"I would say that while to date the problem banks have been quite low, there clearly has been some deterioration since the beginning of this year, and should the economy continue to slow down, as many expect, it is likely that we will continue to see some growth in the problem institutions," he told a seminar at the Bank of Korea.

.....

Rosengren said the turbulence was difficult to foresee because bank models focused solely on their exposure to riskier assets like subprime mortgages, ignoring the possible knock-on effects on other sectors.

"What these stress tests crucially failed to capture was the effect of house price declines on the large holdings of highly rated securities that global banks held -- the products of mortgage securitization activities, with their payment streams ultimately tied to the performance of subprime loans," he said.

The belief that housing prices would never fall on a national basis, which permeated even the Fed itself, was partly to blame for this underestimation of risk, Rosengren said.

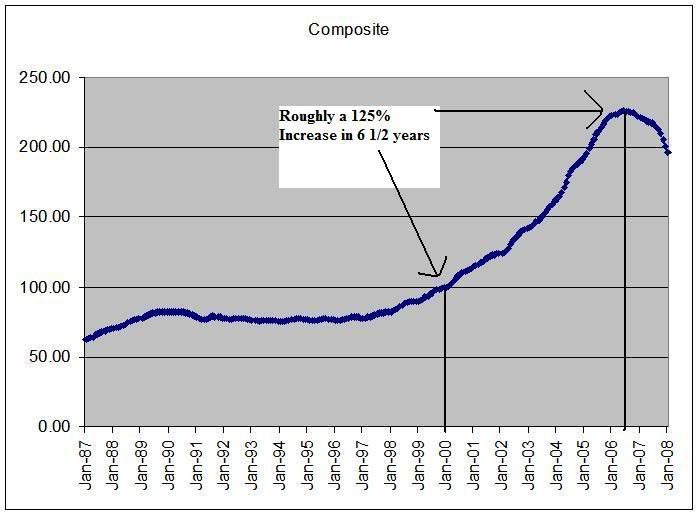

So -- the models that measure stress aren't as attuned to this chart of the national Case Shiller Price Index:

as they should be. That's comforting.

Seriously, banks are nowhere near catastrophic levels of problems. So please do not read into this the fact that bank failures are occurring with regularity because they aren't. However, given the current situation it's clear the situation will get worse before it gets better.

And the FDIC is clearly thinking failures will increase: (hat tip to Calculated Risk

Federal bank regulators plan to increase staffing 60 percent in coming months to handle an anticipated surge in troubled financial institutions.

The Federal Deposit Insurance Corp. wants to add 140 workers to bring staff levels to 360 workers in the division that handles bank failures, John Bovenzi, the agency's chief operating officer, said Tuesday.

"We want to make sure that we're prepared," Bovenzi said, adding that most of the hires will be temporary and based in Dallas.

There have been five bank failures since February 2007 following an uneventful more than two-year stretch. The last time the agency was hit hard with failures was during the 1990-1991 recession, when 502 banks failed in three years.

The FDIC provides insurance for deposits up to $100,000. While depositors typically have quick access to their bank accounts on the next business day after a bank closure, winding down a failed bank's operations can take years to finish. That process can include selling off real estate, investments and dealing with lawsuits.

There are 76 banks on the FDIC's "problem institutions" list — which would equate to about 10 expected bank failures this year, though FDIC officials declined to make projections. Historically, about six banks fail per year on average, FDIC officials said.

Since 1981, total failures per year averaged about 13 percent of the number of institutions that started the year on the agency's list of banks with weak financial conditions.

There have been two failures in 2008 — both of which were small Missouri-based banks. By far the largest recent failure was the September 2007 shutdown of Georgia-based NetBank Inc., an online bank with $2.5 billion in assets. NetBank's insured deposits — representing more than 100,000 customers — were assumed by ING Bank, part of Dutch financial giant ING Groep NV.

And consider the following charts from the FDIC's latest Quarterly Banking Survey

Clearly the situation is deteriorating.