- by New Deal democrat

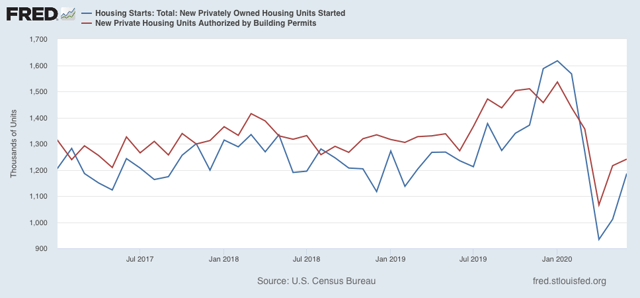

A preliminary note: this morning’s report on housing permits and starts showed improvement across the board in June, although the absolute levels are no better than the low points of 2017 and late 2018-early 2019:

I’ll have more at Seeking Alpha later.

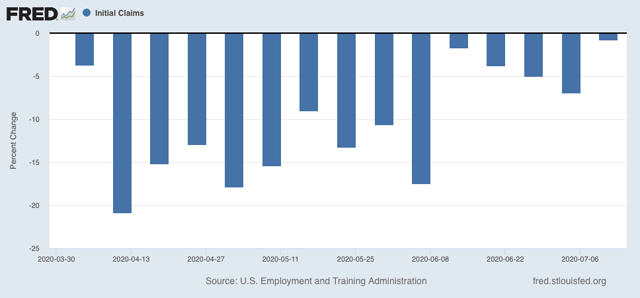

Now let’s turn to yesterday’s report on initial and continuing claims, which have been giving the most up-to-date snapshot of the continuing economic impacts of the coronavirus on employment. This week continued the trend of slight improvement to “less awful,” as shown in the below graph of the week over week % change:

There were 1.300 million new claims, only 10,000, or -0.8%, less than one week ago. This is the smallest weekly decline since the peak in claims in early April.

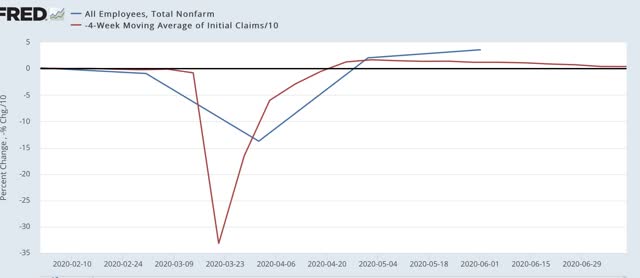

As for continuing claims for the previous week, they declined to 17.338 million, 422,000 less than one week prior (blue in the graph below, vs. red for initial claims):

Although there is slight improvement, this is frankly discouraging, as close to 1% of the workforce is still being laid off and filing for unemployment every week, four months after the onset of the crisis. With special pandemic benefits expiring this month, the economy is set to take a further gigantic hit unless an extension is passed by Congress (which means clearing the GOP Senate). In short, the damage is continuing, and it is continuing to spread out, even if at a slower rate.

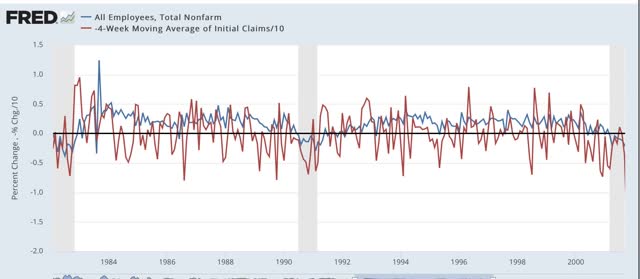

Back in the “regular” pre-coronavirus era, one of the ways of forecasting future employment was by tracking the moving average of initial claims, as the trend in initial claims has a lengthy track record of leading overall jobs. Although the claims data is noisy, even averaging over a month, here is the record in two graphs going back 50 years:

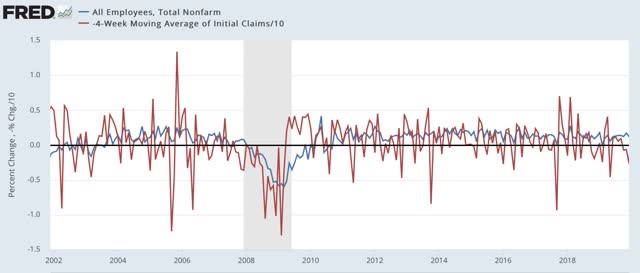

Now here is the past few months:

Note that the typical improvement in initial claims during the past 50+ years has almost never been better than +5% (divided by 10 in the graphs). In the past several months, it has been up to 50% (again, divided by 10 in the graphs). But that has now slowed to about 25% (2.5% in the last graph).

We are probably going to get another big positive number in the jobs report for July, for which the survey week is this one. On the other hand, the slowdown in gains in the initial claims numbers means that job gains are likely to slow in the next several jobs reports. And that does not take into account any large-scale re-closing of portions of the economy in many States.