- by New Deal democrat

I want to follow up on a comment I made yesterday in connection with Wednesday’s consumer price report.

It is certainly true that *inflation* is likely to be transitory. The 5.3% YoY inflation we’ve seen in June and July may certainly pass in the next few months, and reduce to a more somnolent number under 3%.

Hoorah! Inflation was transitory!

But what if the price increases “stick?” In other words, what if the absolute price increases in houses, cars and trucks, and gas don't recede? Then I think we have a problem.

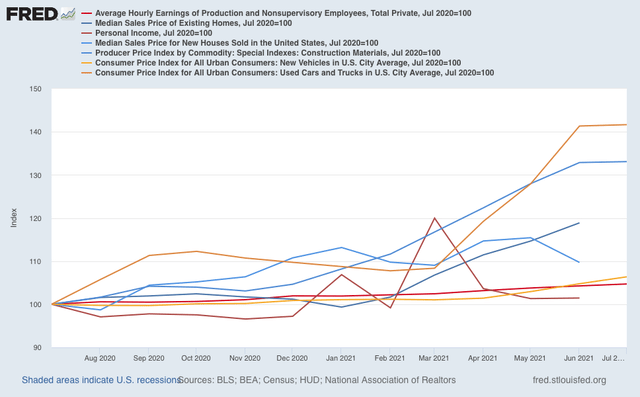

To show you what I mean in one easy (I hope) graph, below are wages and personal income (red shades), house and construction materials prices (blue shades), and new and used vehicle prices (gold shades), all normed to 100 as of one year ago in July 2020:

Wages are up on average 4.7%, and personal income is up 2.3%.

Meanwhile, existing home prices are up 23.4%, new homes up 6%, and construction material prices up 33.1%!

New car prices are up 6.4% and used vehicle prices up 41.7%!

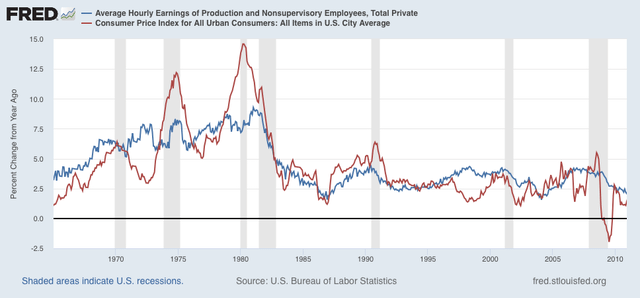

There is simply no way that sales of new homes and new vehicles don’t take a hit if this situation obtains much longer. And here’s the problem: wages not keeping up with prices has historically been a very important “real economy” indicator of an oncoming recession:

Note from the mid-1960s to mid-1990s some of this was ameliorated by the entry of women into the workforce, meaning that household income could increase even if wages didn’t keep up.

So, we don’t simply need for *inflation* to abate. We need the absolute price increases in important consumer assets like houses and vehicles to deflate back to trend.