- by New Deal democrat

This morning we got three reports on housing sales and prices. Let’s start with the sales data.

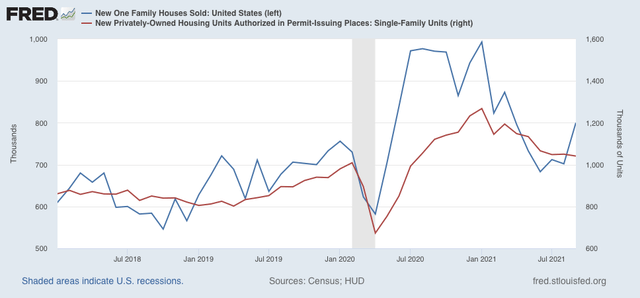

New home sales, while very noisy and heavily revised, tend to lead all of the other housing indicators, even permits.

This morning’s m/m increase in new home sales (blue in the graph below) was good news. It was the second increase in a row, and at 800,000 was the highest since March. This suggests that single family permits (red, right scale) - which have continued to decline, but only slightly in the past several months - are likely to turn up shortly:

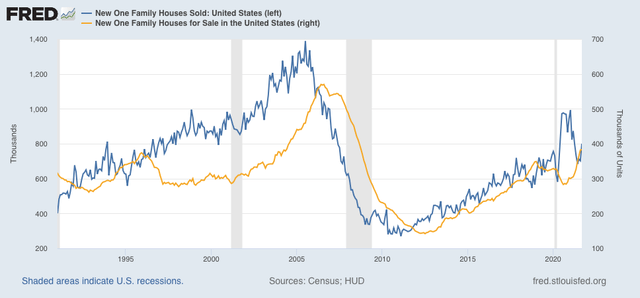

The number of houses for sale (which lags the number sold) was unchanged at 379,000, tied with last month for the highest level since October 2008 (gold in the graph below):

Increasing sales and increasing prices bring out increasing inventory, as home builders jump at the chance for increased profits.

Now let’s turn to house prices.

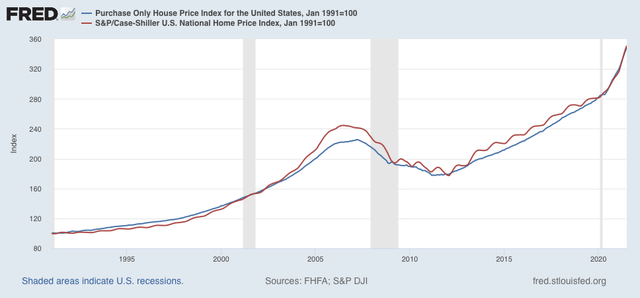

As shown below, both the FHFA and CaseShiller indexes have risen almost an identical 250% since January 1991, when the FHFA index began:

During that time, usually the FHFA index has decelerated, and made a peak or trough a month or two before the Case Shiller index (note for example, 1994, 2006, 2009, 2010, and 2013).

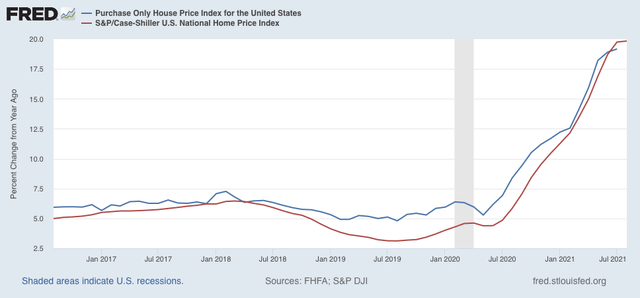

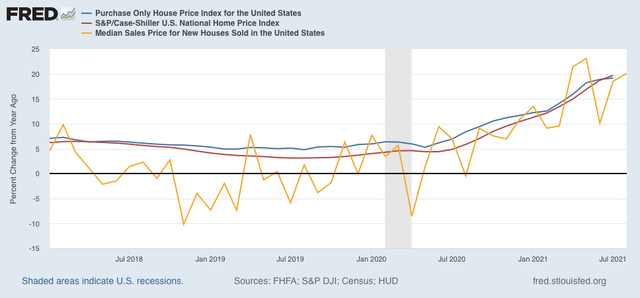

With that in mind, here is the same data zoomed in on the last 4 years (again, note that the FHFA index turned slightly ahead of the Case Shiller index in 2018 and 2020):

The Case Shiller index shows no signs of decelerating, although at least it has stoppped *accelerating* on a YoY basis. But price gains in the FHFA index have decelerated at least slightly, from over 19% one month ago to 18.2%, the least YoY gain in the last 4 months. The 1.0% monthly gain is the smallest since June 2020. I’ve also added new home prices YoY (gold) from this morning’s new home sales report:

Last week I noted that median existing house prices as reported by Realtor.com had decelerated from a 23% YoY gain to 13%, likely indicating the peak in actual prices had either just happened or was imminent. Neither the FHFA nor Case Shiller indexes are confirming that, nor certainly have new home prices, but the *slowdown* in price increases indicates they are not too far behind.

Meanwhile sales, which lead prices, are likely to increase in response to recently lower mortgage rates, although the surge in prices will put a damper on just how much.