- by New Deal democrat

Last month I concluded my post on the July JOLTS report’s sharp declines by noting that “None of these statistics move in a straight line, so it would be a mistake to project this report’s relatively big moves forward. But the trend clearly remains in place.”

This month’s report for August showed that was the case, as all of the major metrics improved, most slightly, but openings strongly. Nevertheless, the decelerating trend continues to remain in place.

Openings increased 590,000 to 9.610 million, the highest in three months. Actual hires increased 35,000 to 5.857 million, and quits increased 19,000 to 3.638 million. Below I show all three series normed to their average as of the three months before the pandemic hit:

As you can see, openings are still up a very strong 38.0% since then, while quits are up only 3.1%, and hires are actually *down* -2.0%.

In short, for all intents and purposes both hiring and quitting are back to where they were in normal times before the pandemic, while openings - which are always suspect because many companies keep fictitious openings posted as a matter of routine - remain very elevated.

Layoffs and discharges, similarly measured, declined all of -1,000 to 1.680 million, a decline of -11.7% compared with their pre-pandemic average:

Note, however, that all 4 metrics discussed above - openings, hires, layoffs, and quits - are receding from their post pandemic highs (and low in the case of layoffs). In other words, the decelerating trend remains intact.

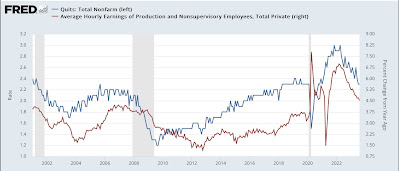

Finally, last month I premiered a comparison of the quits rate and average hourly earnings. This is because the former has a 20+ year history of leading the latter, which I have in the past described as a “long lagging” indicator that turns well after the turns in most other metrics. Here’s the update of that comparison:

The quits rate was flat compared with the prior month, but as with the other JOLTS series, the decelerating trend remains intact. This means that wages should follow with continued deceleration, on the order of -0.1%-0.2% measured YoY. This suggests that on Friday YoY nonsupervisory wages will likely decelerate to 4.4% or 4.3% YoY.