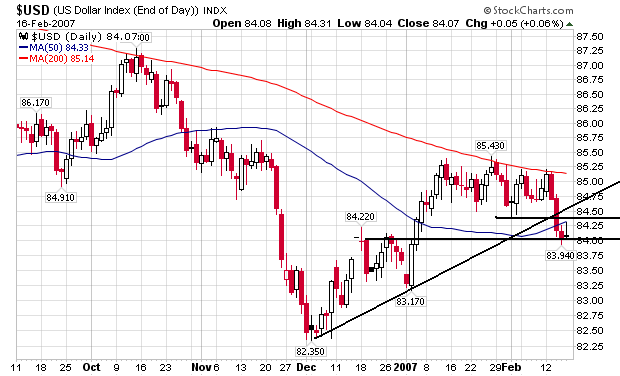

The dollar broke through support in the 84.50 area. This is where Bernanke's testimony last week hurt. The market's interpreted Bernanke's statements as meaning there would be no interest rate increases in the future. At the same time traders are expecting another rate hike from the EU area. Combined, these events are dollar bearish. Also note the dollar broke the uptrend of the recent rally.

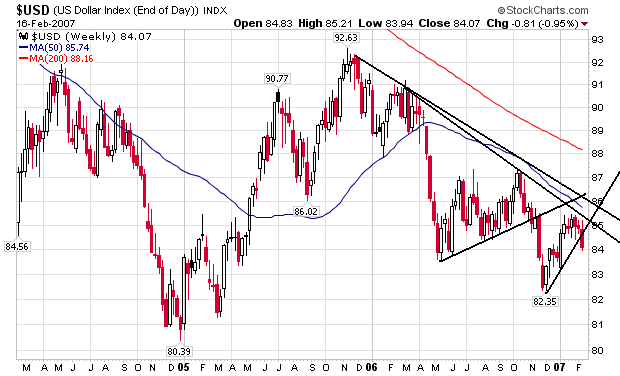

Here's a weekly chart:

Notice that we have two downtrends, neither of which was broken over the last few months. It looks like the dollar rally is near over.