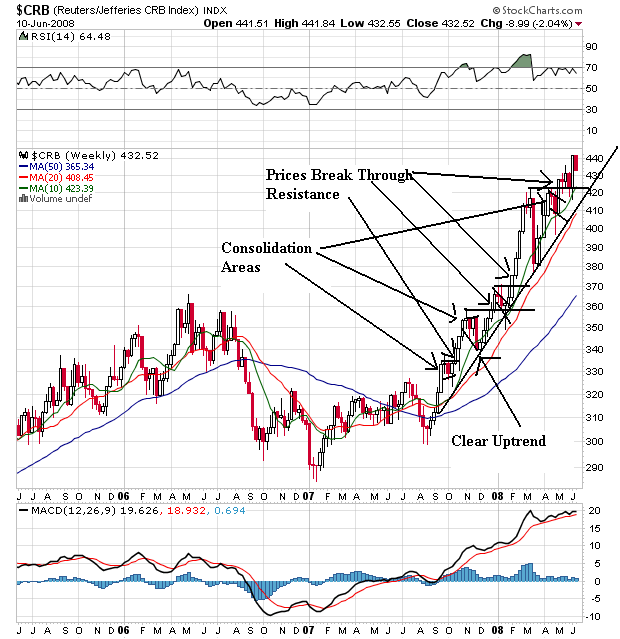

Remember that overall the CRB has been rallying since the beginning of 2007. It has continually moved through upside resistance and made new highs. Also note the SMAs are in the most bullish alignment possible. The shorter SMAs are above the longer SMAs and all the SMAs are moving higher.

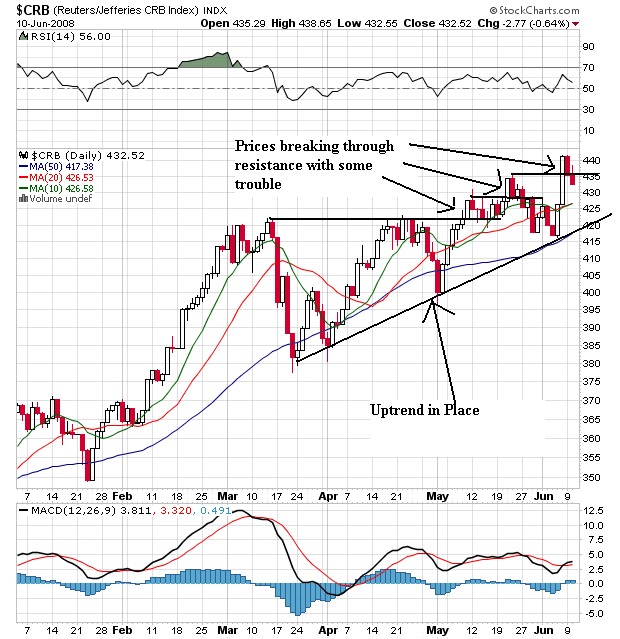

On the daily chart, notice that prices have been technically moving higher since late March. However, also notice that whenever prices have made new highs they have immediately fallen back to previous levels indicating traders are less than thrilled with the new highs.

An the SMA front, notice the following:

-- The 20 and 50 SMA are both moving higher

-- The 20 is greater than the 50, but the 10 is trading right at the 20.

-- All the SMAs are moving higher

-- Prices are above the SMAs

This is still a good alignment, but it could be better.

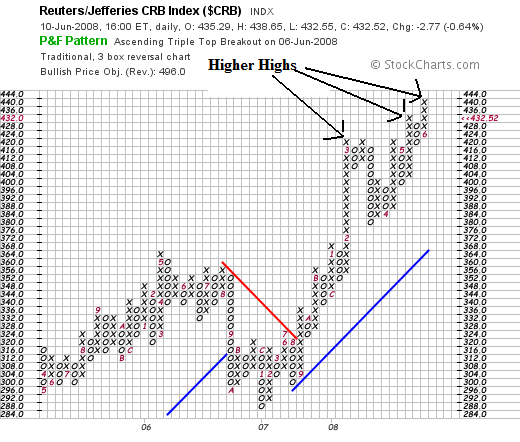

On the P&F chart, notice that prices have made continually made new highs.

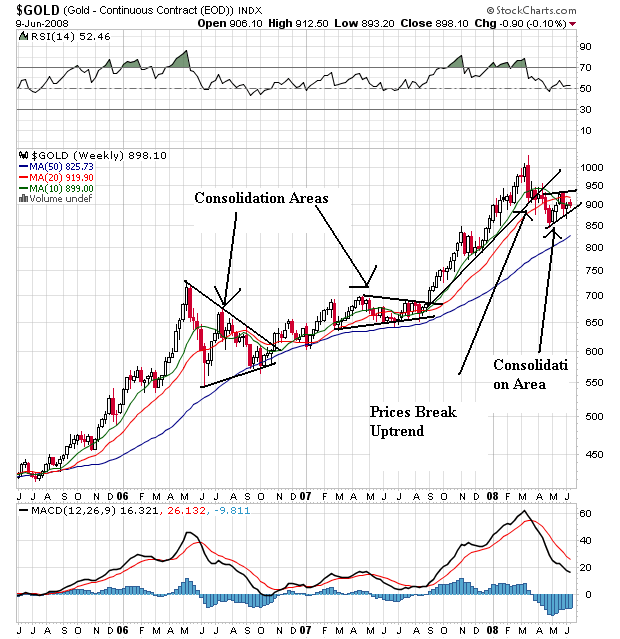

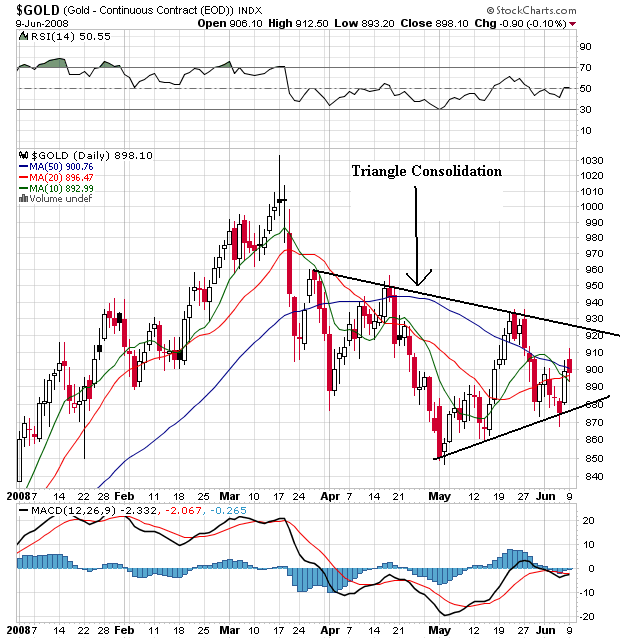

On gold's weekly chart, notice that it has broken through support and is currently consolidating in a triangle pattern.

On the daily chart, notice that after hitting a new high in March the market has been selling off and is currently in a triangle consolidation pattern. Also note that prices and the SMAs are bunched up with little direction. This indicates a we really don't know what the next move will be.

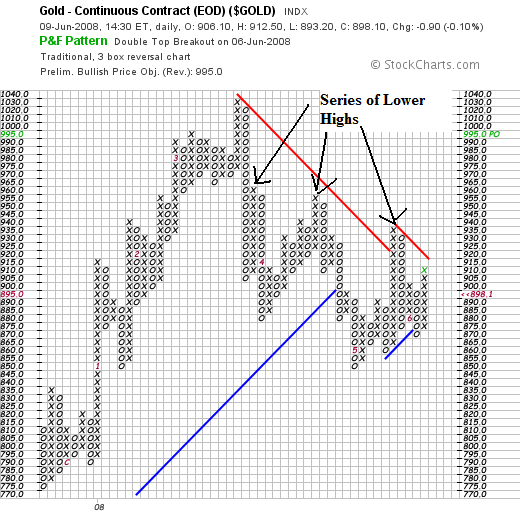

On the P&F chart, notice the series of lower highs, indicating a general sell-off.

Gold's chart tells us that inflation expectations have dropped a bit. That's good news.