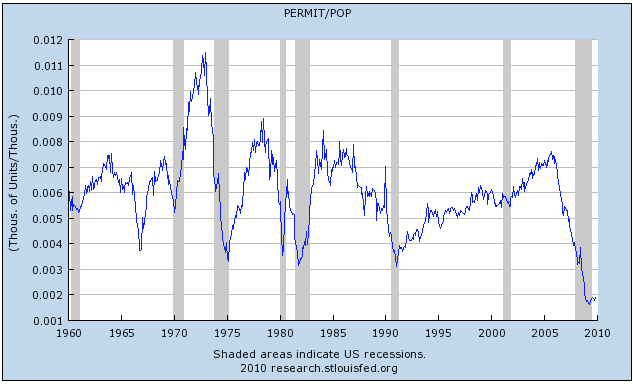

For information geeks like me, the St Louis Fred has premiered a brand new toy, namely, the ability to perform mathematical functions on one or more data series and generate a graph of the result. Taking it for a test spin, I decided to find out how big the housing bubble really was on a population weighted basis. I divided housing permits by population, and this is the surprising result I got:

On a per capita basis, the housing boom of a few years ago doesn't look that outlandish at all! In fact, at least 3 prior booms in the last 40 years were bigger. On the negative side, the current housing bust is even more clearly the worst in the post WW2 era.

Since I had previously done the calculations, I was able to take the comparison further back in time. Last July, I posted about Housing during the Roaring Twenties and Great Depression. Here's the graph from a 1954 text that I started with:

I found the Department of Labor source data or "non farm housing starts," and generated the following chart, which also in the last column converted the housing starts by multiplying the data proportionate to the population for each year compared with our modern population of 300 million. All data is in 1000's:

| Year | Nonfarm housing starts | 2009 equivalent |

|---|---|---|

| 1920 | 247 | 699 |

| 1921 | 449 | 1236 |

| 1922 | 716 | 1953 |

| 1923 | 371 | 994 |

| 1924 | 893 | 2350 |

| 1925 | 937 | 2423 |

| 1926 | 849 | 2177 |

| 1927 | 810 | 2042 |

| 1928 | 753 | 1867 |

| 1929 | 509 | 1252 |

| 1930 | 330 | 805 |

| 1931 | 254 | 615 |

| 1932 | 134 | 322 |

| 1933 | 93 | 221 |

| 1934 | 126 | 300 |

| 1935 | 221 | 522 |

| 1936 | 319 | 748 |

| 1937 | 336 | 781 |

| 1938 | 406 | 937 |

| 1939 | 515 | 1179 |

| 1940 | 602 | 1368 |

Note that this chart is for nonfarm housing starts only. In 1930, 25% of the US population lived on farms, compared with only 2% today. So if anything, the 1920s boom was much more of a bubble than the recent one. Similarly, the population adjusted 221,000 housing starts from 1933 is considerably worse than the April 2009 bottom of 498,000.

So, contrary to most prevailing opinion, is the housing bust creating pent-up demand? Certainly there is an oversupply of houses - at current asking prices - on the market now. Nevertheless, in a long term secular sense, I believe the answer is "Yes."

While the US population is growing by about 1% a year, new home buyers are what drives that market, and that is very age sensitive. First time home buyers are generally younger persons who have formed a new household and are ready to move from an apartment or their parent's home to their own. In other words, the number of first time homebuyers over time ought to be proportionate to the number of persons who are entering the stage of their lives where they are ready to form their own household and buy their first home. That number isn't static or growing smoothly, as this graph of immigration adjusted births by year by the Harry S. Dent Foundation (whose investment advice based on it may not have been so hot) shows:

The Baby Boom peaked at 5 million births a year in the late 1950s, and the Gen X baby bust reached a nadir of less than 4 million in the early 1970s. The echo boom of Gen Y/Millenials peaked at about 5 million again in 1990. The data used in this graph is corroborated by the demographics information supplied in the 2000 Census.

In other words, the number of people at the right age to buy their first house would have contracted by 1 million a year as the Boomers gave way to Gen X, and then rise again by up to 1 million as the Millenials enter house buying ages. What we need to know is, at what age range do people typically form a new household, and at what age range do they typically buy their first house?

Although the data isn't available for use at the St. Louis Fred site, the Census Bureau does break down population by quintile, and from this we can obtain information about the average age that new households are formed, and here it is:

Not surprisingly, young people begin to move out of their parents' homes at about age 20. Those who married very young form their own household, while young singles live with roommates. By age 25, new household formation rapidly accelerates, and continues through age 35, by which time close to the maximum percentage of people are living in their own or spouse's household.

Of course, while some people may move directly from their parents' home to a house of their own, many if not most will go through a period of living in an apartment. The median age of first time homebuyers is therefore a little older than the median age of forming a new household. This information is very difficult to obtain, but a survey conducted in 2006 found that the average age of first time homebuyers in the Gen X and Boomer eras was 29 years old. (The survey found that Millenials were buying at age 26 on average, but since they include persons born as late as 1994 in that group, I think we can safely ignore that anomaly.) For our purposes, we can round to age 30 as the average age of first time homebuyers, which is also the median age of 2009 first time home buyers as found in a survey by the NAR.

Interestingly, the National Association of Home Builders reported that at the peak of the housing bubble in 2005, the Census Bureau found that the median age of home buyers was up to 33 years old, perhaps reflecting the unaffordability of housing at the market's peak.

Applying this information to housing, we would expect the Boomer generation's impact on first time home buying to begin shortly before 1976 and to have reached its peak first home buying years around the late 1980s. After that, the pool of young first time homebuyers would gradually shrink until about 2005, and then begin to rise again. Obviously I'm not suggesting a perfect fit to the data that begins this post. Mortgage interest rates obviously play are role, as do home buyers expectations about whether prices for houses will be stable, go down, or rise during the period of their ownership. For example, as the first Boomers entered the housing market, prices began to rise with demand (and 1970s inflation and interest rates), making housing much more expensive for later Boomers. Similarly, in essense the housing bubble of 2004-6 borrowed future demand for housing. The nadir we should have had then, we are having now.

So, what is the condition of the Millenial generation? According to the Bureau of Labor Statistics, job losses during the Great Recession have been particularly concentrated among the youngest cohort of the workforce. A smaller share of 16- to 24-year-olds are currently employed--46.1%--than at any time since the government began collecting such data in 1948. Thus, at the moment, the "echo boomers" may be the "Boomerang" generation, moving back in with their parents to save money in a dismal job climate:

According to a recent Pew Research Center study [conducted in October 2009], one in 10 adults between the ages of 18 and 34 said the poor economy has forced them to move back in with mom and dad.... In addition to those who have moved home, another 12 percent scurried to find a roommate to scale down living expenses.

Young adults are altering their behavior in other ways too. About 15 percent of adults younger than 35 say they have postponed getting married because of the recession, according to Pew.

Not only can they not afford a big wedding, but they don't have the money to buy a house or take care of a child, the study said. Fourteen percent of young adults say they have put off having a baby.

"They are delaying important decisions, perhaps indefinitely. We hope it's temporarily, but that's contingent upon the economy improving," said Richard Morin, a senior editor at Pew and the study's author. "These aren't slackers. These are people who are in transition, and their lives are on hold."

As this graph of the most recent Case Schiller house price index by Calculated Risk shows, housing prices still have a way to go to fall to their longer term mean:

so the Boomerang generation is going to have a difficult time buying their first home for a few years to come.

I'm not saying that housing is set to take off this month or this year. Nevertheless, in a secular sense, a long term bottom in the housing market is taking place now. Thirty years ago it was 1980, and the Baby bust of Gen X was giving way to the echo boom of Gen Y/ Millenials. This means that every single day, there is more and more demographic pressure building up on the demand side of the housing market, and that pressure is going to continue to increase for the next 10+ years.