- by New Deal democrat

Personal income and spending has become one of the two most important monthly reports I follow, because it nets out the impacts of higher interest rates and abating inflation due to the unlinking of the supply chain. Because real personal spending on services for the past 50 years has generally risen even during recessions, the more leading components of this report have to do with spending on goods. Additionally, there are several components that form part of the NBER’s “official” toolkit for determining when and whether a recession has begun.

Now, to the report for January . . .

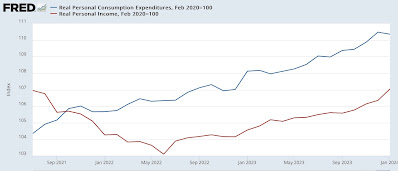

Nominally income rose a sharp 1.0% in January, the same increase as last January, suggesting that lots of people got big annual raises. Nominal spending rose 0.2%. Prices as measured by the PCE deflator increased 0.3% for the month, meaning that in real terms income rose 0.7% and spending declined -0.1%. Since just before the pandemic real incomes are up 7.0%, and spending is up 10.4% (NOTE: Data in all graphs below except for YoY comparisons, and the personal saving rate, is normed to 100 as of just before the pandemic):

On a YoY basis, the PCE price index is up 2.4%, the lowest since March 2021. For the past 16 months, the YoY measure has been declining at the rate of 0.25%/month, suggesting that it will hit the Fed’s 2.0% target in the next two months:

As I indicated above, for the past 50+ years, real spending on services has generally increased even during recessions. It is real spending on goods which declines. Last month real services spending rose 0.4%, while real goods spending declined -1.1%, reversing December’s revised 0.9% gain:

As per form, real services spending has risen consistently since the pandemic, while goods spending have been somewhat of a mirror image of gas prices, which peaked in June 2022.

Real durable goods spending tends to turn before non-durable goods spending. The former declined -2.1% for the month (vs. +1.5% in December), while the latter declined -0.5% (vs. +0.6% in December):

Durable goods spending had been very much affected over the past several years by the shortage of new vehicle inventory, which has largely abated as 2023 progressed.

Another important metric for the near future of the economy is the personal savings rate. In January it increased 0.1% to 3.8%:

On the positive side, the declining trend in this rate since last May indicates a lot of consumer confidence. But on the negative side it remains close to the all time low readings of 2005-07, indicating vulnerability to an adverse shock. One of my forecasting models uses such a shock as a recession warning indicator. In any event, there is no such shock indicated at the moment.

Also as indicated above, the NBER pays particular attention to several other aspects of this release. Real income excluding government transfers (like the 2020 and 2021 stimulus payments) continued to increase, up 0.3% for the month, to yet another new record high:

This has been something of a mirror image of gas prices, rising consistently since June 2022.

Finally, the deflator in this morning’s report is used to calculate real manufacturing and trade sales, another metric relied upon by the NBER. This increased a strong 1.0%,also to another new record high:

In summary, with the exception of real spending on goods - which really just took back December’s big increases - this was an excellent report. Inflation is now very close to the Fed’s preferred baseline rate, and both incomes and spending are up substantially. As I wrote last month, you would be well within your rights to call this a “Goldilocks” economy.