- by New Deal democrat

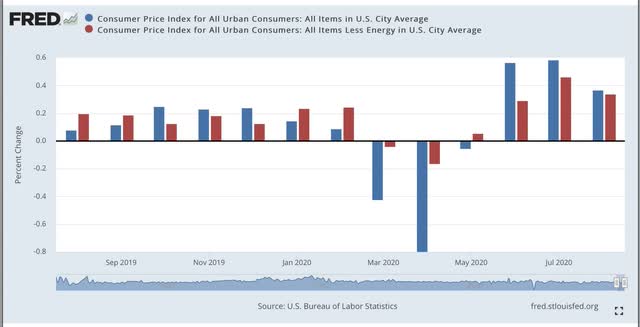

The consumer price index for August was reported up +0.4% this morning. This is the third straight big increase. Below I show this plus the more stable consumer prices minus gas (red):

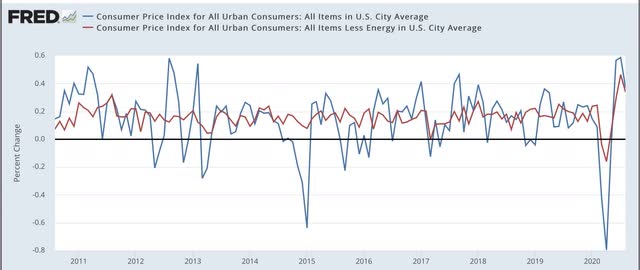

Here’s what the monthly changes look like over the past 10 years:

As you can see, these are at the upper end of monthly inflation increases for the past 10 years.

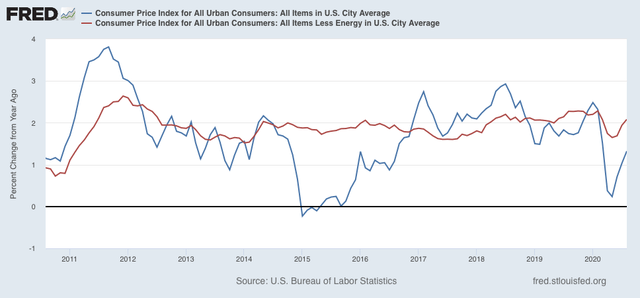

On a YoY basis, however, inflation is still pretty subdued at 1.3%. Inflation ex-gas is up 2.1%, well in the ordinary range for the past 20+ years:

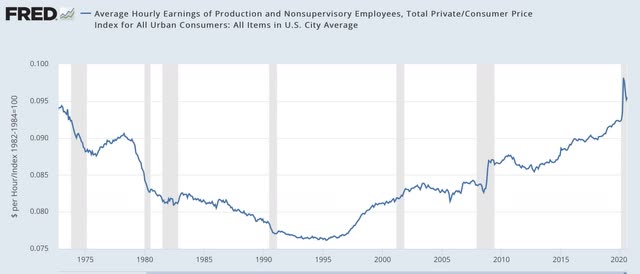

As a result, real wages for non-supervisory employees, in historical terms, have finally surpassed their previous 1973 high:

Of course, this has everything to do with the fact that lower-wage workers have taken the brunt of layoffs and closures due to the pandemic. They were being kept afloat by Congress’s emergency supplemental assistance, which has now ended.

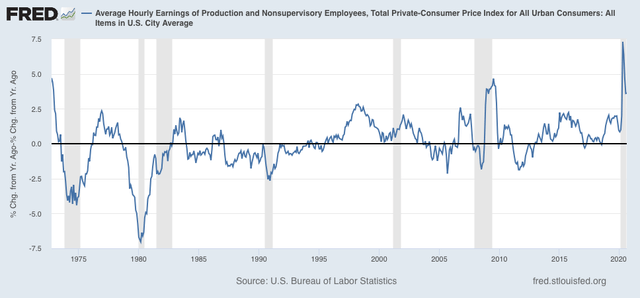

It’s worth noting that a big YoY increase in real hourly wages has been typical coming out of recessions for the past 50 years:

Normally this has been due to a much bigger deceleration in inflation vs. wages. Generally lower paying occupations have been hit harder in past recessions as well, compared with professional and business occupations.

In sum, so far inflation is not a concern, despite the elevated readings of the past three months.