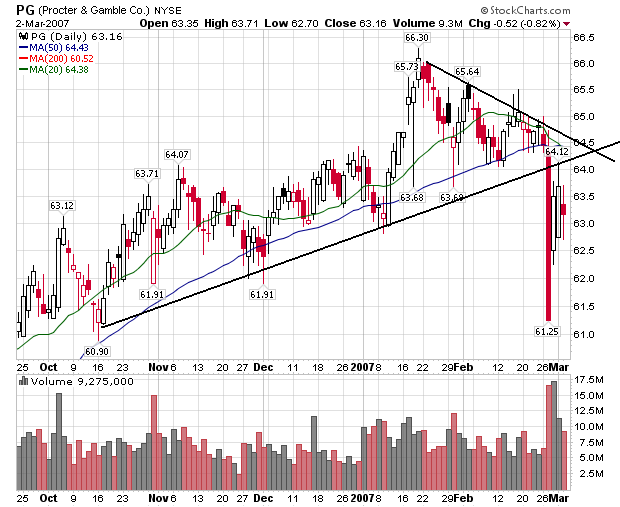

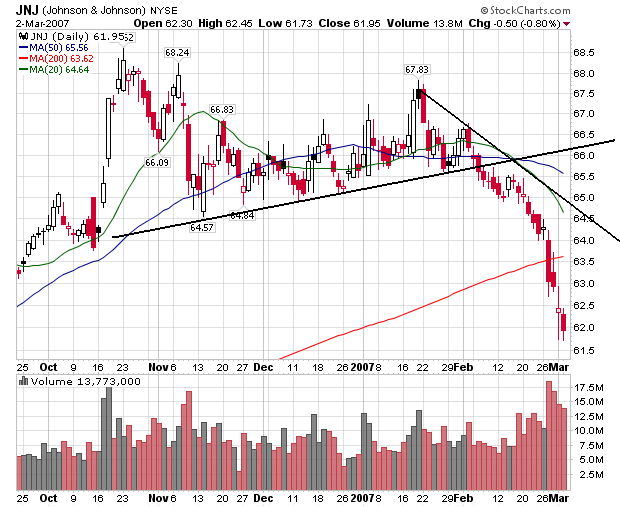

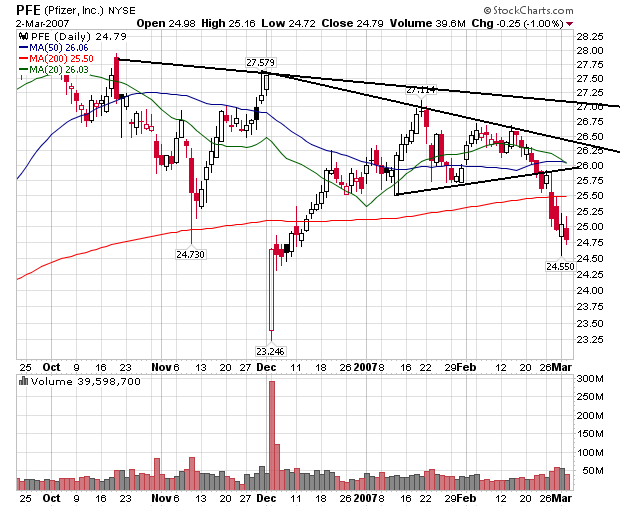

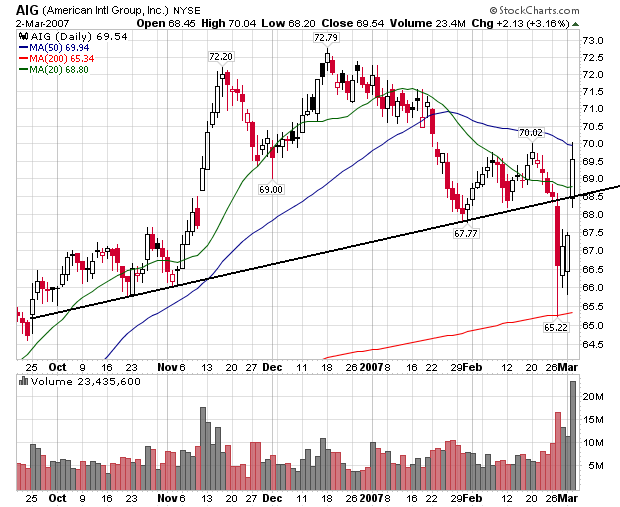

With the exception of AIG, all of these stocks are in clear downtrends. When you combine these charts with the top 5 S&P stocks you get a pretty dismal picture of the big S&P positions: 8 of the 10 largest caps in the index -- representing about 20% of the average -- are in downtrends. Citigroup is close to a downtrend and the only reason AIG is in an uptrend is an incredibly favorable special circumstance YOY earnings performance (Last year AIG's earnings were low because of a legal settlement).