracker increased +2.3% from a year ago. YoY asking prices have been positive for over an entire year.

Money supply has returned to being fully positive:

M1 rose +0.3% for the week, and also increased +3.2% month over month. Its YoY growth rate declined slightly to +13.6%. Real M1 also fell to +11.8% YoY. M2 increased +0.5% for the week, and was up +0.4% month over month. Its YoY growth rate rose to 7.7%, so Real M2 rebounded to 5.9%. The growth rate for real money supply has started to increase again in the last few weeeks.

Rail traffic rebounded and had a strongly positive week:

The American Association of Railroads reported that total rail traffic increased for the first time in many weeks, up +6600 carloads YoY, or +2.2%. Non-intermodal rail carloads were again off significantly, -12,000 or -3.9%, and as usual entirely due to coal hauling, which was off -17,500. Ex-coal carloads were up +5500. Negative comparisons remained at 8. Intermodal traffic, which had suffered due to Pacific port strikes, rebounded to +18,600 or +8.0% YoY. It is very unlikely that this rebound will be sustained at this level.

Finally, the price of oil rose off its seasonal bottom while the price of gasoline fell sharply, and gasoline usage also fell:

Gasoline prices fell $.10 last week to $3.25. This is equal to last year's seasonal lows and probably marks the seasonal low this year as well. Oil prices per barrel increased from $86.73 to $88.38. Gasoline usage was down for one week at 8610 M gallons vs. 8879 M a year ago, or -3.0%. The 4 week average at 8472 M vs. 8722 M one year ago, was off -2.9% YoY.

Turning now to the high frequency indicators for the global economy:

The TED spread fell from 0.29 to 0.26, in the middle of its 3 month range, and also in the middle of its 3 year range. The one month LIBOR rose from 0.2090 to 0.2097, near its 3 year low.

The Baltic Dry Index fell sharply again from 784 to 700, a 3 month low, but still within the middle of its 1 year range. The Harpex Shipping Index also fell 1 more to yet another new 52 week low of 352. The longer term declining trend in shipping rates for the last 3 years is intact.

Finally, the JoC ECRI industrial commodities index rose from 123.20 to 124.57. It continues to be positive YoY, up 5.76.

Most of the recent themes in the weekly data remain intact. Manufacturing is weak, as are shipping and gasoline usage. Consumer sentiment is souring. On the other hand, domestic rail ex-coal is positive and improving. Housing continues its resurgeance from a very low level. Consumer spending remains strong. Money supply is strong. Weekly employment data is generally positive, although temporary help may be flagging. Gas prices are very accomodative at the moment. Commodity prices are positive. Bank lending rates, bond rates, and credit spreads have eased slightly. This week railroad data also turned quite positive.

The "fiscal cliff" is a wild card, and the effects of Sandy remain in the monthly data. In general the most up-to-date weekly data shows a solid positive bias, perhaps reflecting the new seasonality of autumn and winter growth, balanced by spring and summer stalls. At the same time, the flat LEI should not be discounted, as it signifies a complete stall at some point next year, although a post-Sandy rebound in December data, especially jobless claims, may make for a short-lived signal.

Have a nice weekend.

Subscribe to:

Comments (Atom)