- by New Deal democrat

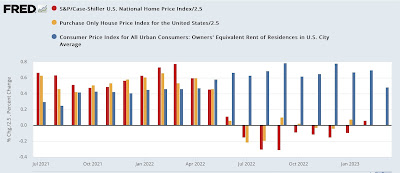

House prices through February as measured by both the FHFA (gold in the graphs below) and Case Shiller (red) Indexes rose, the former by 0.5% (after a downwardly revised 0.1% in January), and the latter by 0.2% (after a -0.2% decline in January). Here’s what the monthly changes look like for each, as compared with Owners’ Equivalent Rent in the CPI (blue):

[Note that both house prices indexes are /2.5 for scale]. Since a year ago, both house price indexes were rising at almost 2% a month, the YoY% changes have continued to decelerate sharply:

The FHFA index is only up 4.0% YoY through February, while the Case Shiller is only up 2.1% YoY. At the rate of decline since last summer, the FHFA Index will be negative YoY by about June, and the Case Shiller Index could go negative YoY by next month’s report for March.

The implications for CPI is that the Owners’s Equivalent Rent component is likely to stabilize at current YoY levels for several more months before declinining, and CPI ex-shelter, which actually was slightly in *deflation* since last June as of the March report, will continue to be flat or lower.

Finally, while the increases in house prices have been quite small compared with the recent past, I was expecting a bigger decline from both indexes once the tide turned last summer. Undoubtedly the reason has a lot to do with the below graph, showing that while the active listing count of houses for sale has increased by over 50% since one year ago (teal), in absolute terms it is much lower than before the pandemic (blue); and indeed the new listing count has continued its almost relentless decline beginning 2 years ago, now down about -20% from a year ago:

The very low number of houses for sale puts a low ceiling on supply, meaning even normal demand can still create bidding wars.

That increasing interest rates is causing fewer houses to be put on the market, as potential move-up buyers do not want to trade 3% and 4% mortgages for 6% and 7% mortgages, creates quite a conundrum for the Fed.