- by New Deal democrat

I’ve been monitoring initial jobless claims closely for the past several months, to see if there are any signs of stress. This is because the long leading indicators were negative one year ago, and many - but not a majority - of the short leading indicators have recently turned negative as well. So I am on “recession watch.” But no recession is going to begin unless and until layoffs increase.

To reiterate, my two thresholds are:

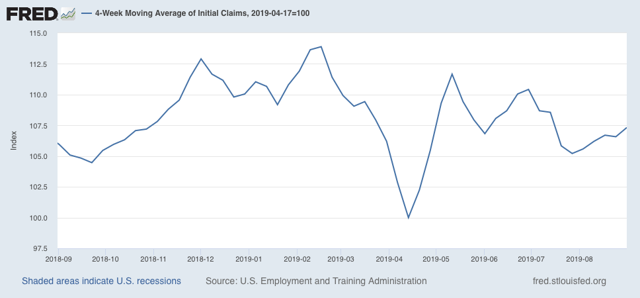

1. If the four week average on claims is more than 10% above its expansion low.

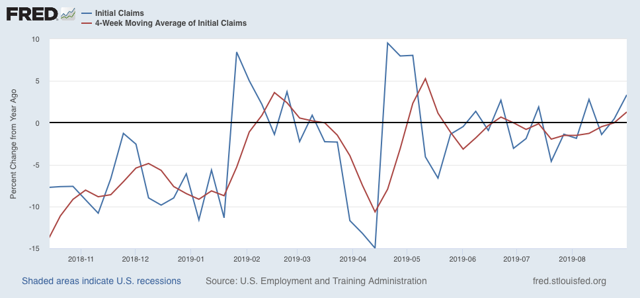

2. If the YoY% change in the monthly average turns higher.

This week the second measure turned negative. Let’s take a look.

Initial jobless claims last week were 217,000. This is in the lower part of its range of 220,000 +/-12,000 for the past 19 months. As of this week, the four week average is 7.3% above its pre-Easter low:

The four week YoY change as well as the YoY change for the month of August as a whole (red) are 450 higher than last year (weekly YoY change is shown in blue):

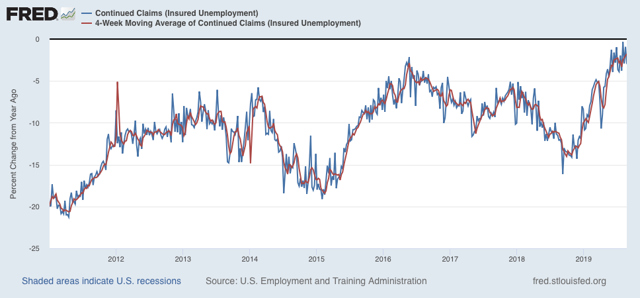

The less leading but also less volatile 4 week average of continuing claims rose slightly and is now only -1.8% below its level of one year ago, which is the weakest comparison in this entire expansion:

Overall, jobless claims remain ever so weakly positive, against some very tough YoY comparisons. There is no imminent economic downturn so long as this remains the case.