- by New Deal democrat

With this morning’s release of personal income and spending, we now have all 4 coincident indicators for May that the NBER uses to determine whether the economy is in recession or recovery/expansion. And all 4 improved from their “most horrible” readings in April.

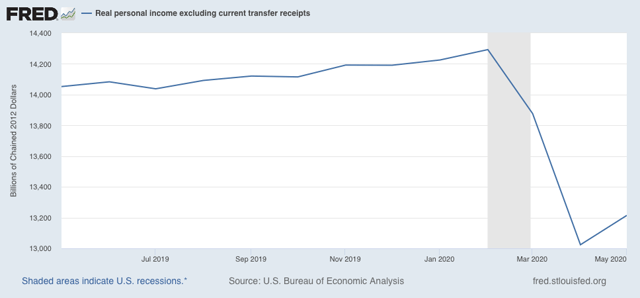

A recession is a generalized downturn in production, employment, sales, and income. The “income” metric that the NBER uses is “real personal income excluding current transfer receipts,” (basically, government program payments to individuals) and as shown in the graph below, it improved from April:

Still a horrible decline from February, but “less horrible” compared to April.

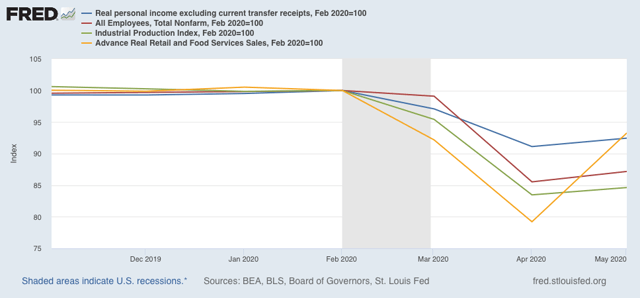

Since industrial production, nonfarm payrolls, and real retail sales also all improved in May from April, that makes it 4 for 4 among the coincident indicators:

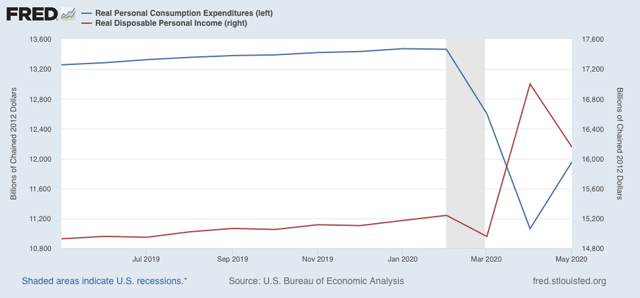

Real disposable personal income (red in the graph below) declined in May from April, but was well ahead of previous months. This probably represents the delayed receipt and cashing of some of the one-time $1200 stimulus checks distributed by Congressional Act. Real consumption expenditures (blue), however, increased significantly, probably reflecting in part spending of that stimulus money by consumers, and partly spending by those called back to work:

In short, in May the situation was still horrible, but “less horrible” than April. That would qualify for the beginning of a recovery by economists’ definitions, *provided* there is no renewed downturn. And as the coronavirus continues to wreak more havoc in the States that have recklessly reopened - or simply let their guards down - a renewed downturn is very much a possibility, and almost a certainty if Congress does not extend the enhanced unemployment program by the end of July.