- by New Deal democrat

Yesterday I shared the best good news from the September jobs report released last Friday: there’s a good argument that the economy has reached “full employment,” although we could do even better if real wages improved more. Today let’s look at the bad news, which comes from examining the leading indicators for employment.

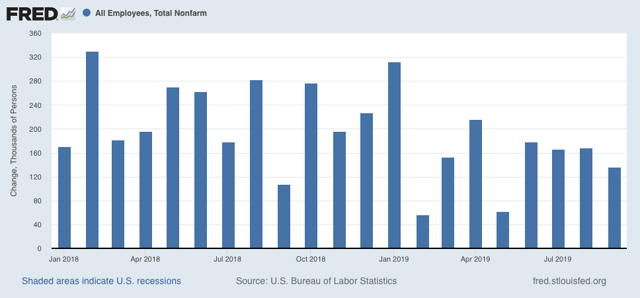

That there has been a jobs slowdown is by now well established. In the last 8 months, per the more reliable establishment report, 1,135,000 jobs have been added, an average of 142,000 per month, which If we subtract temporary census hiring of 26,000, becomes 139,000. And keep in mind that the number of jobs added between March 2018 and March 2019 is going to be reduced from roughly 210,000 to 167,000 per month:

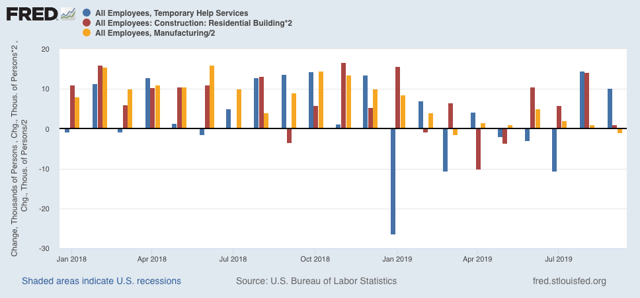

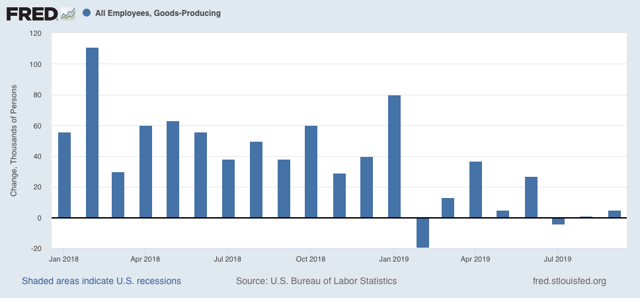

Next, the three leading sectors of employment I track are temporary help (blue in the graph below), manufacturing (gold), and residential construction (red). Here’s what they look like compared with 2018, showing the slowdown this year:

Don’t be fooled by the better-looking bars for August and September in temporary help. At I pointed out a few weeks ago, this year there have been almost relentless downward revisions in that number between the initial report and the final one two months later. That pattern held up for July and August’s revisions on Friday. Below I’ve listed the original number for the last three months on the left, followed by the first and then final revisions to the right:

JUL +2200 -7300* -10,500

AUG +15,400 +14,500*

AUG +15,400 +14,500*

SEP +10,200 —-

*1st revision only

*1st revision only

In other words, against the September gain you have to include the further 4,100 in losses for the prior two months. And I strongly suspect both August and September will have further downward revisions.

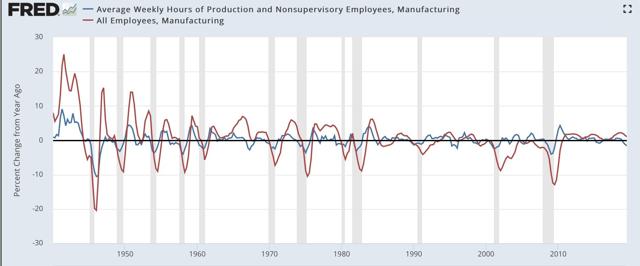

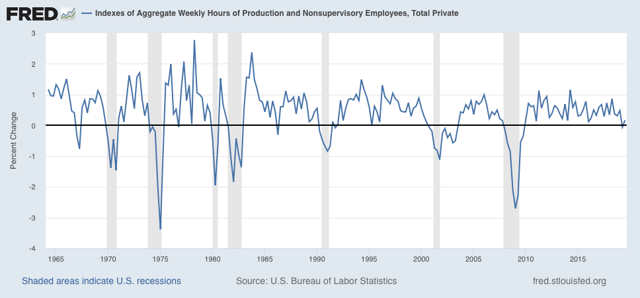

Further, because the average manufacturing workweek is down almost 1 full hour per week YoY (blue in the graph below), we should expect more actual losses in manufacturing jobs going forward:

Before 1980, manufacturing jobs’ growth or decline typically followed hours by roughly 2 months. Since then, the time period has lengthened to more like 6 months.

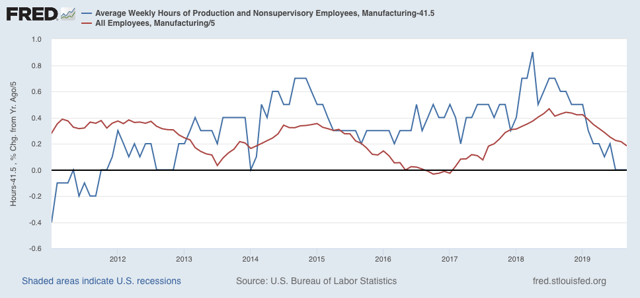

Here’s the close-up look for the past several years:

If a similar pattern is followed to what happened in 2016, by the end of next spring, we should expect *no* net YoY in manufacturing jobs, which means at minimum a decline of over -20,000 more jobs during roughly the next 8 months.

And, like temporary help, the revisions for manufacturing employment have all been downward for the past five months:

JAN +13 +17 [+4]

FEB. +4. +8. [+4]

MAR -6. -3. [+3]

APR +4. +3 (-1)

MAY +3 +2 (-1)

JUN +17 +10 (-7)

JUL +16 +4 (-12)

AUG +3 +2 (-1)*

SEP -2 —- —-

*1st revision only

This year so far only 46,000 manufacturing jobs have been added to the entire economy, compared with 188,000 in the first 9 months of 2018.

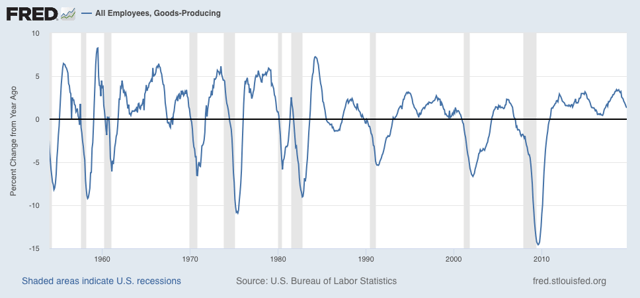

More broadly, there have been YoY losses in goods-producing jobs before all of the past 3 recessions, and going back 70 years, counting 12 recessions, in all but 3 there has been steep deceleration before and actual losses no later than two months into the recession:

So far this year, only 65,000 jobs have been added in the entire goods-producing sector:

This is a paltry gain of 0.3%. A continuation of this trend for just 3 more months would be at very least consistent with a severe slowdown.

Even more broadly, although the household report has been very good for the past two months, the aggregate hours worked by all non-managerial personnel has not improved that much. Below is a graph of the q/q % change going back over 50 years. Only once, in 1966, has there been a decline for more than one quarter without a recession taking place shortly:

This figure did turn positive in Q3, but not by much.

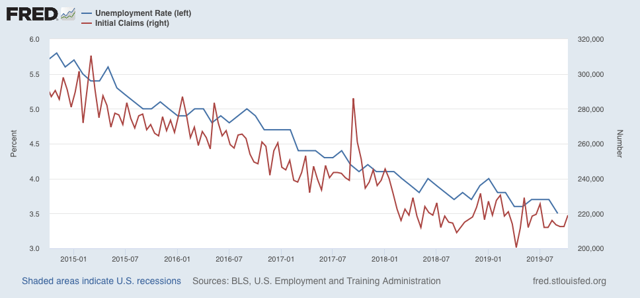

Finally, let me turn to one forecast I made in the past month that didn’t quite pan out. I wrote then that “initial jobless claims have trended only slightly lower in the past 18 months, and are flat over the past 12. The unemployment rate has continued to trend slightly lower, but I expect that to end in the next several months, with no new lows, and more likely a drift sideways at 3.7% or even slightly higher to 3.8% or even 3.9%.”

Well, instead the unemployment rate dropped to 3.5% (blue in the graph below):

I am going to be stubborn here. I think the drop in the unemployment rate in September was a byproduct of a particularly good sample in the volatile household report. Unless initial claims turn significantly lower, I still expect the unemployment rate to move up 3.6% or 3.7% in the next few months.

The bottom line here is that the goods-producing portion of the US economy is probably in a shallow recession right now, and employment there has plateaued at best. The services portion, however, is still doing decently as reflected in the good numbers that have been posted by consumers.