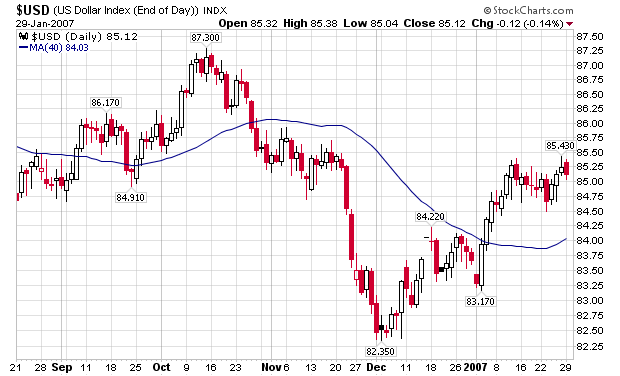

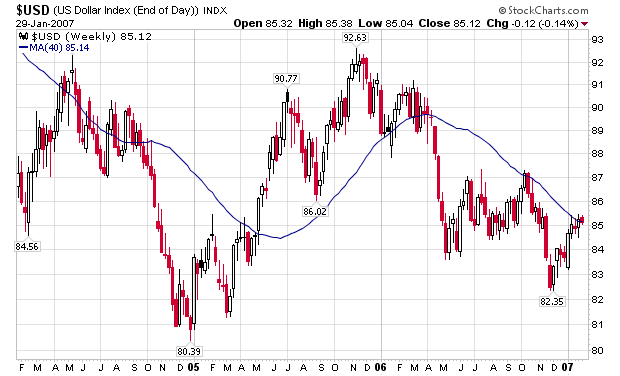

It's up 3.75% since early December. The main reason for the increase is encouraging economic news from the US. Since early December there has been a fair amount of speculation that the housing market has stabilized, job growth has been good, unemployment is low and the "official" retail numbers from the Census Bureau were decent. The Fed's official statements have all said they are still concerned about inflation, implying interest rates aren't coming down soon. All of this has helped the dollar increase in value. But is this a "real" rally, or is it a bear market suckers rally? Here's a weekly chart of the dollar:

The dollar chart has breached resistance at the 84 and 84.5 level. These are both technically strong developments that should encourage traders. While the last 4 bars have been weak, we can interpret those bullishly as the calm below the storm of this week's economic news or bearishly as overall market hesitancy.

Most importantly, the current rally is slightly above the 50% Fibonacci retracement level (84.82) of the October to December sell-off. This should have the bears ready to pull the short trigger on adverse news.

In addition, we have some important economic news this week -- payrolls, an FOMC meeting announcement on Wednesday and preliminary 4th quarter GDP. In order of importance, I would place the FOMC meeting first as interest rate policy is still a very important factor for currency traders. I would follow that with 4th quarter GDP because a perceived US slowdown combined with a perceived European and Japanese rebound were primary drivers of the October to December sell-off. Third I would place payrolls.

Theshort version?

"This week is make-or-break week for the U.S. dollar," said Kathy Lien, chief fundamentals analyst, at Forex Capital Markets in New York.

"The foreign exchange market has turned very dollar-bullish after a series of upside surprises in economic data, causing a sharp plunge in rate cut expectations," she added.