- by New Deal democrat

This is something I used to pay a lot more attention to back around the time of the Great Recession. How stretched were American households in paying their monthly bills? The Federal Reserve publishes a quarterly update tracking this issue.

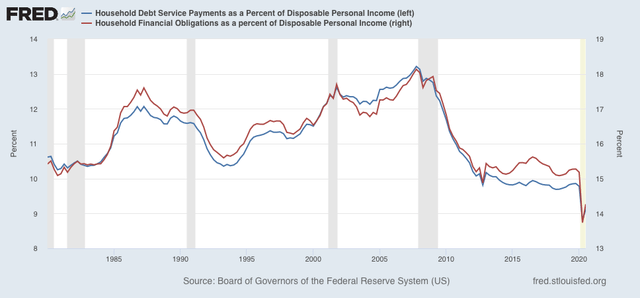

Two of the metrics in that quarterly update are debt service payments and financial obligations, respectively, as percents of household disposable income. The last update was in December, for Q3 2020. The Q4 figure should be released later this month.

And the story is how strong of an impact the pandemic stimulus has made on household balance sheets. Here’s the graph, that pretty much speaks for itself:

Both measures were by far at all-time lows in Q2, and increased slightly in Q3.

One important criticism is that these aren’t median measures. They tell us how the average, not median, household is doing, so they are subject to being skewed by high upper incomes. But the stimulus payments were not matched to income - e..g, every household got a $1200 check back in April, regardless of underlying income. And pandemic unemployment assistance also tended to be skewed towards moderate and lower incomes (i.e., there was a ceiling in the amount of relief).

This is another important data point on how successful (obviously not universal!) the Congressional stimulus has been in alleviating the potentially devastating impact of the pandemic on households and the economy.