- by New Deal democrat

On Sunday I said, “Were the two recent sub-200k readings [on initial jobless claims] a spasm of unresolved seasonality because Easter came so late this year? Or are they truly telling us that the economy is heating up again? If the former, I would expect another reading like the 230k reading we got last week.”

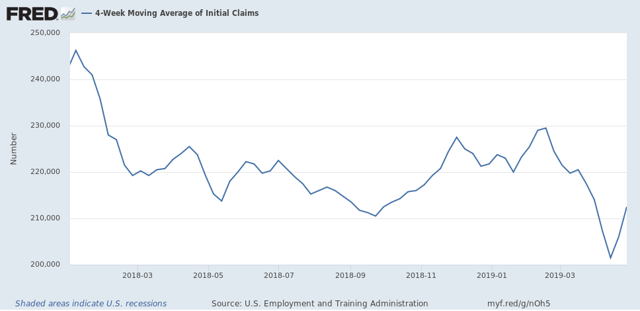

And this morning we got another exactly 230k reading. This strongly argues that there was indeed unresolved seasonality. The 4 week moving average of the two sub-200k readings and the 2 230k readings is a much truer signal, at 212,500:

I don’t normally bother with the non-seasonally adjusted numbers, but here is a look since January 1, 2018. I’ve marked the week after April 1, which was when Easter fell in 2018 vs. April 21 this year:

Note the low levels of layoffs in the several weeks before Easter vs. a slightly heightened level in the weeks just after. We’re seeing the same pattern this year - but with a three week delay.

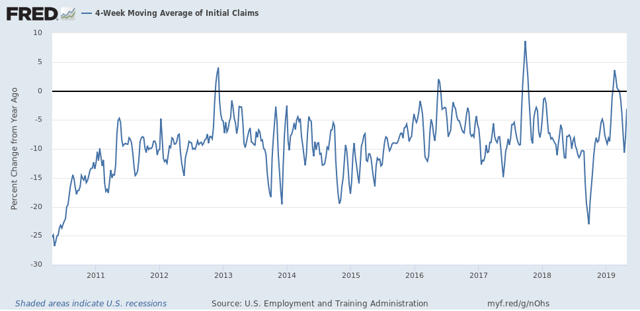

Here is what the YoY% change in the 4 week average looks like:

The current 4 week average is -3.1% less than it was 1 year ago. But it is still below 220,000+ average that we saw from November through mid-March. Since Easter was three weeks later this year, there is still one more week that might have some unresolved seasonality, so it’s possible we go back to 200,000 next week.

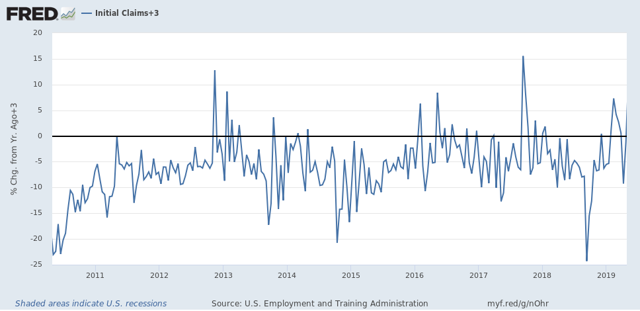

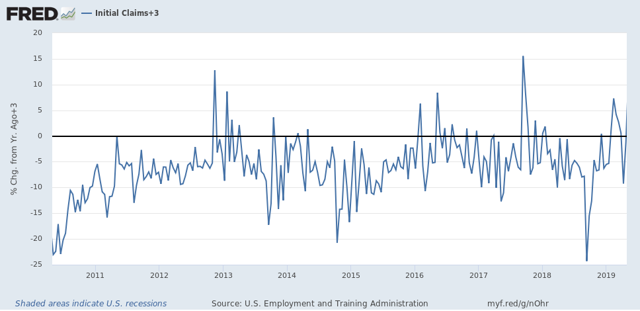

And here is a look at the YoY% change in non-seasonally adjusted claims, averaged biweekly to cut down on some of the noise. The last 6 weeks average to about -3% YoY, so I’ve added that so that it shows as 0, the better to compare with the last 9 years:

The spikes in late 2012 and late 2017 were hurricane-related. Aside from those, the period since December overall is the weakest since the 2016 “shallow industrial recession.”

As of now, both the 4 week seasonally adjusted view of Initial claims, and the non-seasonally adjusted view show us a picture of improving job security, but at a slow or decelerating rate.