- by New Deal democrat

Existing home sales have very limited value in economic forecasting, since they are the trade of an existing product rather than indicating growth or contraction in the creation of a new product. Thus my main focus at present on this data is the extent to which it shows - or not - the rebalancing of the housing market. That’s because, unlike existing homeowners, house builders can vary square footage, amenities, lot sizes, and offer price and/or mortgage incentives to counteract the effect of interest rate hikes. As a result, new home sales have relatively speaking held up, while existing home sales have declined much more sharply. Conversely, the prices of new homes have moderated relative to that of existing homes, which have remained stubbornly high.

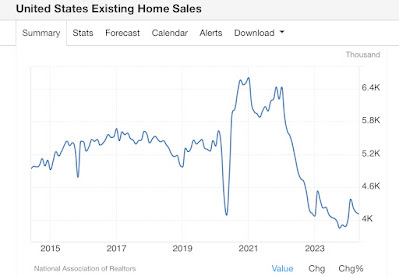

This morning’s report for May gives us very small, incremental evidence of rebalancing. In particular, seasonally adjusted sales declined a slight -3,000 to 4.11 million annualized. For the past 18 months, sales have remained range bound between 3.85 and 4.38 million annualized:

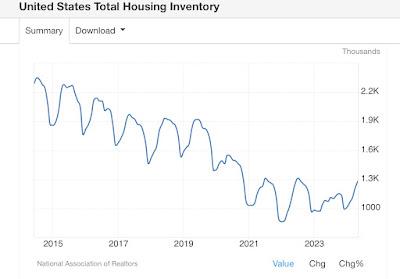

The good news, for rebalancing purposes, is that inventory has increased (note inventories and prices are not seasonally adjusted in this report, so the correct way to deduce the trend is to compare YoY). In May, inventory was higher by 18.6% YoY to 1.28 million units, vs. up 16.3% YoY in April. This also compares with May 2022’s 1.15 million and May 2021’s 1.21 million. Inventory was higher in May 2020 at 1.58 million and higher in May of all of the 5 years prior:

To reiterate, even before the pandemic, housing inventory had been falling almost relentlessly YoY since 2014, the only exception being early 2019. the pandemic exacerbated this trend, which appears to have finally bottomed out in 2022-23. There in a nutshell is most of the story about the chronic shortfall in housing in this country.

Ultimately this is good news, because we want to alleviate this shortfall in inventory, and this morning’s report means that we continue to make progress in that direction.

Unsurprisingly, in response to the longer term decline in inventory, existing home prices rose consistently since 2014, and accelerated when COVID hit and much of the market shut down. The median price for existing homes briefly turned negative in early 2023, troughing at -3.0% YoY in May. Thereafter with a brief break in March of this year, YoY comparisons have accelerated almost relentlessly. They were higher YoY by 5.7% in February, 5.6% in April, and now 5.8% in May:

In summary, COVID and Fed rate hikes conspired to exacerbate an already-existing shortfall in existing home inventory. This pre-existing shortfall has meant that prices failed to respond meaningfully to those Fed rate hikes. The continuing large YoY increases in existing home prices are gradually driving inventory higher, but not high enough yet to completely alleviate that longer term inventory shortage. New home sales, which have increased their share of the overall housing market, will continue to respond as a result. By contrast, existing home sales will likely remain range-bound at their recent levels until the Fed moves on interest rates, whenever that may be.