- by New Deal democrat

As I pointed out on Sunday, polls and poll aggregations really aren’t forecasts, they are nowcasts. They tell you who would win and by how much *if the election were held today.* They don’t tell you whether or by how much that is likely to change over the next few months. Further, candidates, campaigns, and voters react to them, and so change the dynamics. And in the case of several of them, most notably Nate Silver’s aggregations, since they only give you *probabilities* of each candidate winning, in a fundamental sense they are non-falsifiable — e.g., “well I *told* you that Candidate X had a 6% chance of winning, my model was correct!”

Models based on economic fundamentals, however, *can* forecast, because in the case of leading indicators, what the data is likely to show on Election Day is “baked in the cake” months before. For example, the model based on Q1 polling plus the Index of Leading Indicators are the end of Q1 already forecasts a Biden victory, by a substantial margin. That’s because the Index is supposed to tell you what the economy might be like 6 to 8 months later.

Short leading indicators are those which forecast where the economy is likely to be over the next 3 to 8 months, rather than a year, later. Several decades ago, Prof. Geoffrey Moore identified 11 of them:

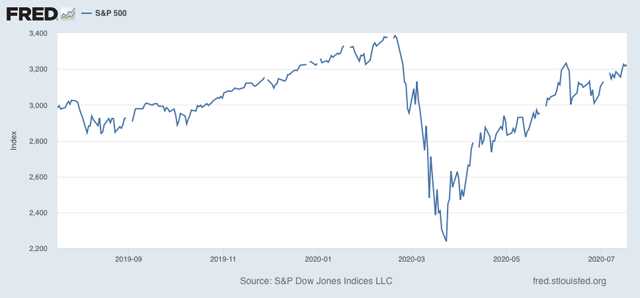

S&P 500 stock price index

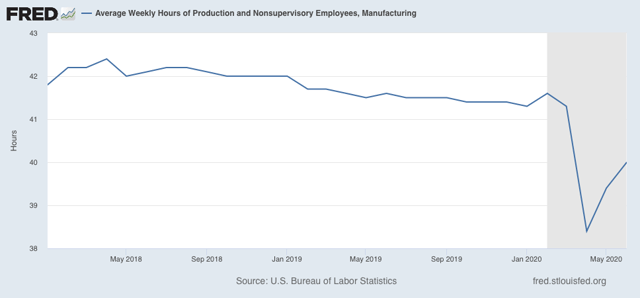

Average workweek in manufacturing

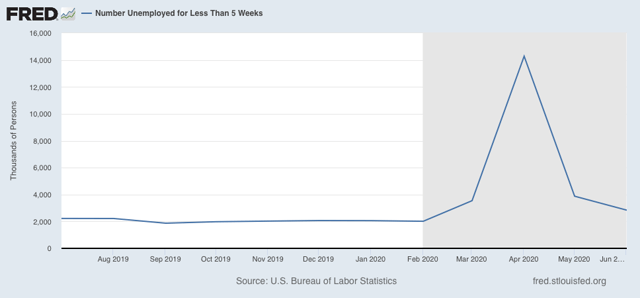

Layoff rate under 5 weeks

Initial claims for unemployment insurance

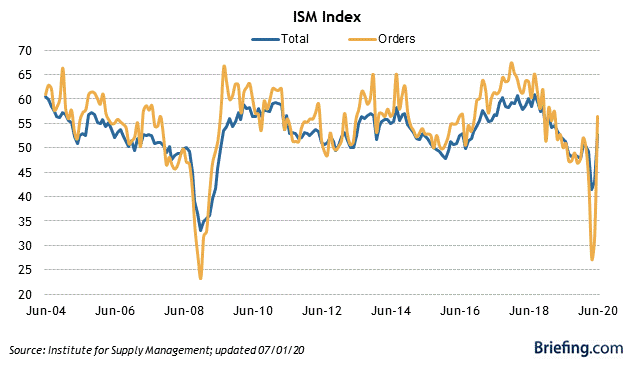

ISM manufacturing vendor performance

ISM manufacturing inventory change

Journal of Commerce change in commodity prices

Change in deflated nonfinancial debt

New orders for consumer goods and materials

Dun and Bradstreet change in business population

Contracts and orders for plant and equipment

With the exception of the Dun and Bradstreet data (which I don’t think even exists anymore), the other 10 are still around, and the results through June are in for all but the two “new orders” categories. So taking a look at them ought to give us a good look at what the economy is likely to look like just before Election Day. To cut to the chase, they have all improved some of them almost back to pre-coronavirus levels, since April, but in general they are still worse than they were at the beginning of this year. So here they are in order.

Average workweek in manufacturing

Layoff rate under 5 weeks

Initial claims for unemployment insurance

ISM manufacturing vendor performance

ISM manufacturing inventory change

Journal of Commerce change in commodity prices

Change in deflated nonfinancial debt

New orders for consumer goods and materials

Dun and Bradstreet change in business population

Contracts and orders for plant and equipment

With the exception of the Dun and Bradstreet data (which I don’t think even exists anymore), the other 10 are still around, and the results through June are in for all but the two “new orders” categories. So taking a look at them ought to give us a good look at what the economy is likely to look like just before Election Day. To cut to the chase, they have all improved some of them almost back to pre-coronavirus levels, since April, but in general they are still worse than they were at the beginning of this year. So here they are in order.

S&P 500 stock price index:

These have not made a new high since February, but have recovered over 3/4 from the March lows.

Average workweek in manufacturing:

These have improved since April, but are still less than half the way back to pre-coronavirus levels.

Layoff rate under 5 weeks

Initial claims for unemployment insurance

The former has improved by about 3/4’s from its worst levels. The latter has improved by about 90%. But both are still at levels comparable to their worst during the Great Recession.

ISM manufacturing new orders

New orders have returned to expansionary levels.

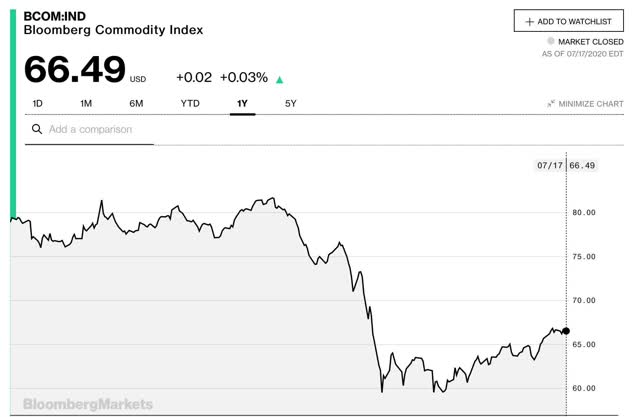

Journal of Commerce change in commodity prices

Commodity prices have only rebounded by about 1/3 to their pre-coronavirus level.

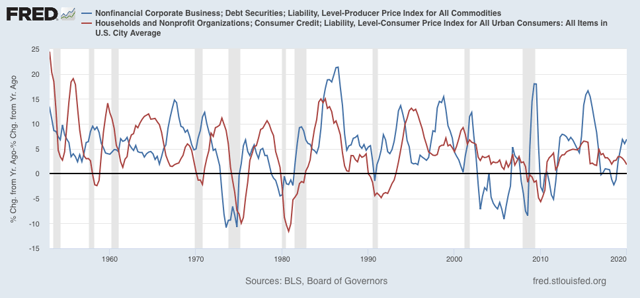

Change in deflated nonfinancial debt

This is only updated quarterly. Through Q1, consumer nonfinancial debt was decelerating, while corporate nonfinancial debt was steady at an elevated level.

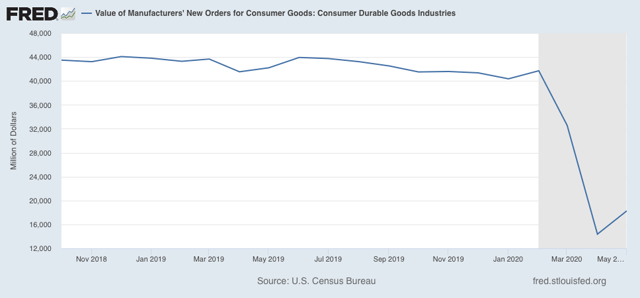

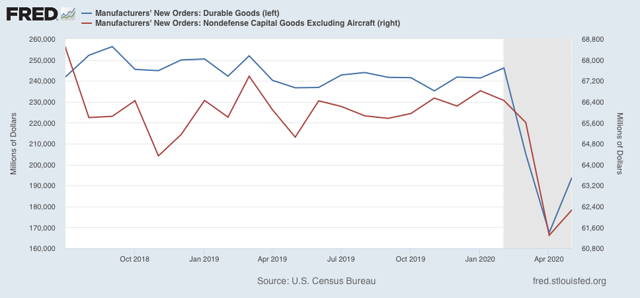

New orders for consumer goods and materials

Contracts and orders for plant and equipment

This data is only available through May. At that point, the rebound was slight compared with its decline when the pandemic struck.

Conclusion:

When we examine all of the short leading indicators, we see an economy that is set to improve in the next few months, but not all the way back to where it was before the pandemic struck in March. Needless to say, this will be affected by the course of the pandemic - whether it leads to partial or total shutdowns again, whether by edict or simply by lack of consumer confidence - between now and then.

Because Biden has been leading at all points this year, this points to a Biden victory, by more than the percent by which he was leading in the first quarter, but by less than he has been leading in the last couple of months.