- by New Deal democrat

Jobless claims continue to tell us two things: (1) the jobs market continues to slowly weaken, but (2) it is not recessionary.

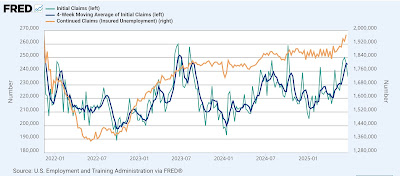

This week I’ve changed my graphing scheme slightly, to emphasize the less noisy four week moving average of initial claims, to better show the residual post-COVID seasonality, and to put the recent increase in continuing claims in better context.

With that said, initial claims declined last week by -10.000 to 236,000, and the four week average declined -750 to 245,000. With the typical one week delay, continuing claims rose another 37,000 to 1.974 million, its highest level in almost 3.5 years (see extreme left in graph below):

Also note that beginning with the end of 2022, we have seen a pattern where initial claims rise into the summer, then fall back into the winter, a pattern which has continued this year so far.

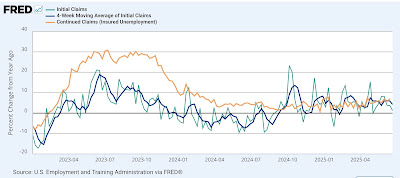

This residual seasonality makes the YoY% comparisons, which are more important for forecasting purposes, all the more salient.So measured, initial claims are up 1.3%, the four week average up 4.3%, and continuing claims up 7.0%:

This is well within the trend of the YoY comparisons averaging 5.0% +/-5% which we have seen since last October.

Finally, since the 4th of July is Friday next week, the June employment report will be released Thursday, which means this will be our last advance look at what jobless claims are suggesting about the unemployment rate. Here is the YoY% change in both measures of claims as well as that of the unemployment rate:

This suggests about a 4% (percent of a percent) increase in the unemployment rate YoY in the next several months.

Since the unemployment rate was 4.1% last June, rising to 4.2% for several months thereafter, this suggests that the unemployment rate is likely to rise to 4.3% or possibly even 4.4% in the next several months:

We’ll find out a week from today. In the meantime, the message - expecially from continuing claims - is that while new jobs are harder to find, layoffs are not increasing that significantly. Remember that my model requires a 10% YoY increase in jobless claims just for a recession “watch,” let alone a “warning.”