- by New Deal democrat

Sales and production are two of the four things that economists look for in gauging whether the economy is in expansion or recession, and this morning both of them - retail sales and industrial production - were released for May.

So it’s true: as defined by the NBER, the Coronavirus Recession may have only lasted two months, from February through April. That’s because, just as February was the peak of economic activity before the coronavirus hit, April may well have been the trough. And recessions technically end, not when the economy becomes objectively “good” or “fair,” but simply when the level of activity is less awful than before. If the trajectory is positive, and activity goes from really awful, to slightly less really awful, the recession has ended, even if the economy is still, well, awful.

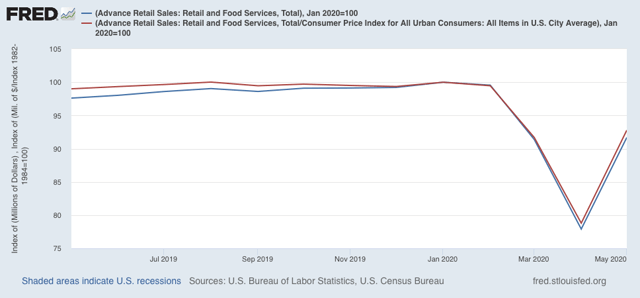

To the graphs! First, here are retail sales, both nominally and as adjusted for inflation:

Both increased 17.7% in May, after declining over 14% in April. Both are also slightly higher than their levels in March. Clearly the “reopening” of the economy in large portions of the country led to a splurge in spending.

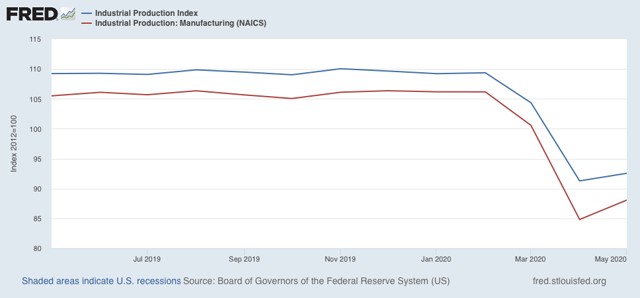

Next, here is total industrial production (blue) along with manufacturing production (red):

Both increased slightly.

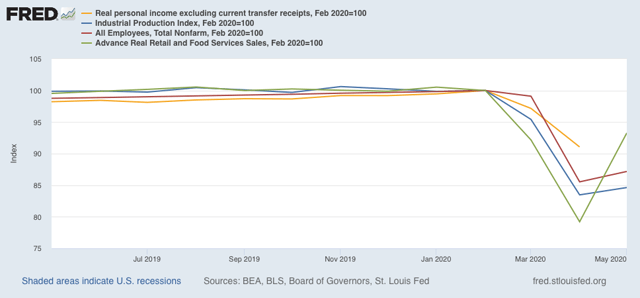

Since employment also increased in May, that makes three of four sectors included in recession measurements that - as of now - are off their lows, as shown in the graph below:

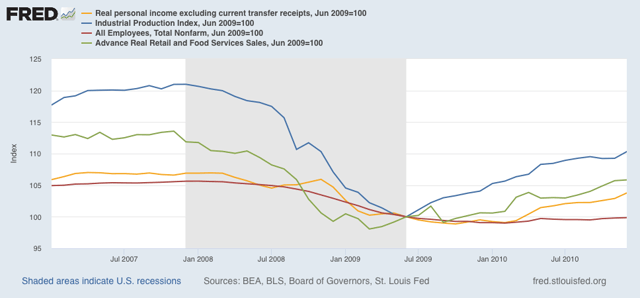

Personal income less transfer receipts for May won’t be reported for another couple of weeks, but even if it is lower, the NBER may still decide that the recession has ended. That’s because industrial productions is the King of Coincident Indicators, and carries more weight than the others in recession calls. For example, here is the period of time including the Great Recession:

The NBER determined that the recession ended in June 2009. That’s when industrial production bottomed. Real retail sales had already bottomed several months before. Both employment and real income were close to but had not yet reached their bottoms.

So, even though the economy as measured by all four sectors is still awful, it was a little less awful in May than it was in April, and that may be enough for the NBER.

Two important caveats:

(1) I don’t expect the NBER to be so quick with this call as they were with their recession onset call, because they will want to be sure that this is not a false start; which leads even more importantly to

(2) the virus is still in control. Those States which have recklessly opened without waiting for infections to abate, and without effective testing, tracing, and quarantining protocols - which is almost all of them, particularly in the South, High Plains, and Mountain West - are seeing new infections start to rise again, and in some cases - Arizona, Alabama, Arkansas, Texas, and South Carolina for example - the graphs are beginning to look exponential again. It would not be surprising at all if renewed panic were to set in, with new lockdowns put in place, or at very least consumers pulling back from face-to-face activity. In other words, the increases in industrial production, employment, and sales may well prove temporary.