- by New Deal democrat

Initial claims, which were one of the most positive indicators of all last year, have turned darker in the last several months, and are edging closer to triggering their recession warning levels.

Claims were unchanged at a revised 264,000 last week, the highest level in over 18 months. The more important 4 week average rose 8,500 to 255,750. Continuing claims, with a one week delay, fell 13,000 to 1.759 million:

On a YoY% basis, claims are up 22.2%. The more important 4 week average is up 19.5%, and continuing claims are up 30.3%:

Here’s what the history of the 4 week average and continuing claims YoY levels look like, with the present values normed to 0 for easy comparison:

With the exception of 1989, and 4 week periods in February 1977 and May 1979 (the former likely weather, and the latter due to a strike), the 4 week average has never been this much higher YoY without a recession having begun. For continuing claims, there are no exceptions at all.

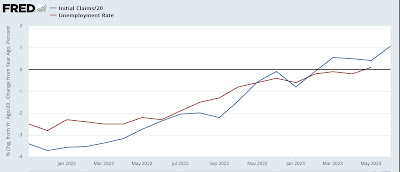

Because initial claims lead the unemployment rate, here is their historical YoY comparison with claims averaged monthly (note initial claims/20 for scale):

Here is the same comparison for the past 18 months:

It is important to note that there are still 2 more weeks left of June claims, so the last value is likely to change significantly. But if it were to continue at the present level, it would imply the Sahm Rule (a reliable early nowcast confirmation of a recession; black in the graph below) being triggered or close thereto within the next few months:

Bottom line: no red flag triggered yet, but the yellow flag caution is looking more orangey..