- by New Deal democrat

This morning’s retail sales report for March was very strong on both a nominal basis, up +1.6%, and also on a real, inflation-adjusted basis, up +1.2%. At the same time, it is still ever so slightly below its peak of five months ago, and YoY real sales have not recovered to those typical for this expansion. Let’s take a look.

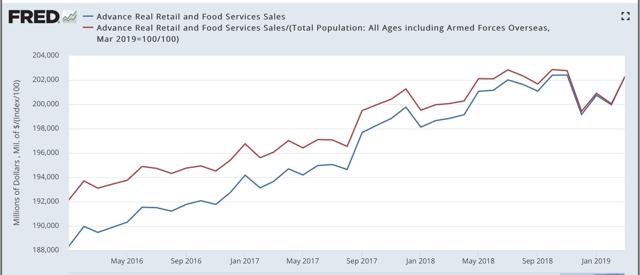

Below are real retails sales for the last few years, and because it is a long leading indicator, real retail sales per capita (in red):

As revised, both of these last made new highs last October. So the good news is, the weakness of the last few months has been entirely reversed. The caution is, we still don’t have a new high, although this data series is notoriously noisy.

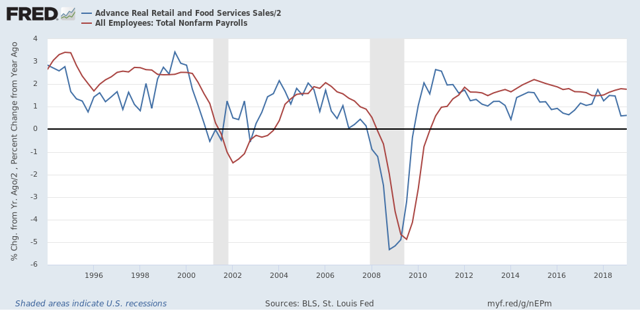

Although the relationship is noisy, because real retail sales measured YoY tend to lead employment (red in the graph below) by a number of months, here is that relationship for the past 25 years (averaged quarterly to cut down on noise):

Although there has been some recovery in the YoY real retail sales measure, the prior weakness has not been revised away. As a result, I continue to think that employment gains are likely to downshift significantly over the next several months.

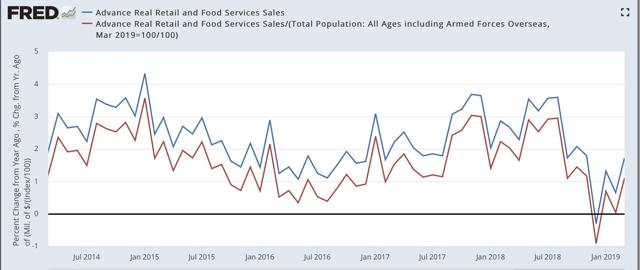

Next, here are both forms of real retail sales YoY recently:

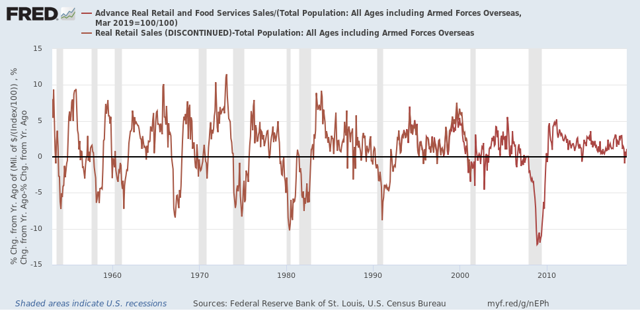

And here are real retail sales per capita YoY, going all the way back to 1948:

In the last 70 years, this measure has always turned negative at least shortly before a recession has begun. There are no false negatives. While there are about a dozen false positives for a single negative month, there are only four false positives for consecutive negative readings — 1966, 1995, 2002, and early 2006. Since there has only been one month - last December - where this was negative YoY, this was probably a false positive as well.

To sum up, this was a very good reading that, together with yet another 49 year low in initial jobless claims this morning, negatives any imminent recession. At the same time, while we are certainly headed in the right direction, because we have not exceeded the highs of nearly half a year ago, there are still signs of weakness.