- by New Deal democrat

Now that we have the August inflation reading, let’s take a look at real wage growth.

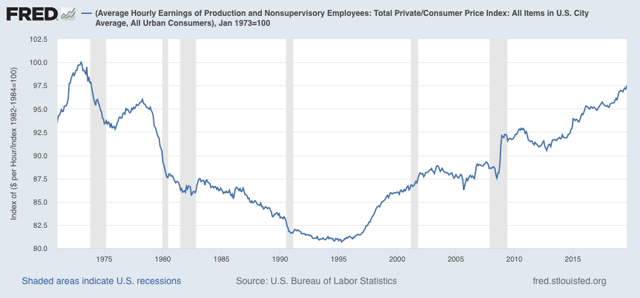

First of all, nominal average hourly wages in June increased a strong +0.5%, while consumer prices increased +0.1%, meaning real average hourly wages for non-managerial personnel increased +0.4%. This translates into real wages of 97.5% of their all time high in January 1973, a new high following revisions to prior months:

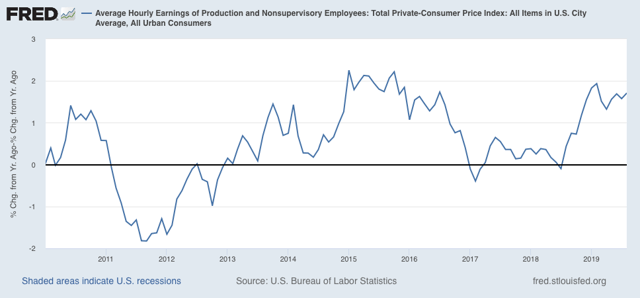

On a YoY basis, real average wages were up +1.7%, still below their recent peak growth of 1.9% YoY in February:

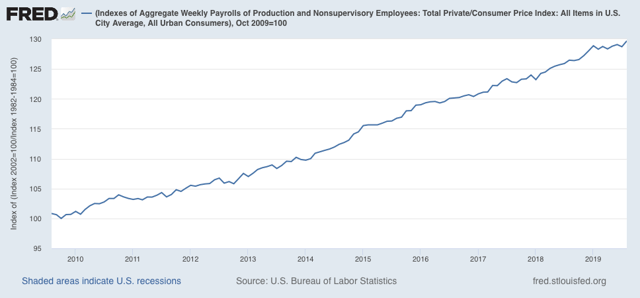

Aggregate hours and payrolls were up strongly in August’s household jobs report, so real aggregate wages - the total amount of real pay taken home by the middle and working classes - are up 29.7% from their October 2009 trough at the beginning of this expansion:

For total wage growth, this expansion remains in third place, behind the 1960s and 1990s, among all post-World War 2 expansions; while the *pace* of wage growth has been the slowest except for the 2000s expansion.

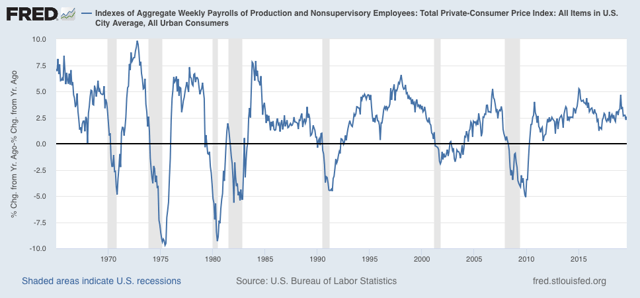

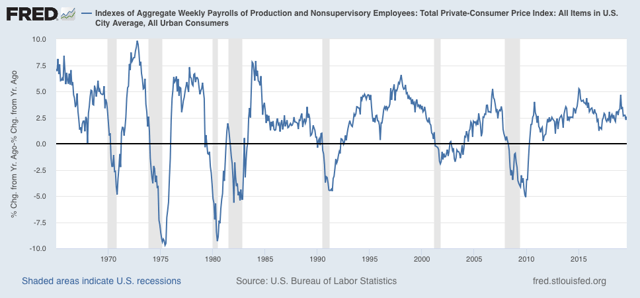

Finally, several months ago I raised a concern that real aggregate wages had decelerated sharply this year. That is because, typically, real aggregate wage growth has decelerated by 1/2 or more from its 12 month peak just at the onset of recessions, although there have been 3 false positives during slowdowns that did not turn into recessions. As of August, YoY growth has declined to 2.6% vs. a revised 4.7% at the beginning of this year, although it rebounded from July:

Note that we have had two similar declines already during this expansion. For now, this is just confirming that we are in a slowdown.