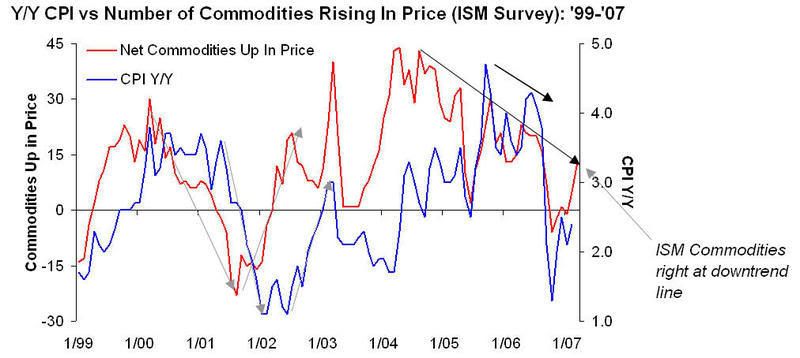

Besides the higher than expected prices paid index in this morning's ISM report, another aspect of the report shows that we could be in store for another up tick in inflation. Each month, in the Commodities survey, respondents are asked about the pricing conditions for the commodities they deal with. Namely, are they up in price, down in price, in short supply, or none of the above. As we have highlighted in the past, increases in inflation are often preceded by increases in the number of commodities rising in price, while decreases in the rate of inflation are preceded by respondents noting that more commodities are falling in price than rising.

In this month's survey, respondents noted increases in thirteen different commodities, with no commodities showing a decline in prices. This marks the highest reading since August of last Summer, and puts the current reading right on the downtrend line from 2004.

The provided chart indicates a very high correlation between this index and inflation.