UPS, the world's largest package delivery group, has warned it faces a "challenging year" in the US as the slowing domestic economy puts the brakes on parcel shipments.

Shares in the group were down more than 3 per cent on Tuesday afternoon after it issued lower-than-expected earnings guidance for 2007 and said the year got off to a slow start in the US.

But Scott Davis, chief financial officer, remained "bullish" about the long-term outlook, predicting that the US slowdown would prove short-lived.

"We feel that this economy is a bump in the road and expect it to get back to normal towards the end of this year or the start of 2008," he said, in an interview.

Everybody is always bullish about the outlook 1 or more years from now. This is one reason I usually discount the "future outlook" from the various Federal Reserve district's manufacturing surveys. It's just too easy to say, "things will be great in 2008!"

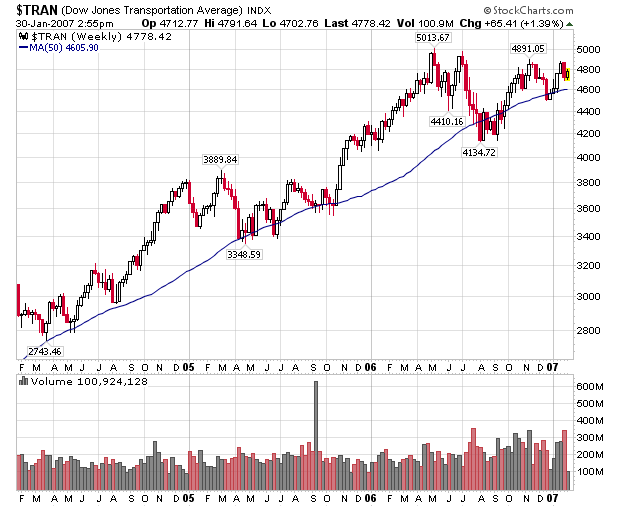

All that aside, UPS and Fed Ex ship a lot of packages in the US. When they issue earnings warnings it's important to pay attention. Just as importantly, here's a chart of the Dow Transports:

The average had a double top formation in 2006 and may be forming another one as we speak. More importantly, the transports failed to confirm the late 2006 rally. This is a clear violation of Dow theory. After you make goods, you have to ship them somewhere. When people aren't shipping you have to wonder how health the economy is.