Thanks to all the commenters from last Friday's installment of Weekly Indicators. You raised a variety of good points.

I had hoped to do a Big Overview Tome about Housing but frankly, the weekend called! So let me address one of the points made Friday -- namely, what if the items I am watching for the possibility of a double dip give contradictory signals? We're not totally at sea. At least in the post WW2 era, there was a definite order in when the series turned, which was:

1. Housing

2. Money supply

3. Real Retail sales

4. Jobs

Prof. Edward Leamer gave a lengthy presentation on this subject several years ago at Jackson Hole (I'd add the cite to my next installment if I don't have the time to add it here.) Simply put, housing leads.

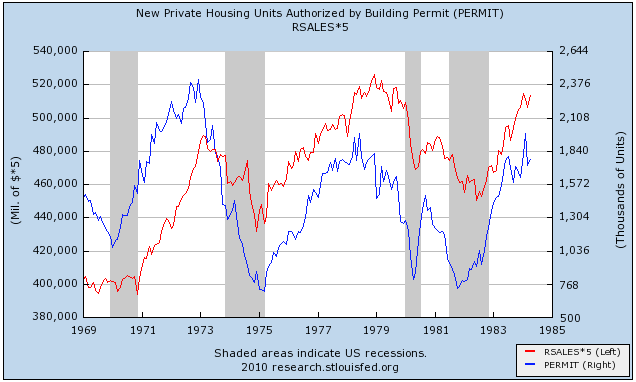

Here are a couple of graphs to show you the point. These compare housing permits (one of the ten components of the LEI) with real retail sales (multiplied by 5 to better show turning points). First, here is the period from 1960 through the early 1980s:

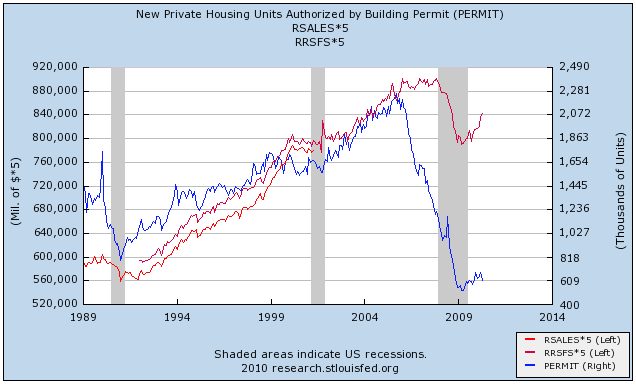

and here is the period from the mid-1980s to the present:

Housing is what ECRI calls a "long leading indicator" because it frequently peaks in particular well before the economy as a whole does. In fact, in the above series, housing peaked a median 8 months before real retail sales, and troughed 1 month before real retail sales. There is a wide variation in range from +19 months to -3 in peaks, and +14 to -3 in troughs. Since we have only had one month's decline from the recent peak in housing permits, at least in post WW2 terms it suggests no double dip yet.

So why look at the other indicators? Partly because of the variability of housing's lead as discussed above. The other reason is that deflationary pulses can happen quickly, and we have very little helpful data predating WW2 and in particular during the deflationary 1920-1940 era. There are annual figures for "nonfarm housing starts" that were kept during this period, and housing did indeed peak in 1925 -- well before the economy peaked in 1929. It troughed on an annual basis in 1933, but we don't know in what month, so we don't know what month would have been the bottom -- and it possibly could have been in late 1932.

At the moment, the consensus is still that housing permits in May grew compared with April. Needless to say, that consensus could be way off, given the collapse in purchase mortgage applications. but it's fair to say that if the decline was only one month, that would be very strong evidence that no double dip is forthcoming.