- by New Deal democrat

New jobless claims are likely to the most important weekly economic data for the next 3 to 6 months. They are going to tell us whether my suspicion is correct that, as a critical mass of those vaccinated is reached, there will be a veritable surge in renewed commercial and social activities and attendant consumer spending, leading in turn to a strong rebound in monthly employment gains.

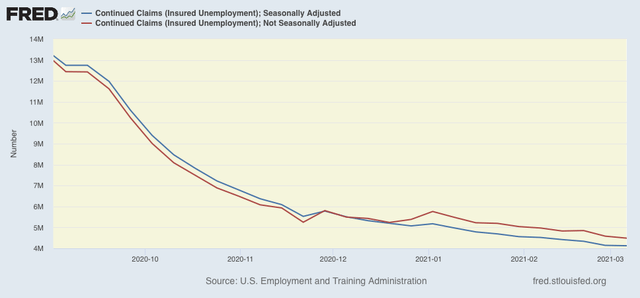

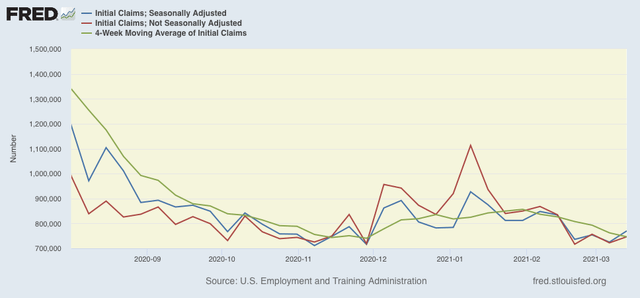

Here is the close up since the end of July (these numbers were in the range of 5 to 7 million at their worst in early April):

While both adjusted and unadjusted claims remain above their worst levels at the depths of the Great Recession, the outbreak-related wintertime surge has abated.

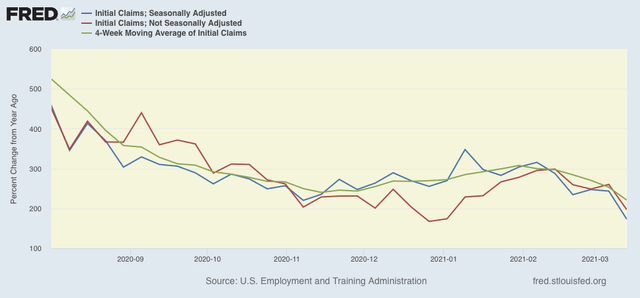

Because of the huge weekly swings caused by the scale of the pandemic, a few months ago I began posting the YoY% change in the numbers as well, since they are much less affected by scale, so there is less noise in the numbers, and the trend can be seen more clearly:

This is at levels last seen in November and December, and confirms that the recent increase in new claims has reversed. In fact, all 3 metrics are at pandemic lows of increases of 175%-225%. An important caveat is that YoY numbers are starting to be compared with the horrific initial pandemic losses of last March and April, so I will probably discontinue this metric in the next several weeks.

Meanwhile continuing claims, which historically lag initial claims typically by a few weeks to several months, made new pandemic lows yet again this week. Seasonally adjusted continuing claims declined by 18,000 to 4,124,000, while the unadjusted number declined by 95,541 to 4,486,389: