Wow -- just one day after the Fed cuts rates the markets tank hard. So the question is -- why? Let's take a look at yesterday's Fed statement.

Readings on core inflation have improved modestly this year, but recent increases in energy and commodity prices, among other factors, may put renewed upward pressure on inflation. In this context, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

The Committee judges that, after this action, the upside risks to inflation roughly balance the downside risks to growth. The Committee will continue to assess the effects of financial and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

Traders interpreted this to mean the rate cuts were over -- no more liquidity for the stock market.

In addition, there was a ton of bad news today. An analyst report downgraded Citigroup and also speculated they would cut their dividend. The ISM manufacturing number was less than expected. Foreclosures doubled from year ago levels. In short -- it was a terrible news day.

Looking at the 5 day SPY chart above notice a few things. First, the market opened lower but then consolidated. However, the market continued to sell-off in a big way at the end. That indicates traders are concerned about the news that will come out overnight. It also shows there was a ton of selling pressure late in the day.

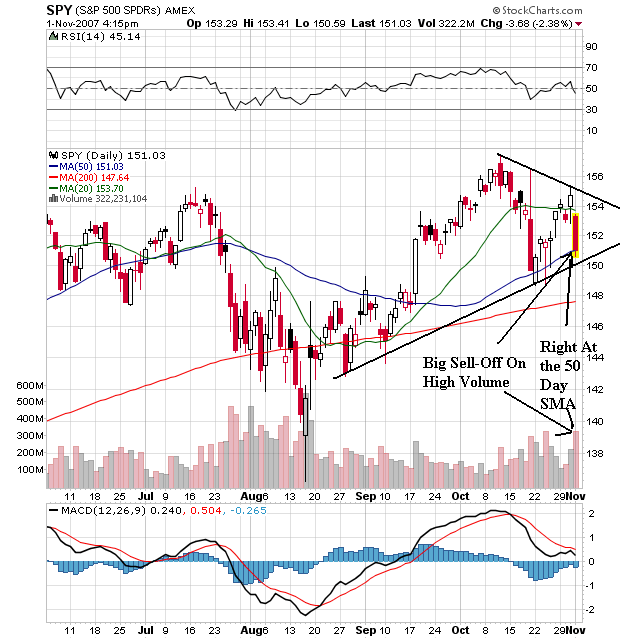

On the daily chart we have the following developments.

1.) We printed a big bar on heavy volume. That's not good.

2.) The market has reversed direction from the rally it started on October 22. Also not the market did not get above previous highs on the most recent rally.

3.) The 20 day SMA is slightly downward, indicating the short-term trend is down.

4.) The market is trading right at the 50 day SMA.

Today's action did some technical damage to the index.