- by New Deal democrat

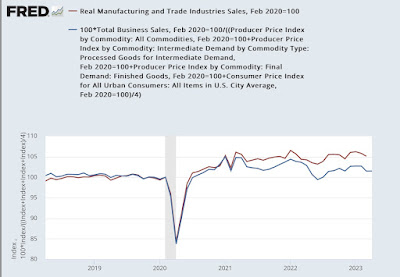

A recession is a sustained and significant downturn in production, sales, income, and employment. Here’s what the monthly indicators of those look like, normed to 100 either as of January, or in two cases to their 2022 peaks:

Notice that sales (gold) are reported with a 2 month lag. We won’t know real manufacturing and trade sales for April until 2 weeks from now.

So I’ve developed several methods for making early estimates. Based on those, we can make a good final estimate for April now, and a preliminary back of the envelope one for May as well.

Yesterday the last component of nominal sales, for the manufacturing component, were reported. As a result, nominal total business sales increased 0.1% in April. I use an unweighted average of CPI and commodity, intermediate, and final goods from the PPI as a deflator. This gives us a very good estimate of real manufacturing and trade sales:

Since the average of the 4 inflation measures was +0.1% as well, this means that the final estimate for real manufacturing and trade sales for April is unchanged.

Turning to May, we do have real retail sales, which are about 1/3rd of the total measure, as well as industrial production, a proxy for real manufacturing sales. We don’t have inventories or wholesale sales, so this method is much less reliable, but it does capture the trend over time:

This method gives us a preliminary, back of the envelope estimate of 0.0%, or unchanged, for May as well.

This leaves both April and May 1.0% below the January peak for real sales.

The economy continues to be held up by real spending on services, and the ensuing growth in payrolls.