Yesterday Bonddad wrote a particularly good summary of the economic situation, I think. As the impetus from manufacturing fades, consumer spending has taken up slack. The economy feels like it is grinding along in slow gear, even though there are some metrics (savings, debt reduction) that like coiled springs could power a much stronger recovery if average Americans felt more confident.

Including census workers, there have been 4 straight months of declines in Nonfarm Payrolls after a strong spring start. Even worse, the BLS announced that in February it will be deducting about 330,000 jobs from the existing reports from March 2009 through March 2010. Is this just another "jobless recovery" or is something else going on?

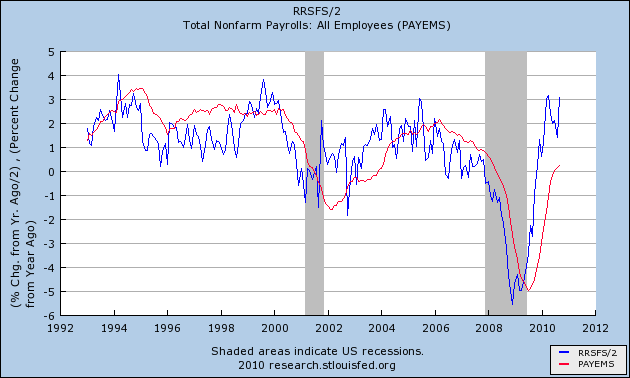

Bonddad thinks it will take a period of 3-5 months of solid job growth for the recovery to take off again. I would take a slightly different tack, since as I have pointed out many times, consumer spending leads jobs, not visa versa. Last year when I studied this seemingly ad nauseum, I found that the best representation was to take YoY % growth in real retail sales, and divide it by 2. This has generally been a good estimate for subsequent job growth. Here is how that metric stands now:

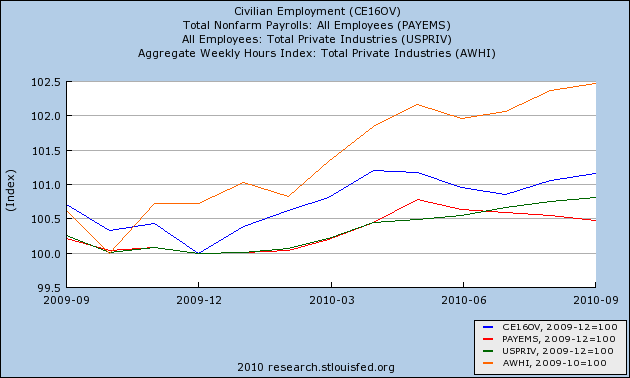

With the strong retail sales numbers from August and September, it certainly appears that nonfarm payrolls are failing to keep up. But that isn't the only metric by which nonfarm payrolls seem unusually punk. Here is a graph that compares growth from the bottom by percent of nonfarm payrolls (red), private jobs (green), the household survey of jobs which is reported each month by the Census Bureau (blue), and aggregate hours worked in private industry (orange):

As you can see, nonfarm payrolls lags all of thee other measures, several of them substantially. In fact, the household survey counted over 1,00,000 more jobs added to the economy than the BLS nonfarm payroll report in the first five months of this year.

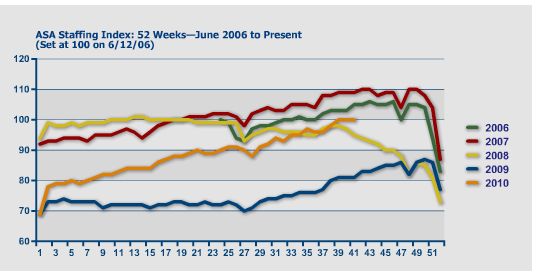

Here's a graph showing the American Staffing Association's temporary hiring index, yet another metric that seems completely at odds with the punk payrolls number:

Notice how, beginning with July 2009, this index has risen strongly, taking back about 3/4 of the ground it lost during the downtrurn.

Finally, let's remember that actual withholding taxes have been running between 0% to 15% higher YoY on a monthly basis since about April, averaging somewhere over 5%. This too seems inconsistent with the nonfarm payrolls reports.

Although nonfarm payrolls reports are frequently revised downward during recessions, they tend to underestimate job growth in the first year of a jobs recovery. If so, the 330,000 downward revision might be exclusively confined to 2009, and in 16 months we could find out that the economy actually created many more jobs this year than we have been thinking.

In my next couple of posts, I'll look at the relationship of nonfarm payrolls to the household survey, private jobs, and aggregate hours in more detail. I'll also take a more detailed, nuanced look at the information revealed by the daily tax withholding statements. With the third quarter preliminary GDP report coming out on Friday, I'll also update my graph of real retail sales vs. jobs to include the latest GDP data as well.