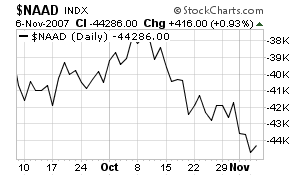

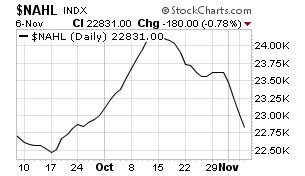

I'm going to start with the QQQQ's daily chart, because this is where the real news of the day lies. For the last few weeks, tech has been the market's saving grace. That stopped today as trader's booked profits. The problem with the NASDAQ has been an ever decreasing breadth. Here are the breadth charts that I put up yesterday that show a decreasing level of participation from issues in the index.

Cumulative advance/decline line

New highs/new lows.

Today we saw some of the market leaders take big hits on high volume.

Apple:

Google:

Bidu

On the 5 day chart, the damage from today's sell-off is clear:

The QQQQs fell through support on heavy volume, formed a double bottom and then rallied. The end of the day rally looks to me like purely technical buying rather than fundamentally based purchases. That is, the index got cheap on a daily basis so traders came in and made some buys.

The daily SPYs are look more and more like they formed a double top and are in the middle of a correction with lower highs and lower lows. Also note that prices are sitting on the 200 day SMA.

The 5-day SPYs show a clear two day downtrend leading to a double bottom followed by a technically based rally into the close.

Yesterday's action hit the SPYs hard. Today's action hit the QQQQs with the same degree of ferocity.