- by New Deal democrat

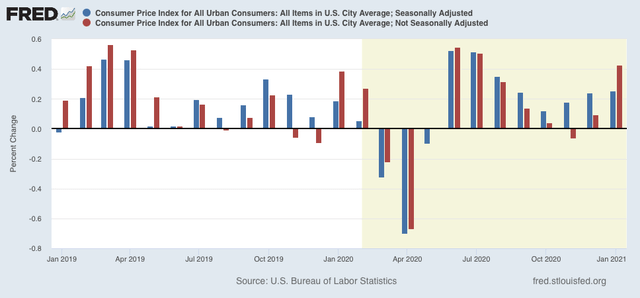

Seasonally adjusted consumer prices rose 0.3% in January. As a result, over the past several months there has been a slight uptick in YoY inflation to 1.3% from 1.1% in October.

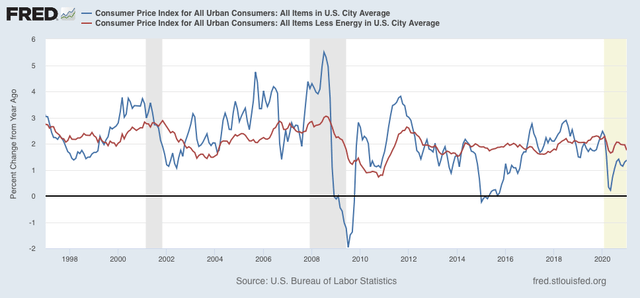

Aside from the pandemic, for the past 40 years, recessions had happened when CPI less energy costs (red) had risen to close to or over 3%/year. As of this month that number is only 1.8%, showing no real price pressure at all:

Because pandemic affects are probably influencing seasonality, below I show both the m/m adjusted and non-seasonally adjusted change in CPI:

While inflation is running higher than in 2019, in the longer term scheme of things there is no cause for concern.

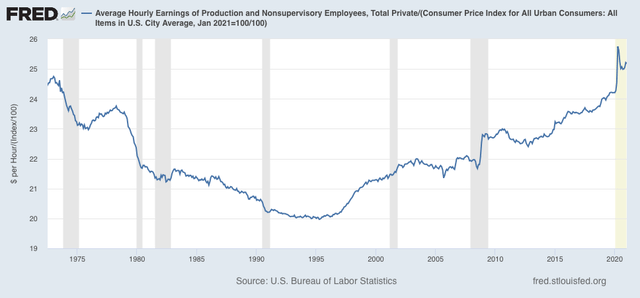

Now let’s take a look at how inflation has affected real wages. Because wages are “stickier” than prices, typically as recessions beat down prices (or at least price increases), in real terms wages rise, either during or just after a recession. That has been the case for the coronavirus recession as well. It is the “real” buying power of wages among those still securely employed during a recession that is one of the engines that usually restarts growth.

While real wages declined -0.1% in January, since October real wages have risen close to 1%, undoubtedly as a result of the skew in layoffs, which have disproportionately affected those in the low-wage food, beverage, and entertainment industries:

Nevertheless, real hourly wages for non-supervisory workers have continued to exceed their previous 1973 peak.

Once the pandemic is brought under control, I am anticipating at least a short burst of increased inflation, as freedom beckons rather suddenly for 300 million people.