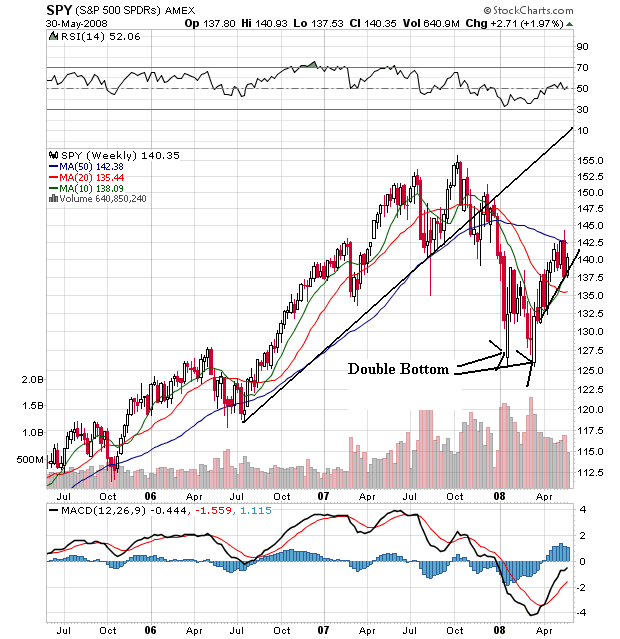

The SPYs started to rally at the end of 2006, and hit a point in 2006 that formed the basis of their long-term trend line. The market continued to rally until the market drop of last summer when all the news about the credit markets started to hit. The market dropped until the beginning of this year when it formed a double bottom. Since the Bear Stearns bail-put we've been rallying.

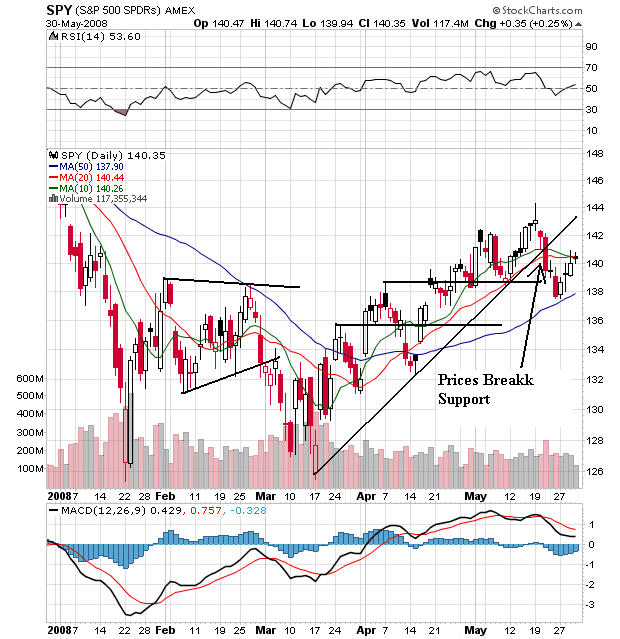

On the daily chart, notice the following:

-- Prices rallied from mid-March, but broke the trend line in mid-May.

-- The 10 day SMA is turning lower and is about to cross below the 20 day SMA

-- The 20 day SMA is now moving sideways.

-- Prices are now below the 10 and 20 day SMA

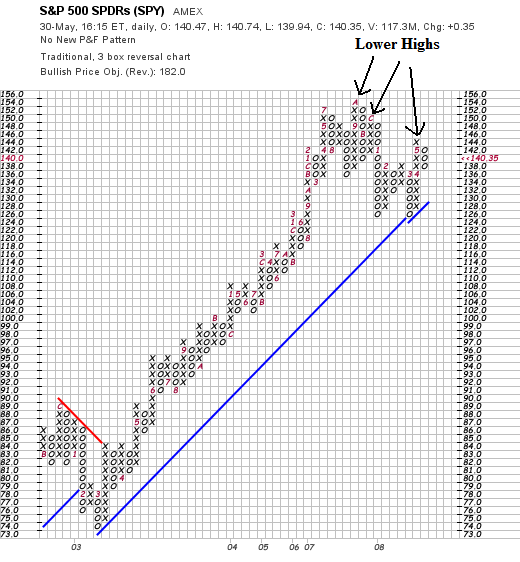

The main point of the SPYs P&F chart is the series of lower highs it has formed since the market top.

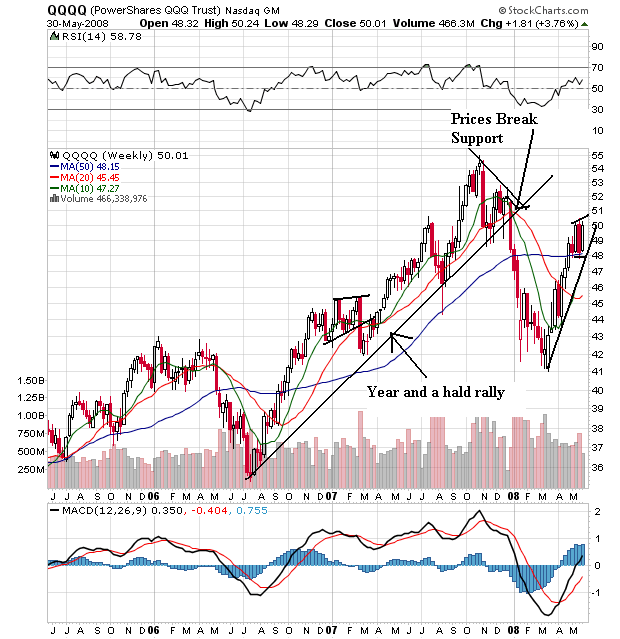

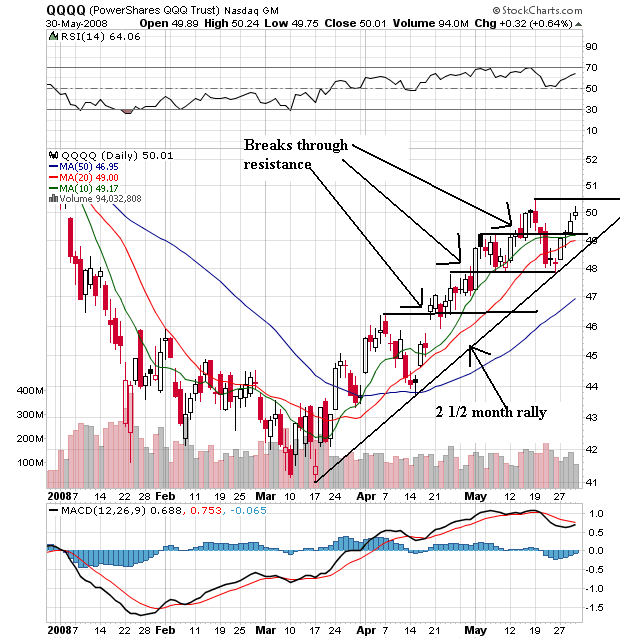

On the QQQQs weekly chart, notice that prices rallied from mid-2006 to the end of the summer in 2007. Then the market dropped until the end of the 1Q2008. The QQQQs have been rallying since then, although they have been consolidating for the last few weeks.

On the daily chart, notice that prices have been moving higher since mid-March, breaking through previous resistance. Also note the short-term SMAs are all moving higher and the shorter SMAs are above the longer SMAs. Also note the prices are above the SMAs.

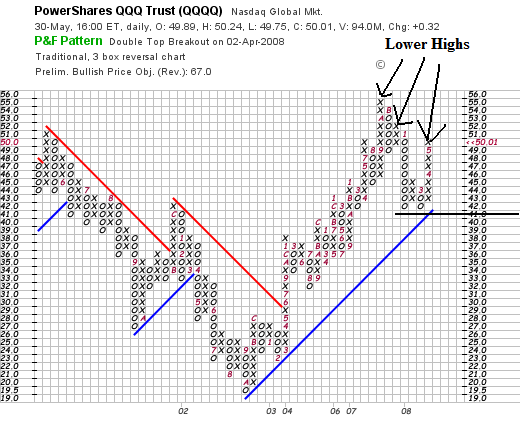

On the P&F chart notice these two points.

-- We've seen a period of lower highs, and

-- We've seen a strong rally over the last two months

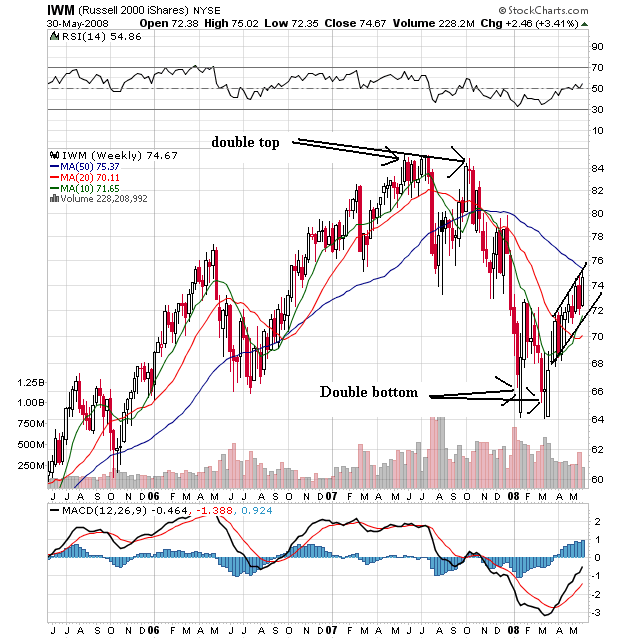

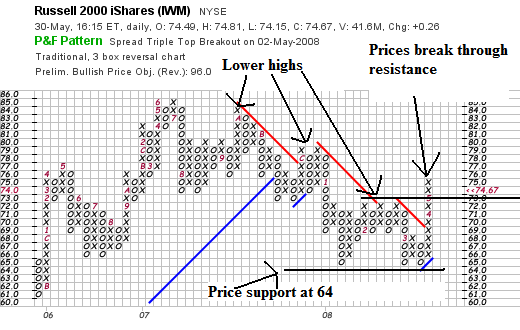

On the weekly chart of the IWMs, notice that prices rallied from the end of 2005 until the end of the summer of 2007, when they formed a double top. Prices formed a double bottom in 2008 and have been rallying since.

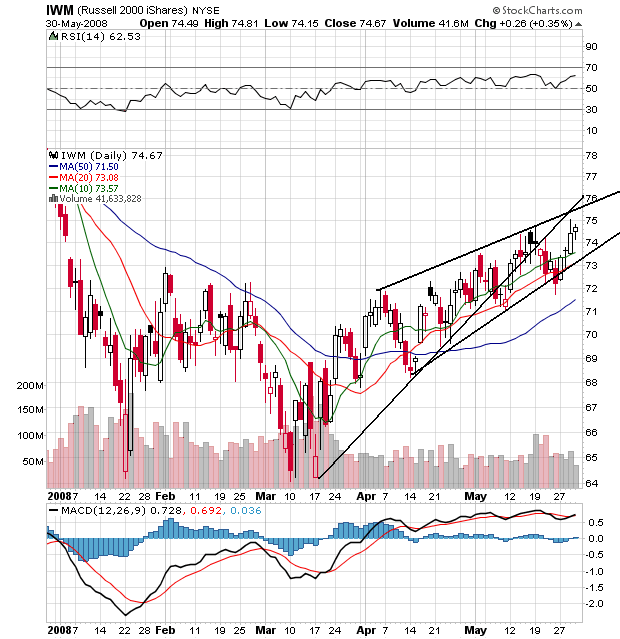

On the daily chart, notice that prices broke the rally that started in mid-March, but are still in an upward sloping trend. On the SMAs, notice they are all moving higher with the shorter above the longer and prices above all the SMAs.

On the P&F chart, notice the series of lower highs until the recent rally.

So - let's sum up:

-- On the P&F charts all the charts have printed a series of lower highs. That's bearish. However, the IWMs breakout throws a bit of a wrench into that theory.

-- On the daily charts, the SPYs have broken their upward trendline, as have the IWMs (although the IWMS continue to move higher. In contrast, the QQQQs continue to have a bullish profile.

The market does not say big reversal, but it's also not saying big rally either. This appears to be a wait and see market.