The Fed said banks submitted 93 bids totaling $61.553 billion for the $20 billion in loans auctioned off Monday. That put the bid-to-cover ratio at a little more than 3-to-1.

.....

Jay Bryson, global economist with Wachovia, said the strong auction demand was positive.

"It shows that there's not a stigma attached to this as there was at the discount window and that banks are willing to come to the Fed directly," Bryson said.

The interest rate on the 28-day loans — set by the bidding process — was 4.65%. That's higher than the fed funds target rate of 4.25% for overnight bank loans. But it's below the 4.75% discount rate.

.....

Scott Brown, chief economist with Raymond James, said that at this early stage the results of the Fed's first auction are still somewhat hard to interpret.

The heavy demand for the auction loans "suggests either that there's a huge need for (the auction) or that it's working," Brown said. "You need to see the results in the credit markets in the next few days — the Libor (market) in particular is the one to watch."

Mr. Brown has the right take; it's still way too early to tell whether this will work or not.

Let me add a few points.

1.) I've said it before, and I'll say it again; this isn't about liquidity -- it's about confidence. When lenders are concerned that borrowers will take a financial hit over the period of a short-term loan, then lenders are going to be reluctant to lend. In addition, lenders have every reason to be concerned about their own balance sheets right now. Just yesterday, Morgan Stanley announced a writedown of $9.4 billion and S$P downgraded insurer ACA to junk status. In other words -- there are still a ton of problems out there in the financial market.

2.) The Fed is in a serious policy bind. Let's assume this plan works -- then great, the Fed is the champion. But if the plan doesn't work, what can the Fed do then? The latest CPI and PPI reports seriously hem the Fed in from a policy perspective. My opinion is the Fed opted for this plan because of the high inflation levels reported last month.

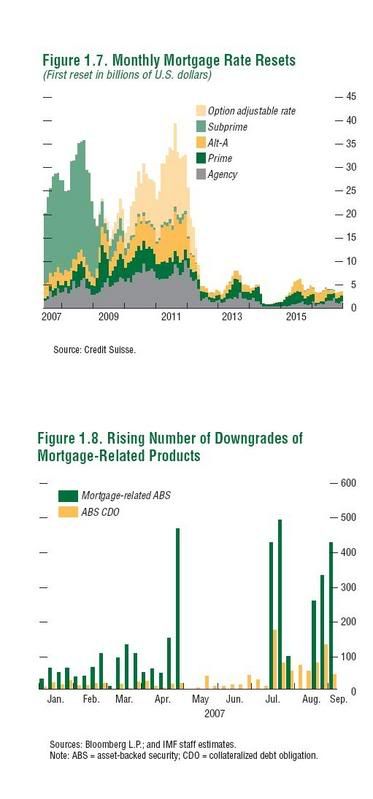

3.) This reset chart

shows one clear point: this problem is just getting started. Estimates for the total amount of losses range between $300 billion and $500 billion. So far, we've seen about $80 billion in writedowns. That means we've got a ways to go before we're out of the woods.