- by New Deal democrat

Yesterday I wrote: “Both [personal income and spending] are important to my “mini-recession” hypothesis. The February spending number might still be punk, but I am expecting spending in particular to come roaring back in March, especially after the blowout March retail sales report.”

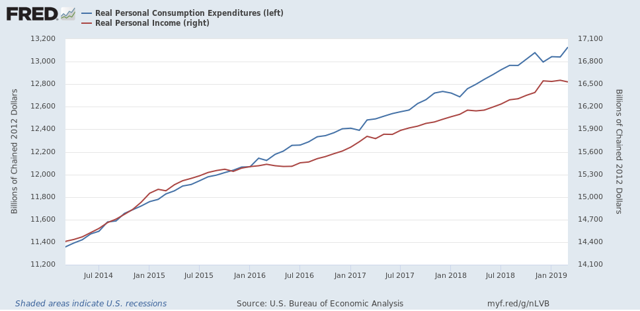

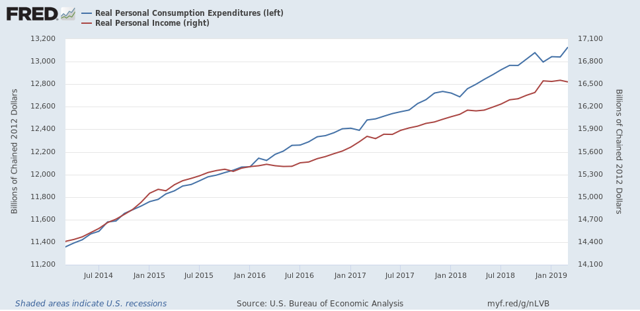

That’s exactly what was reported this morning. Nominal personal income rose +0.1% each month. In real terms, income was flat in February and actually fell -0.1% in March. Nominal spending also rose +0.1% in February, and shot up +0.9% in March, so real spending was also flat in February but rose +0.7% in March:

That’s exactly what was reported this morning. Nominal personal income rose +0.1% each month. In real terms, income was flat in February and actually fell -0.1% in March. Nominal spending also rose +0.1% in February, and shot up +0.9% in March, so real spending was also flat in February but rose +0.7% in March:

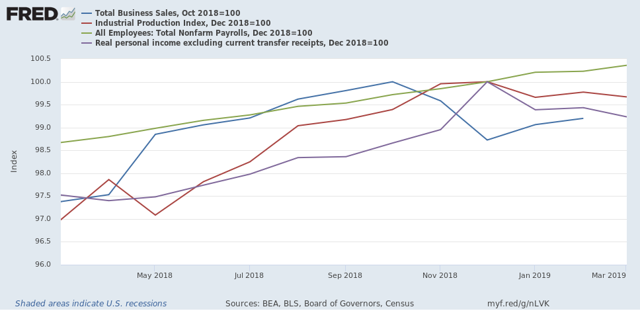

With the exception of March business sales, we now have all of the inputs for production, employment, sales, and income for the first quarter that the NBER typically makes use of in determining recessions. Here they all are together:

Since December, only employment and sales are up, and sales are still below their October peak.

Note that the NBER does *not* use GDP growth to date recessions. Based on the four that they do use, the “mini-recession” appears not to have ended yet.