- by New Deal democrat

Let me start out with the statement that has been my touchstone for the JOLTS report for the last year or more: for the last several years, the jobs market has been a game of “reverse musical chairs,” where there are always more chairs than participants. Those employers whose chairs weren’t filled had to increase their wage and/or benefits offerings, or go without. This was good for labor, but certainly put pressure on prices as well. Because the jobs market has remained so strong, it has been unlikely that a recession would start unless the situation with job openings returned to at least close to its pre-pandemic levels. Only then could there be enough layoffs to actually be consistent with a negative monthly jobs number.

This morning’s report for May was more of the same: the decelerating trend remained intact, but there was some month over month strength. And there hasn’t been enough of a return to pre-pandemic “normalcy” to make me think we are anywhere close to an actual negative monthly jobs print.

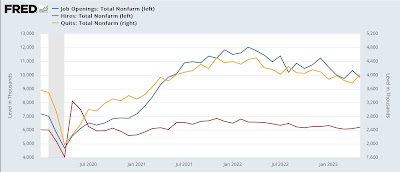

To the numbers: Job openings declined -496,000 to 9.824 million. This is less than 1/2 of the decline from the post-pandemic peak of 12.200 million vs. the pre-pandemic peak of 7.600 million. Hires rose 107,000 to 6.208 million, still significantly above their pre-pandemic record. And Quits rose 250,000 to 4.015 million, also well above their pre-pandemic level, but also well below their post-pandemic peak:

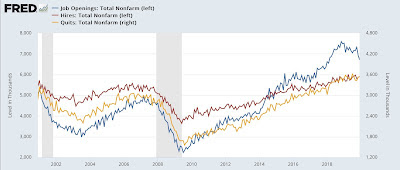

Here is the long-term pre-pandemic history of all three metrics for comparison:

Just to emphasize again: note the current numbers are all trending down from their post-pandemic peaks, but not close to their pre-pandemic averages or even peaks.

Meanwhile layoffs and discharges were virtually unchanged from April, at 1.585 million:

Here is their pre-pandemic history as well, showing that they are well below those levels (a positive):

Last month I wrote that “there are two overarching trends in this data:

(1) the absolute fundamentals for labor remain quite positive,

(2) but they continue to decelerate.”

That remained the case with this month’s report. While I am anticipating that the unemployment rate is likely in rise slightly in the next few months, I don’t think we are anywhere near having an actual negative jobs print.