Fed rate cuts lower borrowing costs throughout the economy and effectively increase the money supply. But cheaper greenbacks can also have a downside: inflation. In particular, natural resources traded globally in dollar terms tend to rise if demand in foreign countries remains solid, making it necessary to purchase the same amount of commodities as before using devalued dollars.

.....

"The market is essentially saying to the Fed, hey, you really want to boost the (U.S.) economy at any cost? Well, here are the costs," said strategist Bill O'Grady, chief global investment strategist the brokerage A.G. Edwards & Sons in St. Louis.

Bernanke is in a terrible spot. He basically gets to either clean-up Greenspan's mess or try an reflate the economy in some measure to prevent pain. The problem is Greenspan's mess is wide and deep and therefore hard to clean-up and there are no more assets to inflate.

What Ben should have done from the beginning is to say the following: "Alan left a big damn mess that is going to take a long time to clean up. There is no getting around the fact that some pain will be felt. However, what we can do is make sure the economy does not completely spin out of control by keeping prices somewhat stable."

The problem with the previous plan is twofold: it's really hard to do and we're in the middle of an election year. So, the interest rate cuts will come fast and deep. This is leading some to question Bernanke's leadership of the Fed:

Federal Reserve Chairman Ben Bernanke faces a perception problem: It looks like he is too ready to respond to a falling stock market.

That criticism was sounded after the Fed moved to cut interest rates Tuesday, in part because of fears that an overseas stock-market plunge would spill over to the U.S. The drumbeat grew more intense yesterday as critics and others confronted the possibility that the global selloff was at least partly a false alarm, reflecting French bank Société Générale SA's unwinding of a trader's unauthorized bad bets, and due less to economic anxiety.

As a result, investors are looking at the possibility of increased inflation.

Thursday, futures on everything from gold to corn to lumber to crude oil traded higher, and the broad-based Dow Jones-AIG Commodity Index climbed 2.3%, or 4.202 points, to end at 185.359.

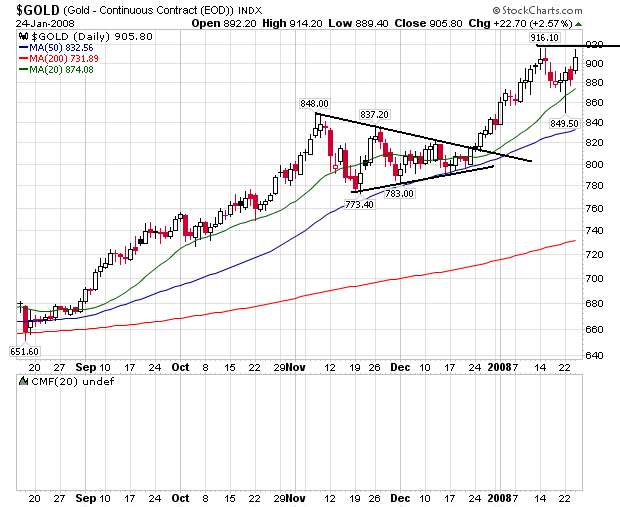

On gold, notice the markets have recently pulled back a touch on a round of profit taking from the recent run up. But yesterday, they printed a large candle and appear ready to move higher if the Fed cuts next week.

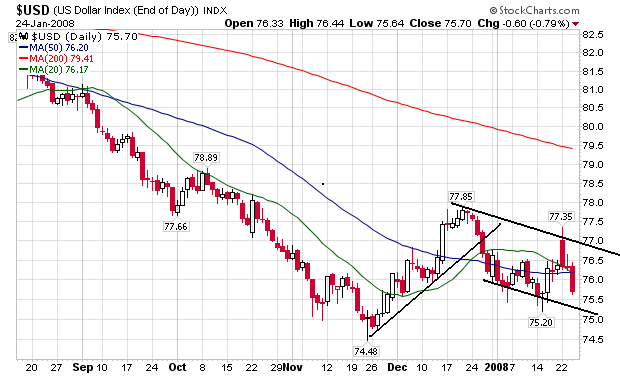

The dollar had a bear market rally from late November to late December, but has since started to move lower in anticipation of further Fed rate cuts. That should be no surprise too anyone.