A long time ago, I looked at the current account blowout in The Long View: Current Account, which ended with a promise to have a look at the make-up of the blow out in terms of both geography and industry.

What I am looking at now is the broad outline of the geographic break down.

How broad? I am breaking the whole world down into The Americas, Europe, Asia & Oceania, and Africa. So the answer is, just about as broad as possible.

The Story So Far

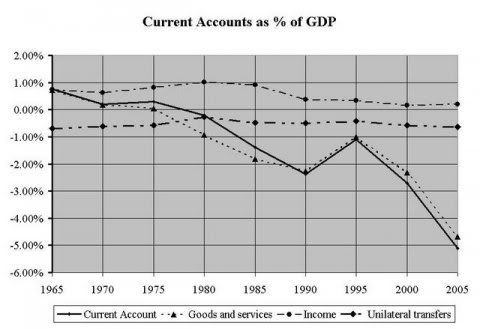

Where I left off, before the long haitus, was the stark reality of the current account blowout:

- It is massively bigger than anything we have experience in living memory

- The problem is not income or unrequited transfers: it is trade

The trade account is made up trade in goods and trade in services. What I am going to be looking at today is trade in goods.

And before I put this information up, I will add a note that you should not shoot the messenger. After careful contemplation, I have come to the firm conclusion that messenger-shooting is counter-productive.

The source of this information is the same BEA site that provided the info for the first in this series. The only difference is that instead of working with table 1, I am working with Table 2b: Trade in Goods, Additional Historical Historical Data.

Where In The World Is the Trade Taking Place?

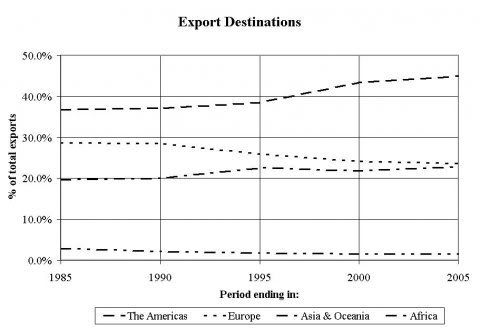

First, lets look at Exports to these four regions as a share of total exports. In all three of these graphs:

- the Americas are the "dash" line,

- Europe is the "dot" line,

- Asia and Oceania is the "dash dot" line, and

- Africa is the "dash dot dot" line.

The trends here are simple. Europe is losing ground as an export market, with most of that share being taken up by the Americas, and some being taken up by Asia and Oceania. Africa is a very small market, both because of the small size of so many African economies as export markets, and because of the dominance of European firms in those markets.

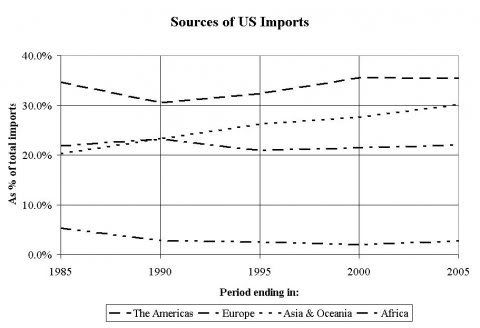

Now, lets look at Imports from these four regions, as a share of total imports.

Here we have the Americas as the dominant source of imports, with a loss in market share in the 80-85 period that is regained with something to spare. The second spot, however, trades place, Europe holding a slight lead over Asia in 80-85, while by 01-05, Asia and Oceania is on a path toward taking over as the primary source of imports.

Don't Forget the Blowout

A word of caution is in order here. It is important to bear in mind that the two diagrams are showing shares of totals that are sliding rapidly apart. That is, 45% (about) of our goods exports go to the Americas, and 35% of our goods imports. But that is 45% of a smaller number, and 35% of a bigger number.

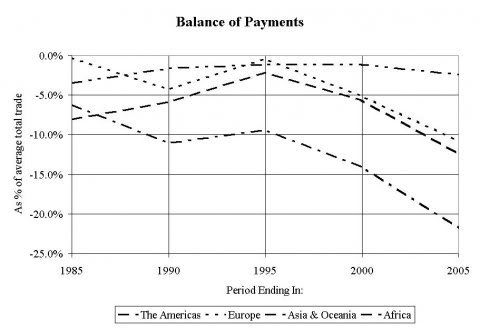

The way I have set this up is to take the average of imports and exports as "average trade", and look at the Balance of Payments with each global region as a percentage of "average trade". And here ... as in the earlier diary that focused on the current account overall ... things are moving "south" at a very rapid pace.

Bear in mind here that what you are looking at is trade in goods, not goods and services overall. The US tends to have a stronger position in services than in goods. As you will see when I look at trade in services, a "small" negative balance in goods trade is good news for the overall trade account.

And for the global regions, the balance of trade compared to average trade breaks down into two stories. For the Americas, Europe, and Africa, the story by and large is improvements up through to 90-95, and then a rising deficit through to 00-05 (and, if we sneaked at table 2a, on to the present).

For Asia and Oceania, the "improvement" in the trade deficit is there, but it is very small ... from about -11% to about -9% ... and the slide since then is the single largest source of the trade deficit.

And remember: this last figure is compared to the average amount of all trade in goods. The deficit in goods trade with Asia and Oceania is more than 20% of the average trade in all goods.

The Path Ahead

Of course, whenever you find Economic bad news, you can find a pollyana that will explain that its just the market in operation, and in the end its all for the best. The main hope for the pollyanas are that "in the long run", the deficits in the goods trade will be balanced by surpluses in services trade.

And so, in the third installment in this series, I will see what the long term view of the balance of trade in services has to tell us. ... to be continued ...