- by New Deal democrat

The last significant data for the first half of 2025, personal income and spending for May, was released this morning. It was the first month that reflected the impact of Tariff-palooza!, and boy howdy was it impacted. Not a single metric was positive. One metric was unchanged; everything else was negative. Let’s take a look at the carnage.

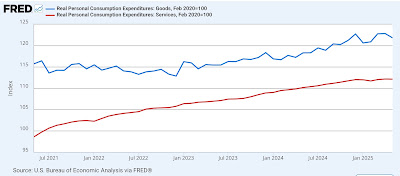

Nominally personal income declined -0.4%, and personal spending declined by -0.1%. Since the PCE deflator increased 0.2%, real income was down -0.6, and real spending down -0.3%. Here is this month’s update of real personal income and spending normed to 100 since the onset of the pandemic (as are all other graphs below except for the personal saving rate):

Typically real spending on goods declines before recessions, while real spending on services has increased throughout all but the most severe of them. In May real spending on goods declined by -0.6%, while that for services - the sole relative “bright” spot in this morning’s report - was unchanged:

Further, ant least one important historical recession model posits that evidence that spending on durable turns down before spending on non-durable goods. This month both were abysmal, as the former metric turned down by -1.8%, and the latter by -0.3%:

While on a YoY basis none of the above metrics have broken a trend, it is noteworthy that all of them show a sharp slowdown in growth since last December, from a meager 0.1% increase in real spending on services to a sharp -0.9% decline in spending on durable goods. Some of this can be put down to the effects of front-running earlier this year, but if the trend continues that could indicate a real turning point.

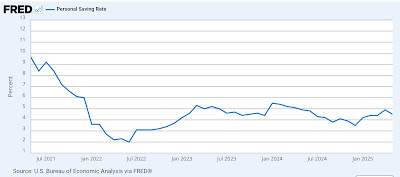

Next let’s take a look at the personal saving rate. Generally, as expansions continue, consumers become more aggressive with their purchasing, and then more cautious immediately in advance of (and partially the cause of) recessions. In May this declined -0.4% to 4.5%, but still well above its low of 3.5% last December:

Again, there’s no indicated break in trend, although it is important to note that such a rate remains below any reading below 1999, and the average between 2000 and 2019 was 5% (not shown).

Finally, there are several important coincident indicators used by the NBER in recession dating in this report.

The first is real personal income less government transfer payments. This declined -0.1%:

The second is real manufacturing and trade sales, which are calculated with a one month delay. In April they declined -0.4%:

Again, neither of them show a clear break in trend, although by the time such a break would be apparent, almost by definition a recession would have already begun.

Last month I concluded that “because of the tariff situation, forecasting based on this report is particularly fraught. What we can say is that the consumer portion of the US economy remained in expansion through April”, and that it would be important to see if the initial evidence of an end to consumer front-running of tariffs would be continued or amplified in May.

This morning we got a clear answer, as the report showed ample evidence of payback, as consumers cut back on spending of almost all sorts, and even spending on services turned flat. Perhaps more concerningly, real incomes declined, even after we account for transfer payments like Social Security. As I wrote above, whether this might mark an actual turning point vs. simple payback for the front-running of tariffs earlier this year will have to wait on another month or two of data. For now, the important point is that in May all of the leading and coincident indicators of personal finance turned down.