- by New Deal democrat

Industrial production historically has been the King of Coincident Indicators, turning up and down at the onset and end of recessions in the past. But as I wrote last month there are signs that has changed in the past 20+ years since China was admitted to normal trade relationships with the US. Because manufacturing is a much smaller share of domestic economic activity, and employment, downturns which before 2000 would always have meant recession probably do not do so now.

More specifically to the past several months, we had a very effective UAW strike in the motor vehicle industry which distorted both of the last two months. To wit, after revisions motor vehicle production in October declined -9.9%, and this morning’s report indicates a rebound in November of 7.1% which obviously is not complete.

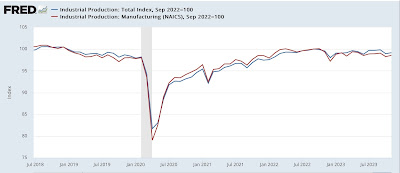

More broadly, industrial production as a whole rebounded 0.2% in November. Manufacturing production increased 0.3%. But there were negative revisions of -0.3% to total production, and -0.2% to manufacturing, meaning that after rounding on net total production was unchanged, and manufacturing only improved 0.2%. The below graph show their levels compared with their post-pandemic peaks in September 2022:

Total production remains down -0.8% since then, and manufacturing down -1.4%.

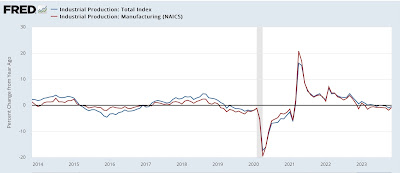

On a YoY basis, total production is down -0.4%, and manufacturing production is down -0.8%. Going back over 100 years before 2016, there have only been 6 occasions when negative readings did not coincide with a recession within the next 6 months, and on only 2 of those occasions did the negative readings last more than one month:

But that changed in 2016, when production was down YoY for over a year, and yet no recession happened:

In other words, while industrial production remains recessionary, it has not been enough to produce a recession in the entire economy without the participation of other sectors, most notably construction.