The Fed and the markets agree the economic outlook is worrisome. Minutes of the Fed's December meeting released Wednesday show Fed policy makers share Wall Street's concern that the economy could fall into recession. The minutes raised the prospect of "substantial" further rate cuts if a self-reinforcing spiral of tightening credit and weaker growth develops.

The real disconnect is over inflation. The Fed thinks it is a bigger risk than it was in 2001, and bigger than Wall Street and many prominent economists think. That forces the Fed to accept a greater risk of recession than it did in 2001. That could mean either fewer rate cuts than anticipated by futures markets, which see the Fed's short-term rate target falling to 3% by year-end from 4.25% now, or a quicker reversal of the rate cuts.

Today's situation is in sharp contrast to the Fed's last rate-cutting cycle. In early May 2001, a survey of private-sector forecasters put the odds of recession at 35%. But by that point the Fed, under then-Chairman Alan Greenspan, had already slashed its target for the federal funds rate by two percentage points, to 4.5%, while declaring weak growth to be a bigger worry than inflation. The economy ultimately did experience a mild recession in part because of that September's terrorist attacks, and the funds rate ended the year at 1.75%.

Today, private-sector economists put the odds of recession at 38%, yet the Fed has cut the funds rate only one percentage point since August and has yet to say weaker growth worries it more than inflation.

I have speculated that the Fed's auction plan was a result of their inflationary concern. The Fed wanted to ease the credit crunch and its associated problems but because of rising commodity prices they can't aggressively cut interest rates. As a result, the Fed is looking for ever more creative ways to help the financial sector.

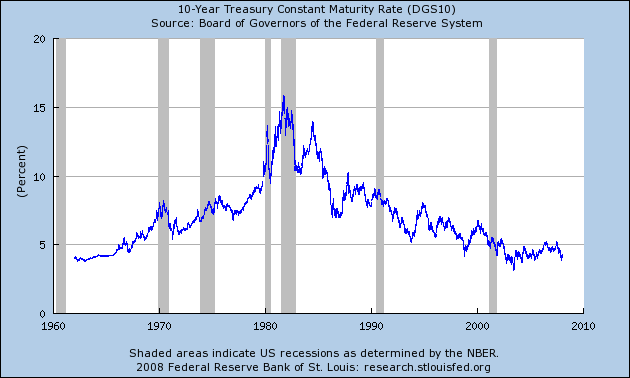

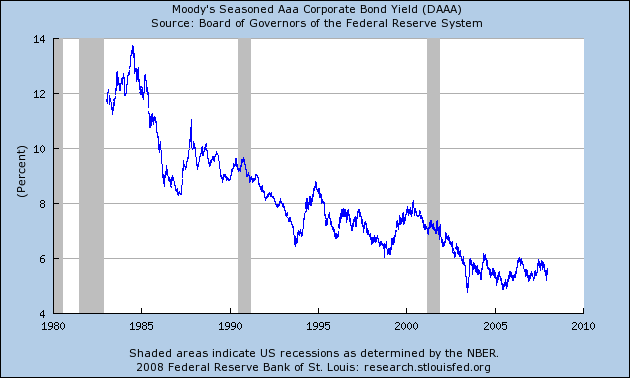

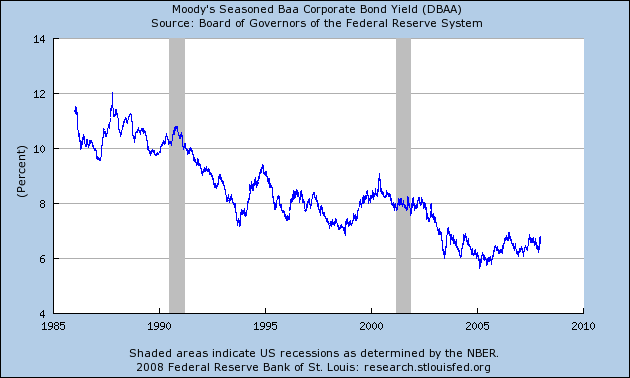

Something else bears mentioning: interest rates aren't that high right now. Here's are three charts from the St. Louis Federal Reserve of various interest rates:

The 10-year Constantly Maturing Treasury

AAA Corporate Paper

BBB Corporate Paper

And that's before we take inflation out of the financing picture.

The bottom line is the issue isn't the cost of money -- it's confidence. People are concerned about the overall condition of the economy. Even if you give someone money in that situation, they are less likely to spend the money. This makes cutting rates a less than stellar policy alternative.