Now that Bonddad and I are both on record that the Recession has ended, the focus shifts to what the Recovery will look like -- what are the engines of growth, how robust will it be, how long will it last, how widely shared will the benefits of growth be? Bonddad's excellent post from yesterday describes a "Fits and Starts" recovery, while I suspect the chances for a V-shaped recovery are much greater than almost anybody else anticipates.

I further suspect that this will be an old-fashioned recovery, where manufacturing leads the way. In that regard, the 72 hour period from this morning through Friday morning will give us a slew of data about the strength of the manufacturing rebound. Yesterday's Chicago PMI reading of 50.0 was the third surprise in several weeks, after both the New York and Philadelphia regions showed a dramatic shift to growth.

This morning's ISM manufacturing reading of 52.9 was not only significantly higher than estimates, but according to the ISM, "the highest since June 2007." The New Orders Index surged, "up 9.6 points to 64.9 percent, the highest since December 2004." The deliveries index, a leading indicator, also improved to 57.1. Inventories shrank, meaning that replacing goods on shelves will require more manufacturing in the future. The only negative part of the report was that employment at 46.4 is still in contraction, although less so than before.

Later today we get auto and truck sales, which will almost certainly also show a dramatic pop due to "cash for clunkers." Tomorrow brings us factory orders. We already know that durable goods showed surprising strength, but should new orders for nondurable goods not swoon, that will make the final, 10th Leading Economic Indicator to have a positive 6 month reading, making it a a virtual certainty that economic growth is already happening.

Friday ends the week with a bang. Although the employment number will receive the most attention, manufacturing workweek and overtime are also reported. Strong numbers for these will support the V-shaped recovery hypothesis (as did, e.g., the strong new orders component of ISM today). And last month manufacturing lost only 52,000 jobs, after having lost in excess of 125,000 every single month previously this year. It is at least possible that jobs could have been gained in manufacturing in August.

In short, this week the data will begin to paint the picture of the recovery in earnest.

-Update from Bonddad

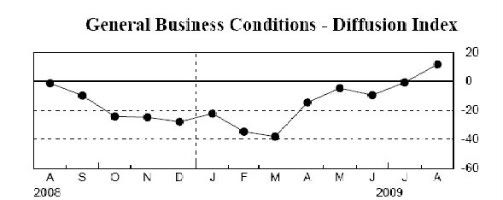

Let me add the following points. First, here's the chart:

That shows continued growth since the beginning of the year. This indicates momentum is for an increase. In addition, consider this information from Reuters:

A similar index covering the heavily industrialized Milwaukee region rose to 56 in August from 45 in July, while the Dallas Federal Reserve Bank said factory activity in Texas declined in August but at a slower pace than in July.

Meanwhile, business activity in New York City, which tends to be driven by trends in the financial sector, expanded in August for the first time in three months, thanks to increased purchases and a slowdown in layoffs.

The National Association of Purchasing Management-New York index of business conditions rose to 55.3 from 48.3 in July. Improvements in purchasing volume and employment conditions signaled the worst of the city's downturn might be ending, the group said.

This is encouraging news as it indicates it's not just one number causing the increase.

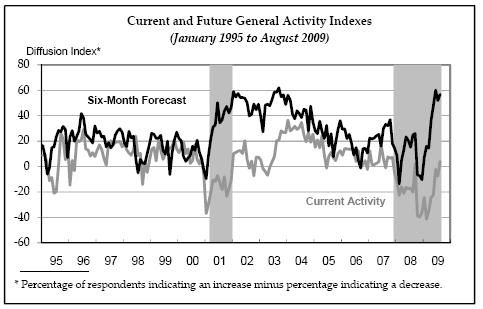

Let's add the following charts:

The Empire State Manufacturing Index:

The Philly Fed Manufacturing Index

The Richmond Fed Manufacturing Index

Together these chart paint a picture of a sector on the rebound.