AT LAST, WE MAY BE THERE. AFTER MONTHS OF TURMOIL capped by a run on a leading Wall Street house, banks and brokerage firms may finally have hit bottom. You can thank the multipronged regulatory response to the near-collapse of Bear Stearns. Those measures may well prevent the deeply depressed stocks of many financial outfits from sinking further. The shares may even start to recover, with encouraging implications for the entire market. Yes, after being down on financial stocks for more than a year, we find ourselves unable to resist some real springtime optimism.

Last week, the Federal Reserve slashed short-term interest rates, increasing the difference between short- and long-term rates, which typically boosts lenders' earnings. The Fed also opened its lending window to investment banks, giving them a new, stable, liquid source of funding. And regulators' decision to allow Fannie Mae (ticker: FNM) and Freddie Mac (FRE) to boost their investments in U.S. mortgages by $200 billion gave the mortgage market a big shot in the arm.

The market has yet to appreciate just how powerful those forces could be. Stocks of the industry's strongest players could climb by 10% to 20% over the next year as panic recedes, earnings improve and price-to-earnings multiples expand.

But make no mistake: Headlines will remain negative. Witness CIT Group's (CIT) report Thursday that it had lost access to short-term financing and Credit Suisse Group's (CS) warning of a first-quarter loss. Likewise, Standard & Poor's on Friday placed the debt ratings of Goldman Sachs Group (GS) and Lehman Brothers Holdings (LEH) on "negative outlook" because of earnings weakness. We fully expect economic growth will continue to decline, resulting in further loan losses. We wouldn't be surprised to see some of the weaker banks either go bust or turn to the industry's stronger players for a bailout.

But at this point, most of those risks are reflected in financial stock prices. And it won't be long before investors start looking at the second half of the year, when the worst of the write-downs should be over and earnings comparisons become much easier.

"From here, I think things are getting better, and the government and the Fed will do what they need to do when they need to do it," says Ernie Patrikis, a partner at Pillsbury Winthrop Shaw Pittman and former first vice president of the Federal Reserve of New York.

I read Barron's every weekend. In fact, I look forward to Saturday morning with Barron's. In fact -- I love Barron's (now you know how much of an economic geek I am). And their is nothing wrong with their analysis. There have been a lot of positive developments for the financial sector over the last few months and especially in the last week with the latest Fed action.

But I don't think the problems are over. Not by a long shot. There are several reasons why I believe we have more pain to go through.

The first is the general economic backdrop. If we're not in a recession, then the current facts indicate it's not a matter of if but when. Consider the following information.

Job growth is decreasing -- and has been for some time.

The unemployment rate has hit bottom and has started to move higher.

Disposable income is dropping -- and has been for awhile.

Add these figures up and you get more distress in the economy at large, which means more distress in the mortgage market -- meaning a continuing increase in defaults and and foreclosures. In other words, the causes of the current problems in the financial sector aren't going away any time soon.

And then there is this problem.

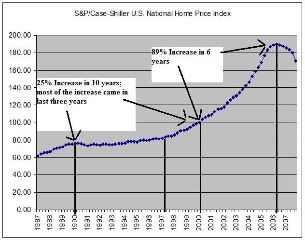

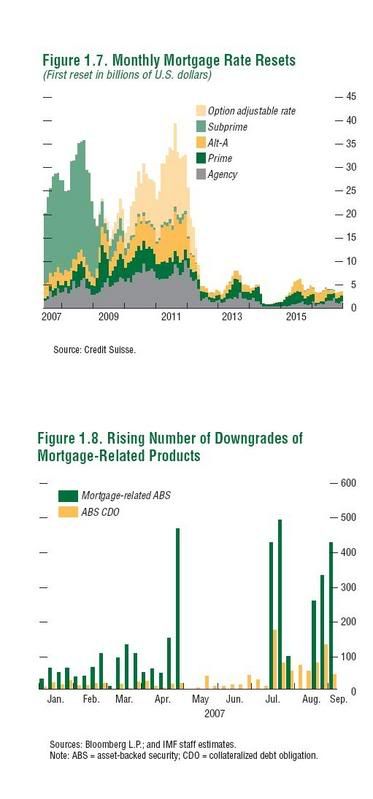

The value of real estate -- the asset that is backing all of the mortgage loans -- is dropping. As a result, people are more and more inclined to simply walk away from their mortgage commitments. This will add further pressure on the mortgage market. And finally, there is this chart:

Notice what the top chart says: we're going to be experiencing problems associated with resets for some time.