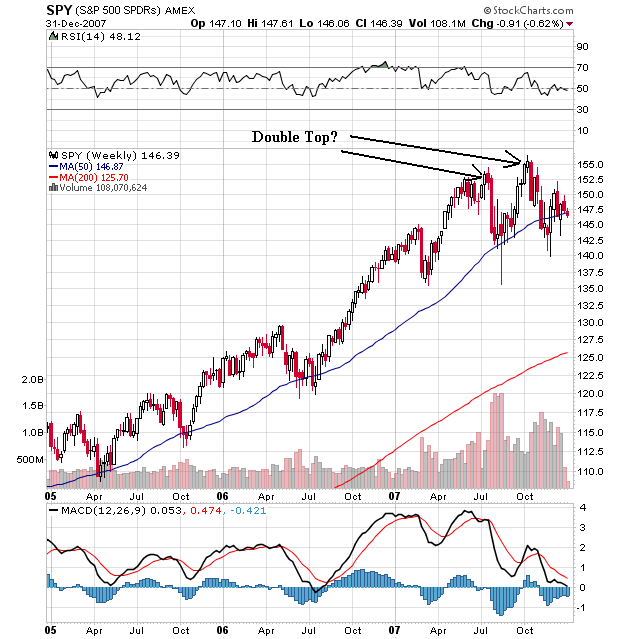

Since I speculated the SPYs were in a double top the economic news has continued to disappoint. Christmas sales were fair but not great as the consumer is still hemmed in by increasing gas and food prices, durable goods disappointed, regional Fed surveys showed weakness, housing is still a mess and the credit market shows little sign of unfreezing. However, the SPYs now offer multiple possible interpretations.

Here's the original analysis, which still stands. The market formed two tops -- one in early July and one in early October. Since then the market has drifted lower, but has not convincingly entered bear market territory.

But there are other ways to look at this chart.

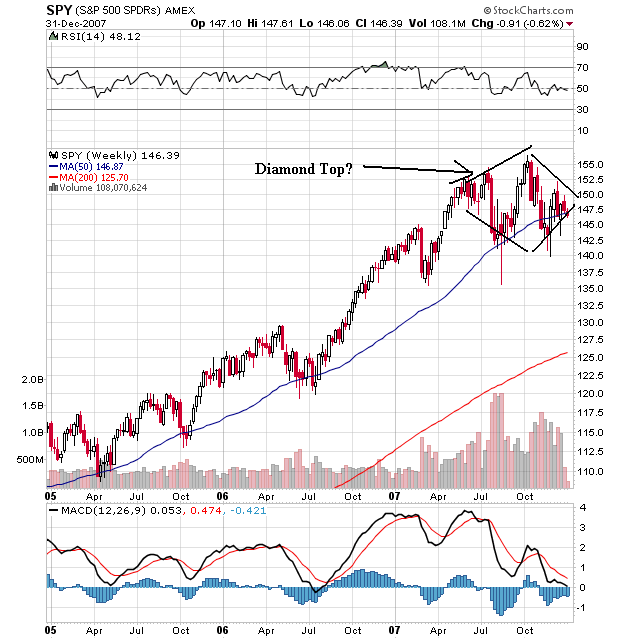

The second possibility is a diamond reversal, which is defined as:

A technical analysis reversal pattern that is used to signal the end of an uptrend. This relatively uncommon pattern is found by identifying a period in which the price trend of an asset starts to widen and then starts to narrow. This pattern is called a diamond because of the shape it creates on a chart.

I first got this idea from the blog afraid to trade which identified the broadening pattern which is the first part of the diamond top formation. After reading that analysis, my first thought was, "why didn't I see that?" Then I looked at the post broadening pattern and thought, "that looks like a diamond top".

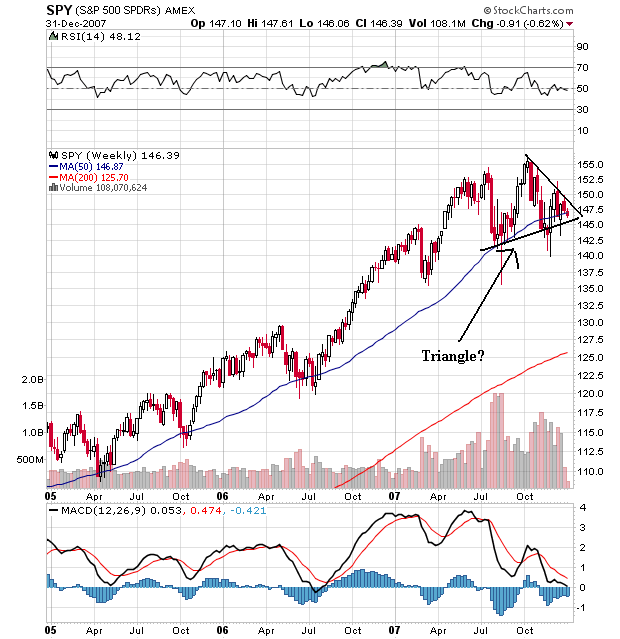

Finally, we have a possible triangle consolidation as well.

There is one important concept at play here and that is two of these patterns are recognized as reversal patterns (the double top and the diamond top). The third -- the triangle pattern -- is either a reversal or a continuation pattern. What matters here is the market's move after it breaks from the triangle pattern.

However, the evidence is leaning fairly heavily towards a reversal of some sort.