Both John McCain and Barack Obama have proposed tax plans that would substantially increase the national debt over the next ten years, according to a newly updated analysis by the non-partisan Tax Policy Center. Compared to current law, TPC estimates the Obama plan would cut taxes by $2.9 trillion from 2009-2018. McCain would reduce taxes by nearly $4.2 trillion. Obama would give larger tax cuts to low- and moderate-income households and pay some of the cost by raising taxes on high-income taxpayers. In contrast, McCain would cut taxes across the board and give the biggest cuts to the highest-income households.

.....

Neither candidate's plan would significantly increase economic growth unless offset by spending cuts or tax increases that the campaigns have not specified.

For those of you who are unfamiliar with the Tax Policy Center, it is a joint effort by the Brookings Institution and Urban Institute. They have consistently done very good policy work.

Now -- here are some basic overviews of the individual plans.

Despite not working as advertised under Reagan and Bush II, McCain is adopting a supply side cut of corporate taxes from 35% to 25%, and making all cuts from 2001 and 2003 permanent. He would lower the estate tax to 15% with a $5 million dollar exemption.

The Obama plan would reduce taxes for low and moderate income families, but raise them significantly for high-bracket taxpayers. By 2012, middle-income taxpayers would see their after-tax income rise by about 5%...Those in the top 1% would face a....1.5% reduction in after tax income.

The end result of both plans is a loss of revenue for the years 2009 - 2013 of $1.4 trillion under McCain and a loss of $966.7 billion under Obama.

Here's the basic problem with the plans. No one is talking about specific spending cuts. And spending has really increased over the last 8 years. According to the Congressional Budget Office discretionary spending totaled $649 billion in 2001 and $1.041 trillion in 2007 for an increase of 60%. At the same time revenue increased from $1.9 trillion to $2.5 trillion -- an increase of 31%. As a result, the US government has issued over $500 billion dollars of net new debt per year since 2003:

09/30/2007 $9,007,653,372,262.48

09/30/2006 $8,506,973,899,215.23

09/30/2005 $7,932,709,661,723.50

09/30/2004 $7,379,052,696,330.32

09/30/2003 $6,783,231,062,743.62

09/30/2002 $6,228,235,965,597.16

09/30/2001 $5,807,463,412,200.06

09/30/2000 $5,674,178,209,886.86

Total debt outstanding is now $9,618,645,199,394.09.

The Republicans fiscally jumped the shark a long time ago. Under Reagan we saw debt balloon from a little over 30% of GDP to a little over 60% of GDP. Under Bush II we've seen the total increase from about 57%/GDP to about 64%/GDP, yet they continue to push their "supply side" theory under the psychotic belief that repeating a behavior proven not to work will somehow work if they just try it again. In addition, no Republican administration has come close to balancing a budget in the last 25 years. So please -- if you're a Republican and you believe the supply-side garbage (along with the statement that Republicans are "fiscally responsible") please -- just don't talk. I have better things to listen to.

However, the Democrats are beginning to move into dangerous ground as well. Clinton balanced the budget in 8 years, yet he is still pilloried for his other problems. Then the Republicans came into power and they spent more money on their constituency then anyone thought was possible. Now the Democrats want their turn at Washington's feeding trough. To that end, we've seen an increasing justification for massive Washington spending. Add to that an economy in a recession with little possibility of solid growth ahead and the impetus to spend big increases.

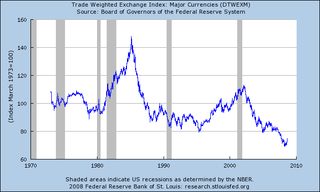

The problem with this theory is the dollar. Here is a 30 year chart of the dollar:

Notice the dollar is near its lowest level in 30 years. Also notice the dollar dropped in value during the latest expansion, which is extremely odd behavior. When an economy is expanding the country's currency should increase because a growing economy attracts investors which in turn should bid up the country's currency. But the dollar fell. The primary reason for the drop was the US economy was issuing debt like it was going out of style, indicating the possibility of the US actually paying back its debt was decreasing, which in turn makes the US dollar less attractive. This has led to a host of problems, not the least of which is spiking commodity prices. Because commodities are priced in dollars, a drop in the dollar is a de facto increase in commodity prices. A long-term drop in the dollar is an invitation to inflationary pressures that hurt everyone (been to the gas station lately?).

The point to all of this is the US can't go on a major spending spree right now without seriously risking the dollar dropping further leading to another round of commodity price spikes. It may be that the dollar doesn't drop. But the possibility of the dollar dropping more is pretty high.

As a result, it is imperative for Washington to get the national checkbook under control. We've spent the last 8 years not making tough choices that need to be made. Now we have two presidential hopefuls who would continue that trend. If this trend continues, the market will make our choice for us by sending the dollar lower and spiking commodities further. And that is something no one wants in any way shape or form.